- ETH has seen a 47% decline in the past year.

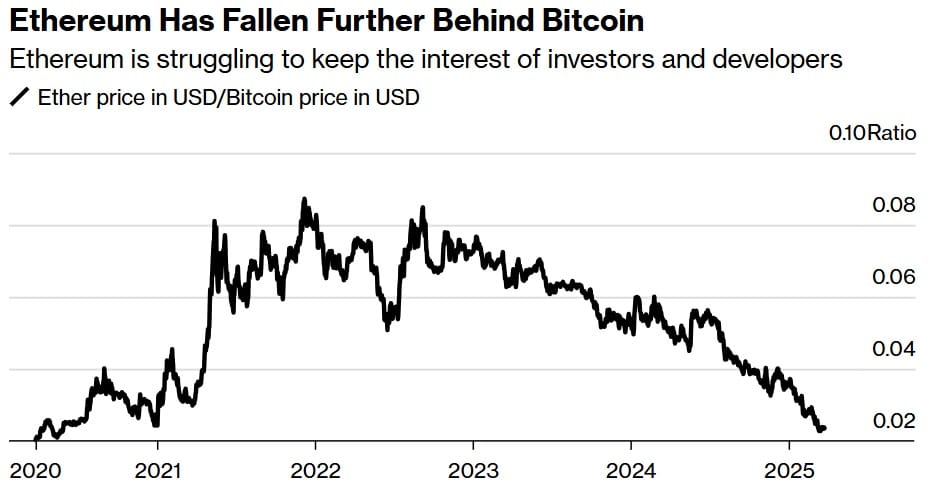

- Ethereum’s underperformance has caused it to fall behind BTC, losing its leading position.

Since the beginning of 2025, Ethereum [ETH] has been facing significant challenges. The once-promising altcoin is now struggling to compete with smaller cryptocurrencies.

This decline has not gone unnoticed by key stakeholders and the mainstream media. According to a recent Bloomberg report, Ethereum is entering a tough phase as it enters its second decade of operation.

Ethereum developers are leaving, early adopters are disappointed, and the token is falling behind both BTC and its smaller rivals.

Despite being the second-largest cryptocurrency with a market cap of $221 billion, ETH has experienced a significant decline. Year-to-date, ETH has dropped by over 44%, falling from $3.6k in January 2025 to $1.8k.

This decline has set the altcoin up for its worst quarterly drop since the 2022 bear market. While BTC has surged by 30% in the past year, Ethereum has declined by 47%, gradually losing its lead.

As a result, its market dominance has fallen from 17% to 7.9% over the past year, allowing its competitors to grow at a faster rate.

For example, the number of active developers working on Ethereum-related software decreased by 17% in 2024, while its rival Solana [SOL] saw a significant increase in active developers.

Therefore, Solana has become a popular platform for meme coins, with an 83% year-on-year growth.

This trend is also evident in other cryptocurrencies, such as Ripple’s XRP, which has seen a 249% increase in price and a market cap rise from $30 billion to $127 billion.

