- In recent days, selling pressure on Ethereum has been increasing.

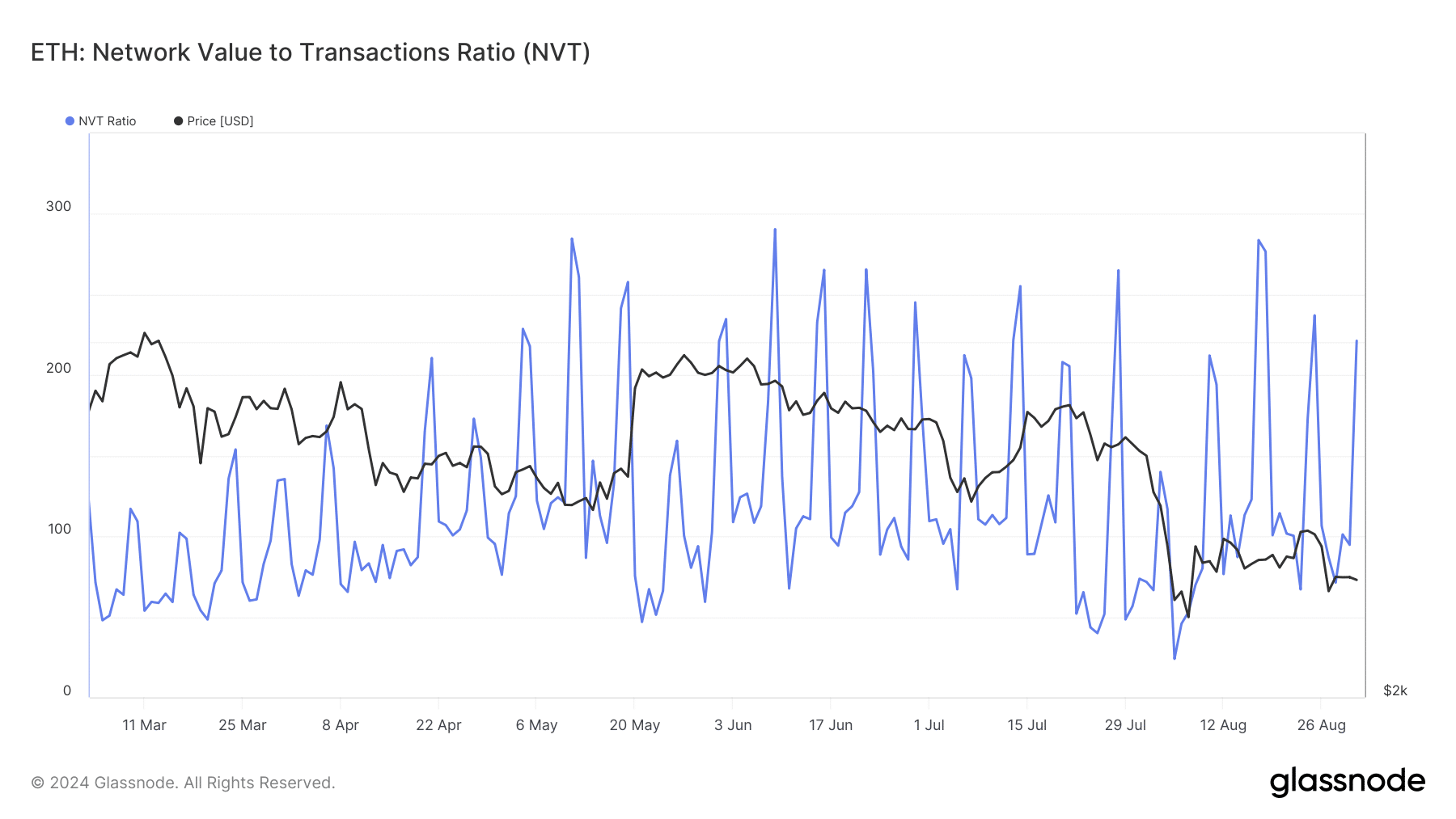

