- BlackRock saw a surge in ETF inflows while GreyScale experienced outflows.

- Analysis suggests Ethereum’s price could dip to $2k.

BlackRock, a major institutional investor, has shown significant interest in Ethereum (ETH) ETFs recently. As they accumulated ETH, other prominent players in the crypto industry also began stockpiling the altcoin.

Let’s delve deeper into the current scenario.

Performance of Ethereum ETFs

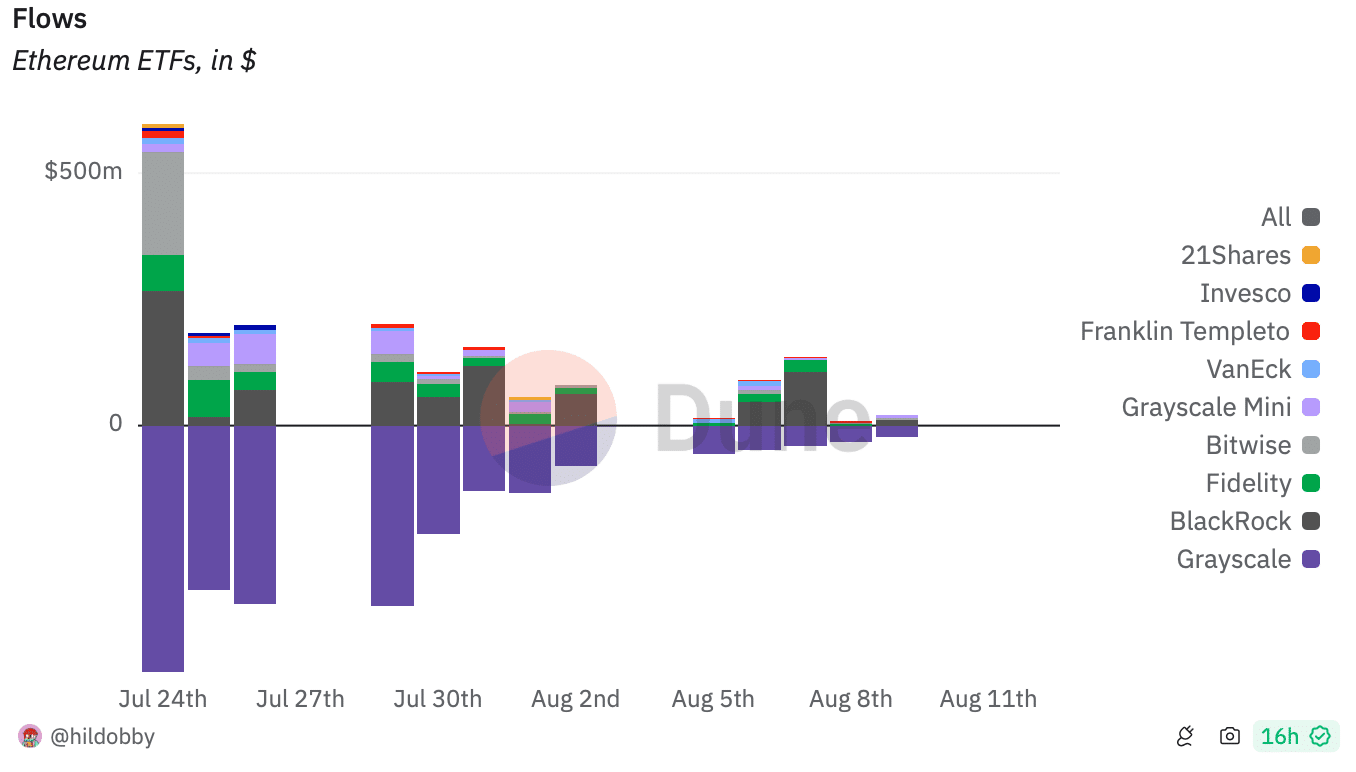

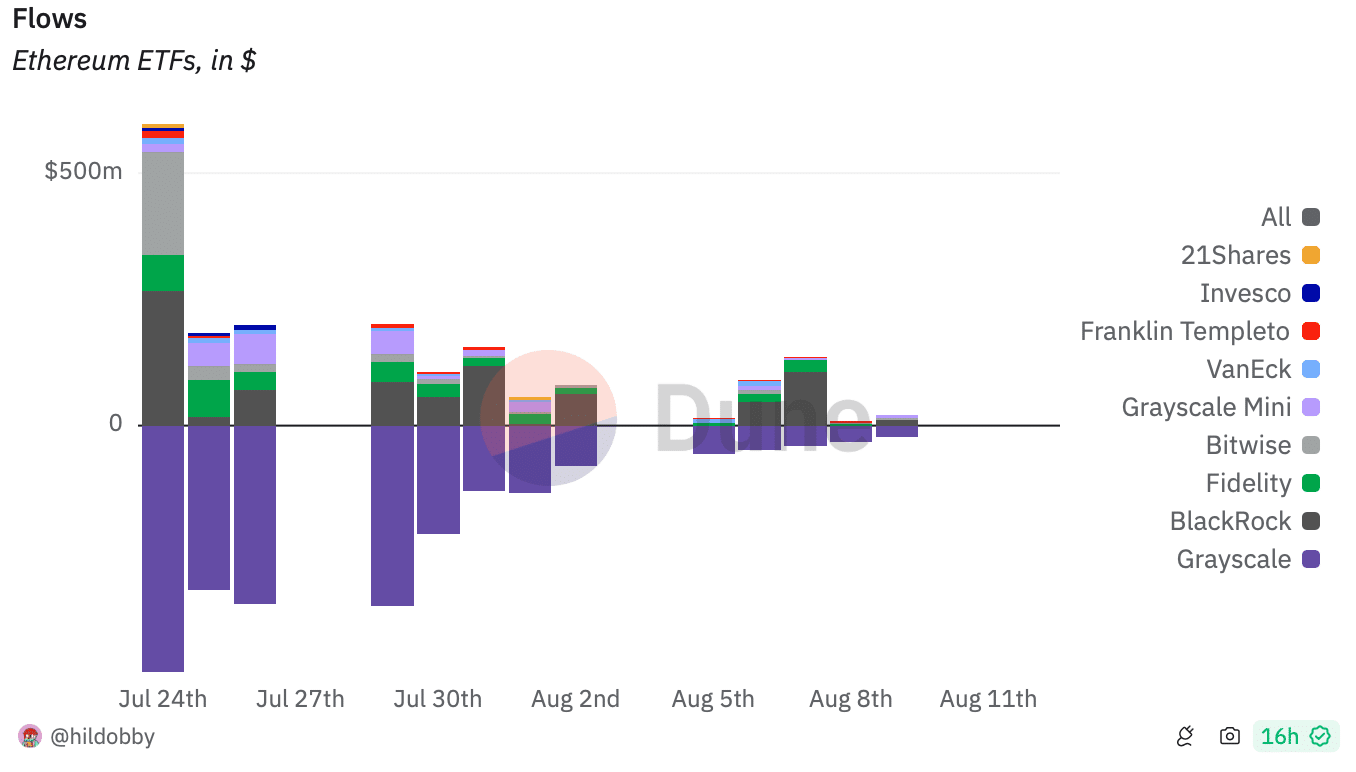

BlackRock’s Ethereum ETF witnessed a substantial increase in inflows, with nearly $900 million coming in within a span of 11 days.

On August 6th alone, the iChare Ethereum Trust recorded an inflow of over $100 million.

Interestingly, while BlackRock was accumulating, GreyScale, the largest ETH ETF, was selling off. For instance, BlackRock’s inflow surpassed $12 million on August 9th, while GreyScale’s outflow reached $20 million.

Source: Dune

In the past week, ETH ETFs saw a netflow of +31.5k. However, the overall netflow since inception stands at -124.2k, according to Dune’s data.