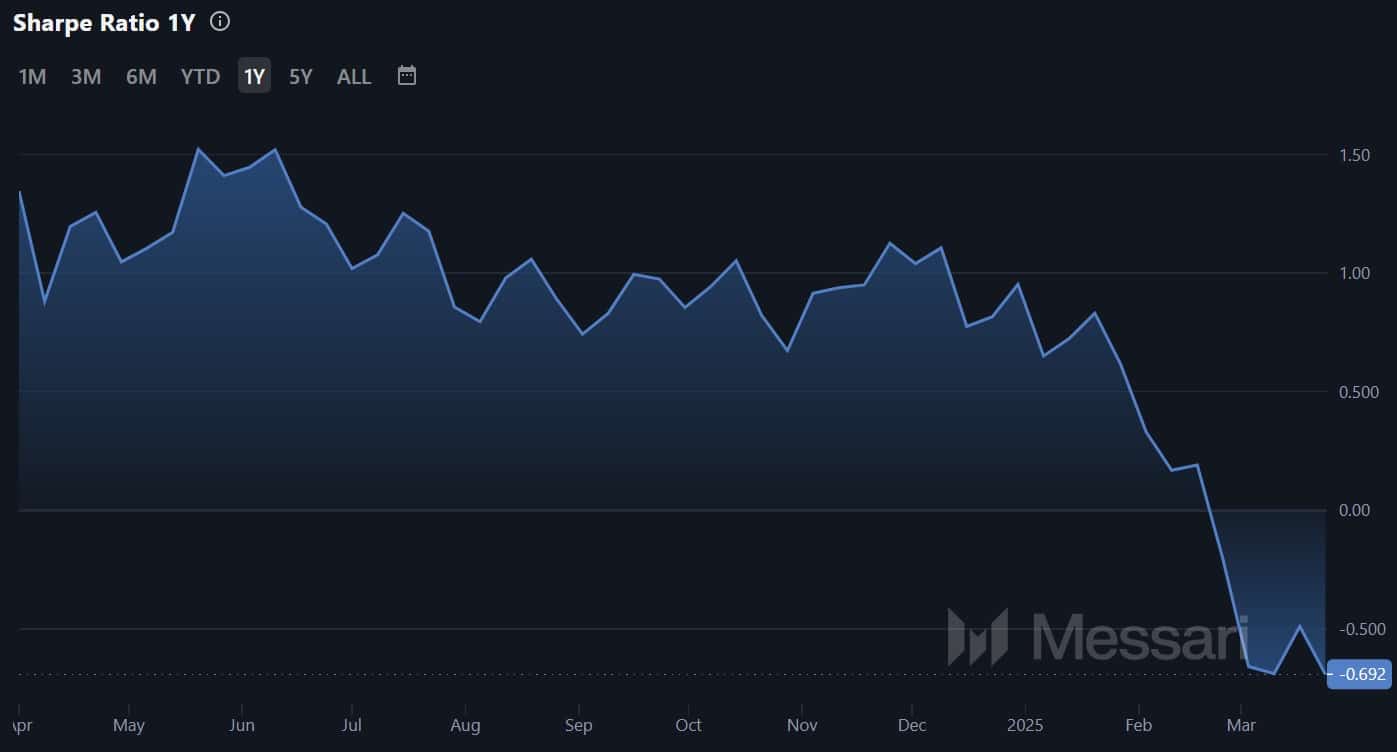

With ETH’s continued poor performance, the altcoin has lost its appeal to investors. The Sharpe ratio for ETH over the past year has declined to -0.69, indicating lower investment returns and higher risk compared to risk-free assets.

What’s Going on with Ethereum?

According to industry experts, one of the main challenges facing Ethereum is leadership. Ryan Watkins pointed out that Ethereum’s leadership has not been able to maintain the momentum needed for growth.

“It’s all about growth and leadership — If the Ethereum ecosystem kept pace with, or outpaced, its peers, none of these above would matter.”

Bloomberg also highlighted this leadership issue, attributing Ethereum’s struggles to founder Vitalik Buterin’s resistance to change.

Under Buterin’s leadership, Ethereum has remained entrenched in its early decentralization ideals, failing to engage with politicians and lobby in Washington DC as other players have done.

Buterin’s reluctance to align with politicians or support any government-backed cryptocurrencies has left Ethereum isolated as other projects collaborate with regulatory bodies.

What’s Next for ETH?

According to AMBCrypto’s analysis, Ethereum is facing strong downward pressure, with the altcoin trading at $1839, a 2.11% decline in the past day.

On a weekly chart, ETH has dropped by 8.39%, indicating negative sentiment among investors.

The Stoch RSI on ETH’s charts suggests a continuation of the downtrend. With a bearish crossover and a Stoch reading of 14.6, the momentum remains strongly negative.

Therefore, if the current market conditions persist, ETH could experience further declines, potentially dropping to $1761. To see a bullish trend, ETH must reclaim and sustain a price above $2k.

following sentence in a different way:

The cat lounged lazily in the sun, enjoying the warmth on its fur.