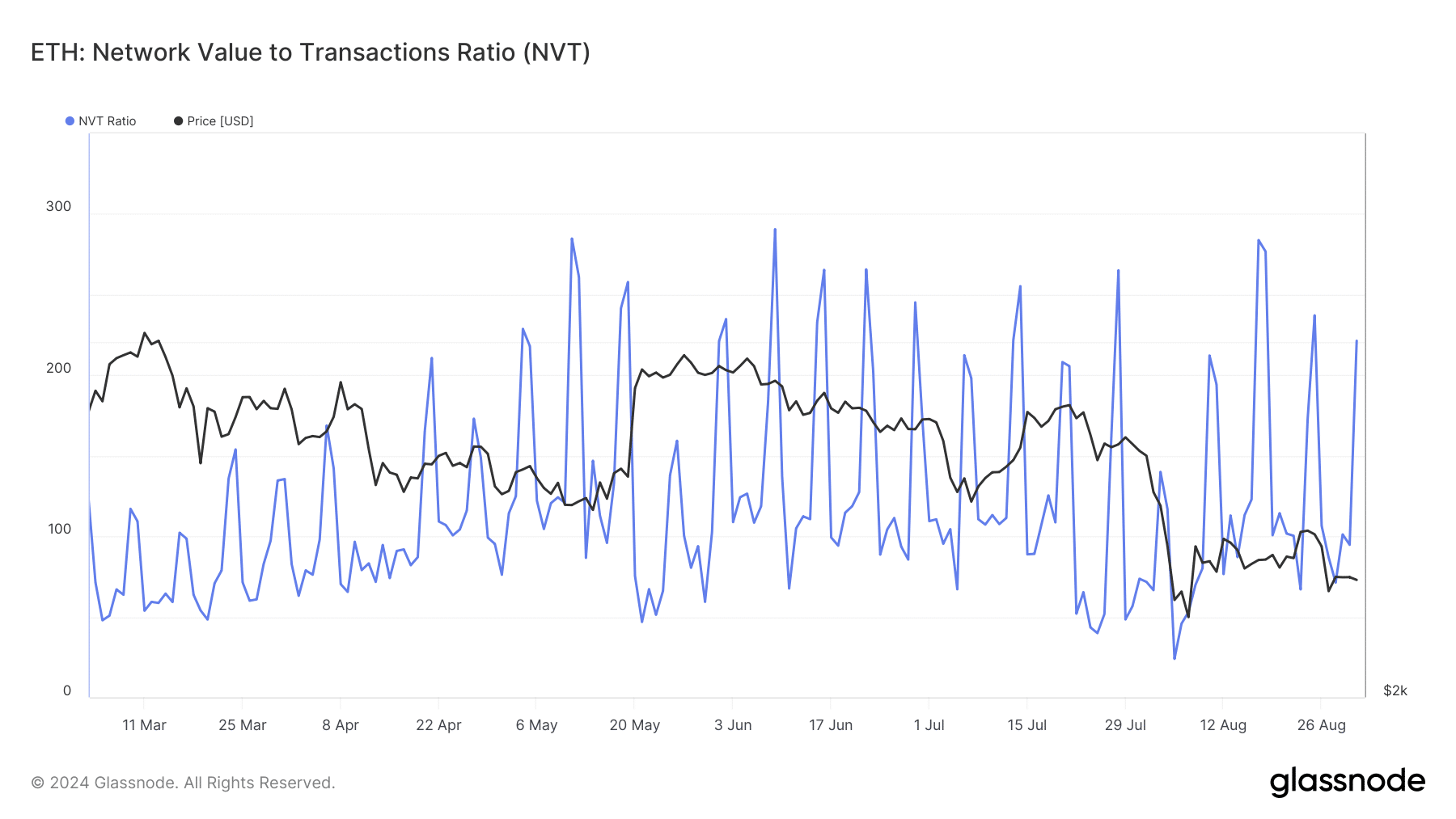

- The NVT ratio for Ethereum indicated that the asset was overvalued.