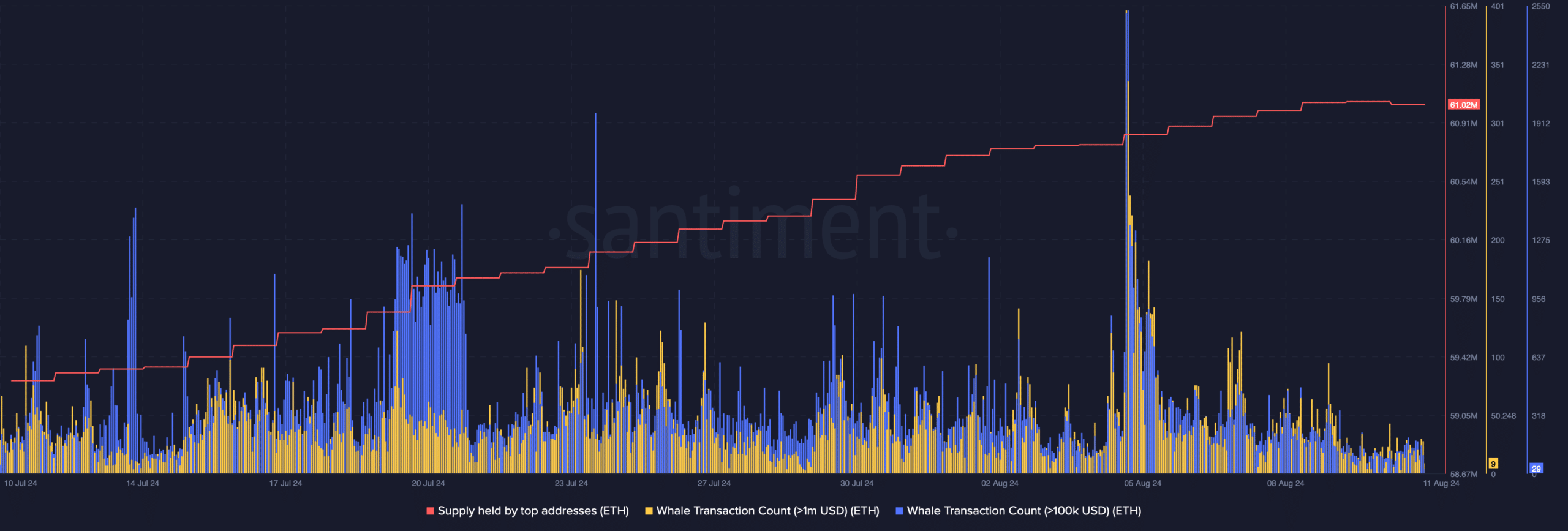

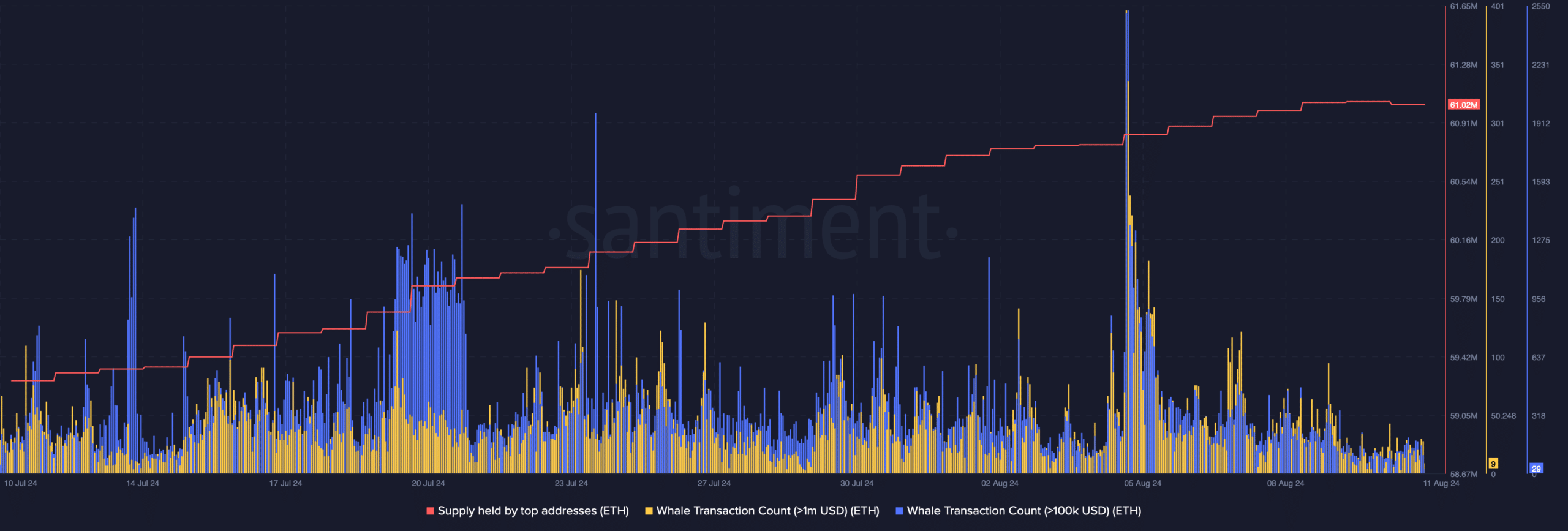

As these movements unfolded, ETH whales increased their holdings. Santiment’s data analyzed by AMBCrypto revealed a sharp rise in ETH supply held by top addresses over the past month.

