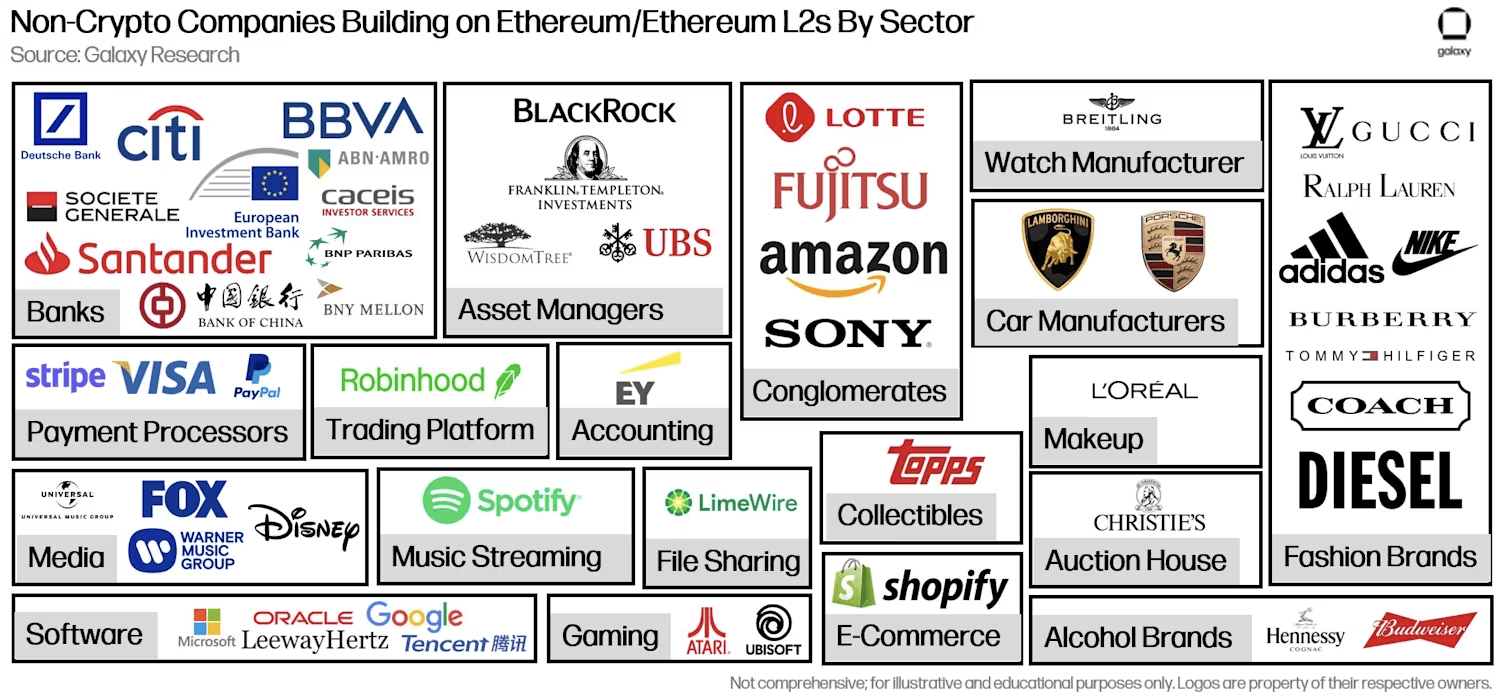

More than 50 traditional companies, including global banks and luxury brands, are currently developing blockchain-based products on Ethereum and its layer two networks, focusing on NFTs, tokenized assets, and scalable infrastructure, as revealed in a recent report by Galaxy Digital.

Major Players in Traditional Finance and Retail Embrace Ethereum’s L2 Networks

A Galaxy Digital report, led by Vice President of Research Christine Kim, highlights the involvement of over 50 non-crypto companies, such as Deutsche Bank, Paypal, Louis Vuitton, and Adidas, in the creation of crypto-specific applications on Ethereum and its layer two (L2) networks. These initiatives are centered around real-world asset (RWA) tokenization, NFTs, and Web3 gaming, showcasing a shift towards practical blockchain applications over speculative trading.

The research conducted by Galaxy Digital identifies 55 traditional enterprises actively engaged in developing blockchain frameworks and decentralized tools on Ethereum and its L2 ecosystems, indicating a growing interest in Web3 integration beyond conventional crypto markets.

Ethereum leads the way in RWA tokenization, boasting nearly ten times the value of assets compared to its competitor Stellar, according to Galaxy Research. Among the 20 financial institutions involved in building crypto infrastructure, 13 are actively issuing RWAs, including Blackrock’s Ethereum-based fund, BUIDL. The stablecoin market on Ethereum is thriving, with notable contributions from Paypal’s PYUSD and Robinhood’s USDG, driving a substantial 70% increase in stablecoin supply by 2024. Ethereum currently commands over 50% of the $400 billion stablecoin market.

Corporate investments in scalable infrastructure highlight the increasing adoption of blockchain technology. Deutsche Bank, for instance, is collaborating with ZKSync to develop an Ethereum L2 solution for compliant financial services, while Sony’s Soneium rollup is geared towards gaming and entertainment applications. These projects underscore Ethereum’s versatility as a foundational platform for enterprise-grade blockchains, despite ongoing discussions surrounding centralized control, as evidenced by Sony’s oversight of Soneium activities.

The gaming sector is driving innovation in NFTs, with companies like Atari and Lamborghini launching L2-based platforms. Atari has introduced classic games on Coinbase’s Base network, offering NFT incentives, while Lamborghini’s Fastforworld platform enables digital car ownership across multiple games. South Korea’s Lotte Group has partnered with Arbitrum for its “Caliverse” metaverse, citing the L2’s 250ms block speeds as crucial for seamless gaming experiences.

Ethereum’s L2-focused roadmap emphasizes a balance between scalability and security, attracting institutions seeking efficient onchain solutions. Regulatory developments, including the SEC’s focus on tokenization, and strategic partnerships like Stripe’s acquisition of stablecoin platform Bridge for $1 billion, indicate a growing acceptance of blockchain technology in mainstream markets.

Galaxy Digital’s report concludes that Ethereum remains the preferred blockchain for finance-oriented crypto services, with RWAs and stablecoins poised for significant expansion in 2025. Christine Kim remarked, “As the most decentralized general-purpose blockchain with the widest user base in the crypto space and a proven track record of network reliability, Ethereum continues to serve as the launchpad for many institutions venturing into finance-focused crypto services and products.”