Investors in Ethereum [ETH] are facing challenges as bearish sentiment dominates the market. Recent data suggests that it may take some time for bullish momentum to return.

Let’s explore the reasons why it appears likely for ETH bears to push the token’s price lower.

The Troublesome Future of Ethereum

According to CoinMarketCap’s data, Ethereum has seen a decline of over 10% in the last seven days due to bearish pressure. The downward trend continued with a 1.6% drop in the last 24 hours.

Currently, Ethereum is trading at $2,486.34 with a market cap exceeding $299 billion.

Data from IntoTheBlock revealed that 76.8 million ETH addresses are in profit, representing 63% of total ETH addresses.

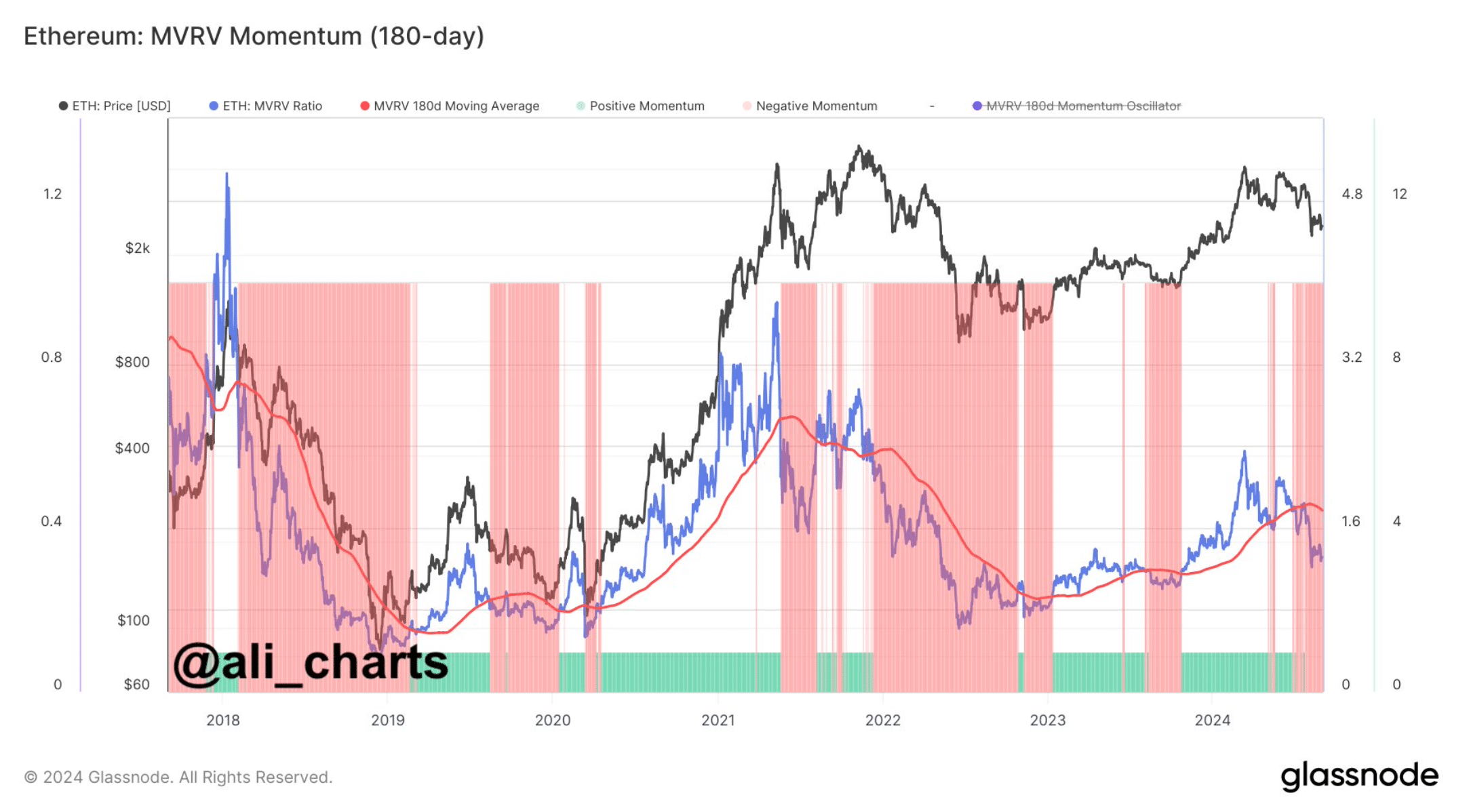

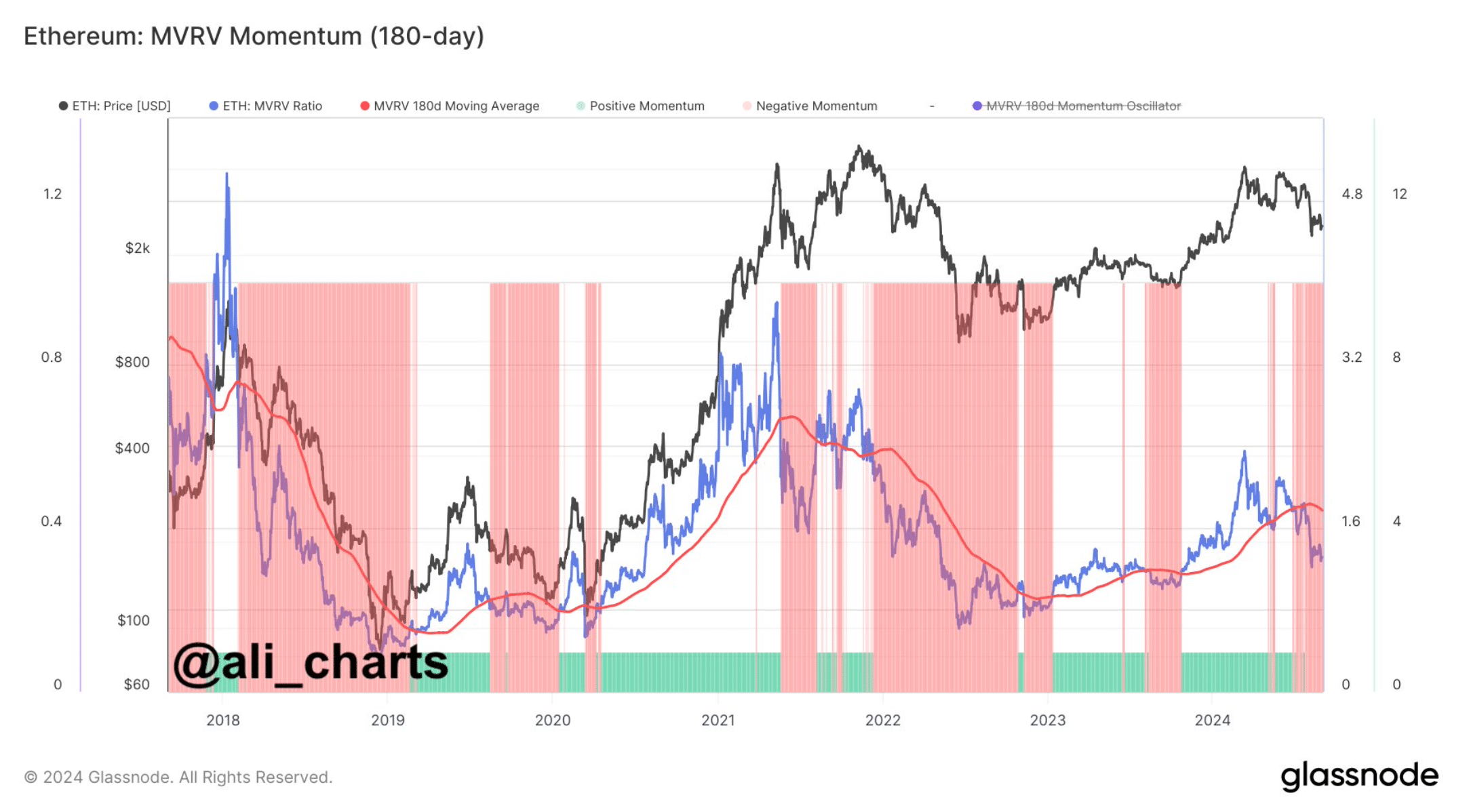

Meanwhile, a tweet from popular crypto analyst Ali highlighted that the MVRV Momentum indicates Ethereum is still in a downtrend.

The lack of signs for a trend reversal suggests that investors could witness further decline in the value of the top altcoin in the coming days.

Therefore, AMBCrypto is set to delve deeper into the state of ETH to predict what lies ahead.

Source: X

Potential Support Levels for ETH

AMBCrypto’s analysis of Glassnode’s data points to a significant spike in Ethereum’s NVT ratio. A higher NVT ratio indicates overvaluation and typically precedes a price correction.

Source: Glassnode

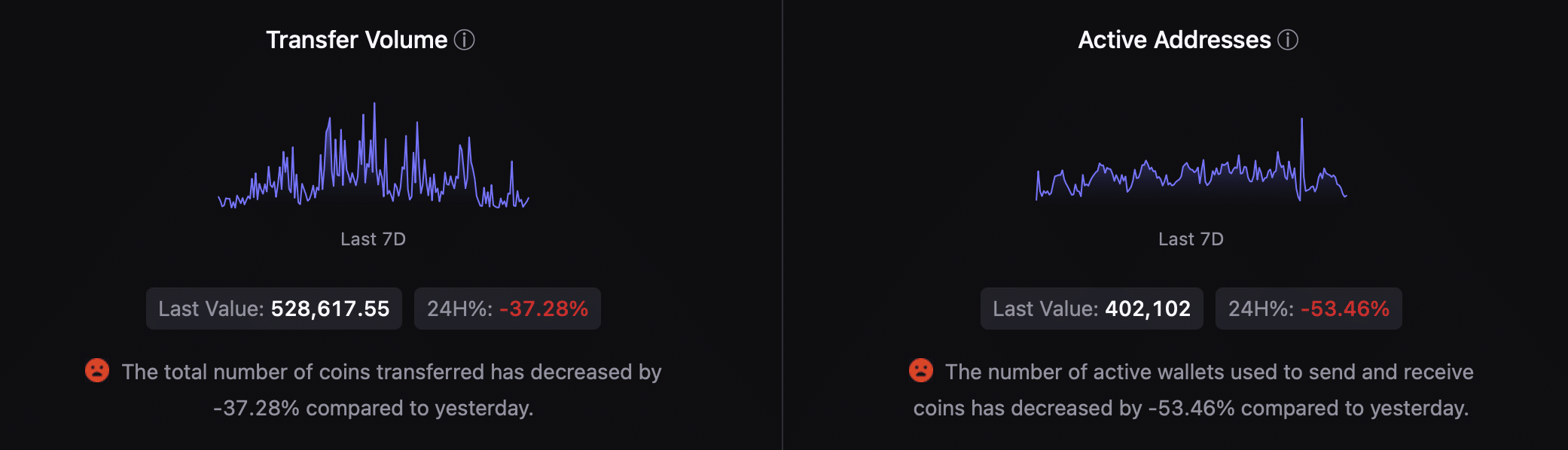

Data from CryptoQuant indicated several bearish metrics for Ethereum. The increase in ETH’s exchange reserve suggests growing selling pressure. Additionally, the decrease in total coin transfers and active addresses in the last 24 hours are further bearish signals.

Source: CryptoQuant

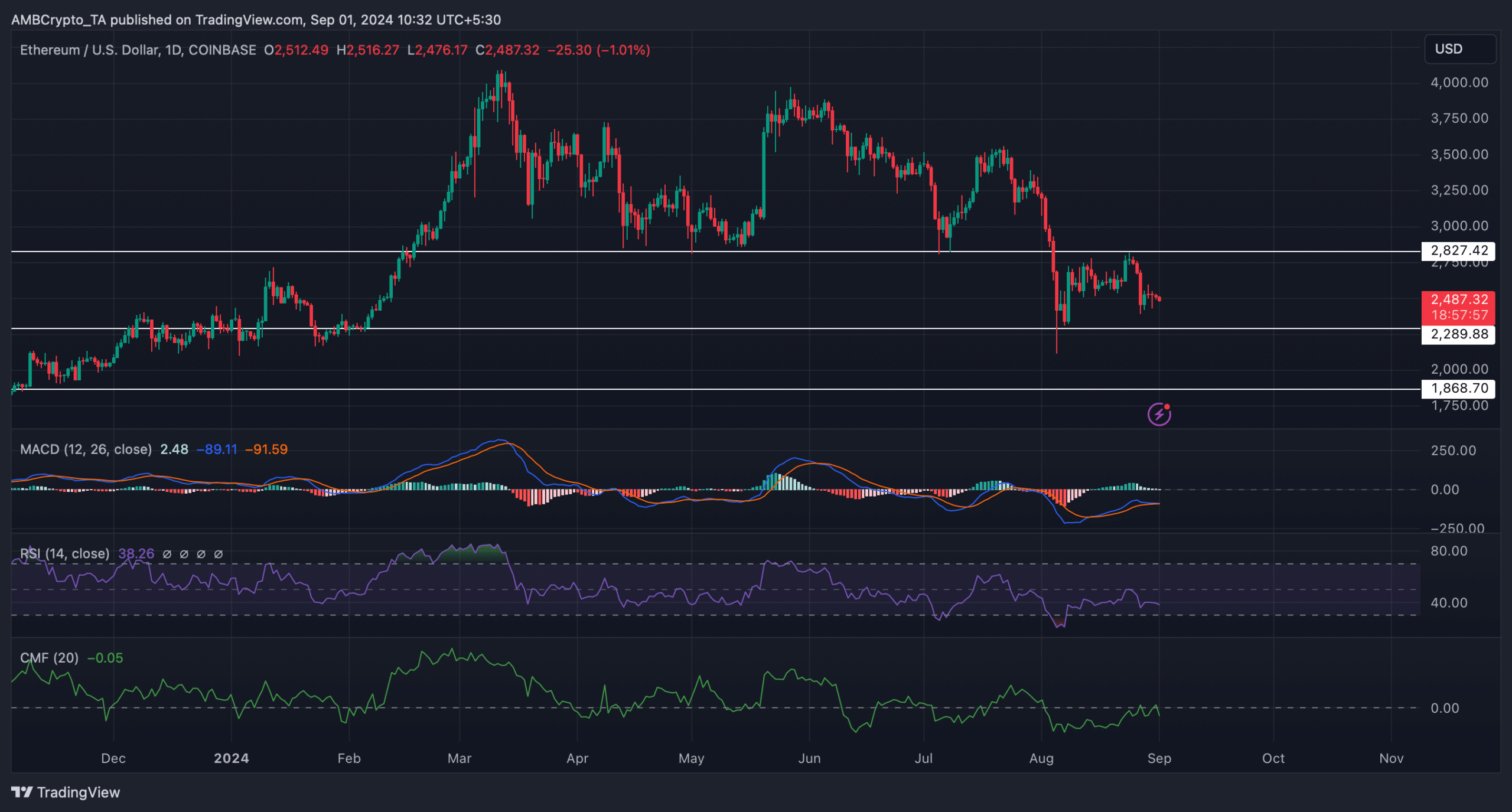

Given the data pointing towards a continued price decline, AMBCrypto examined Ethereum’s daily chart to identify potential support levels. The MACD indicator showed a bearish crossover, while Ethereum’s Chaikin Money Flow (CMF) indicated a downtrend.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The Relative Strength Index (RSI) mirrored the declining trend, suggesting a high probability of further price depreciation. If this trend continues, Ethereum could potentially drop to $2.28. A breach below that support level could push ETH towards $1.86 in the near future if bullish momentum does not strengthen.

Source: TradingView

phrase in a different way:

Change the phrase.