Currently, the metric stands at 61.2 million ETH, with an uptick in whale transactions during the same period.

Source: Santiment

Evaluating ETH’s Situation

AMBCrypto conducted an analysis of ETH’s current performance to gauge its price movement. According to CoinMarketCap, ETH’s price dropped by over 4% in the last 24 hours.

At the time of writing, ETH was valued at $2,543.14 with a market capitalization exceeding $305 billion.

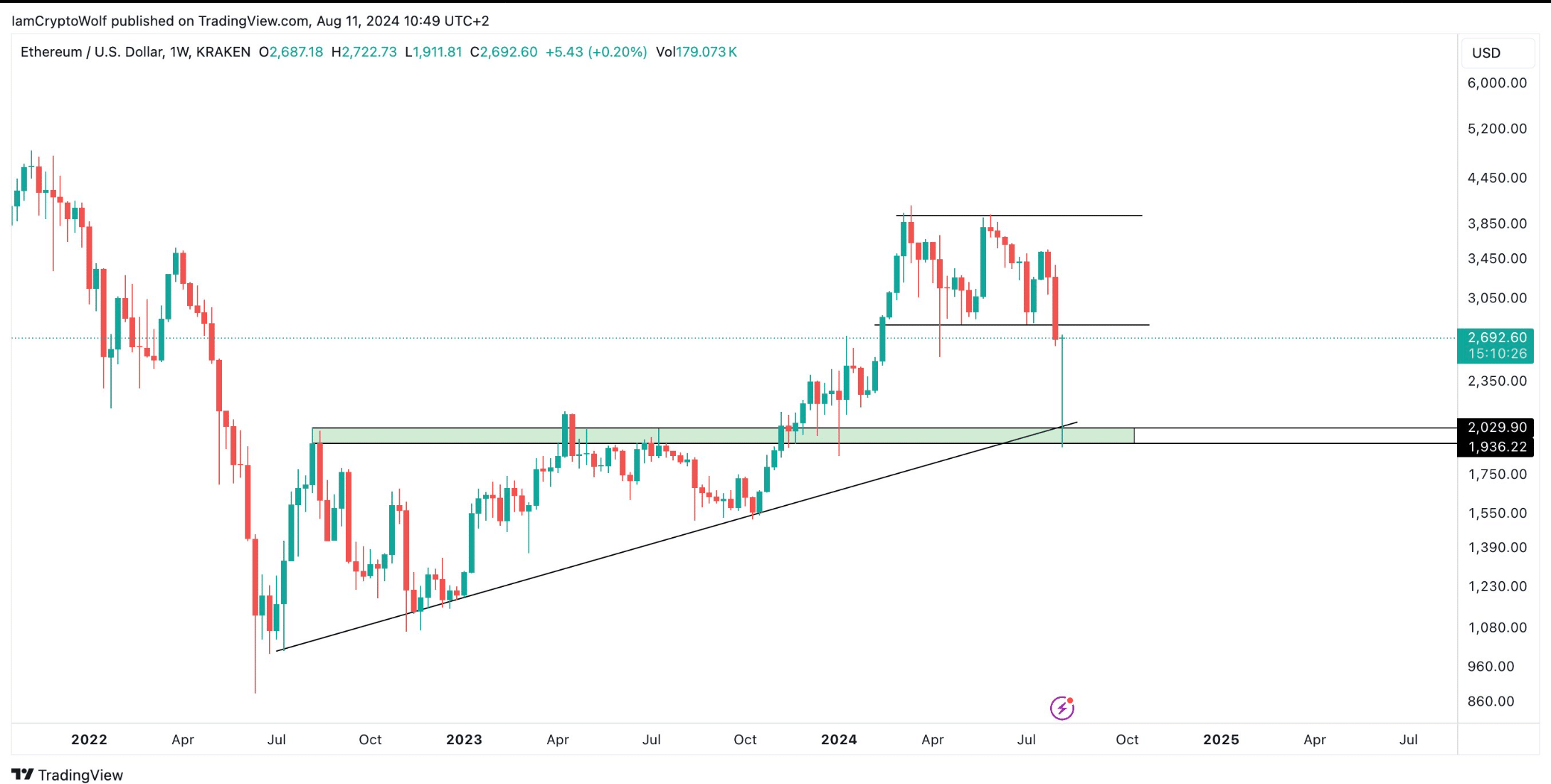

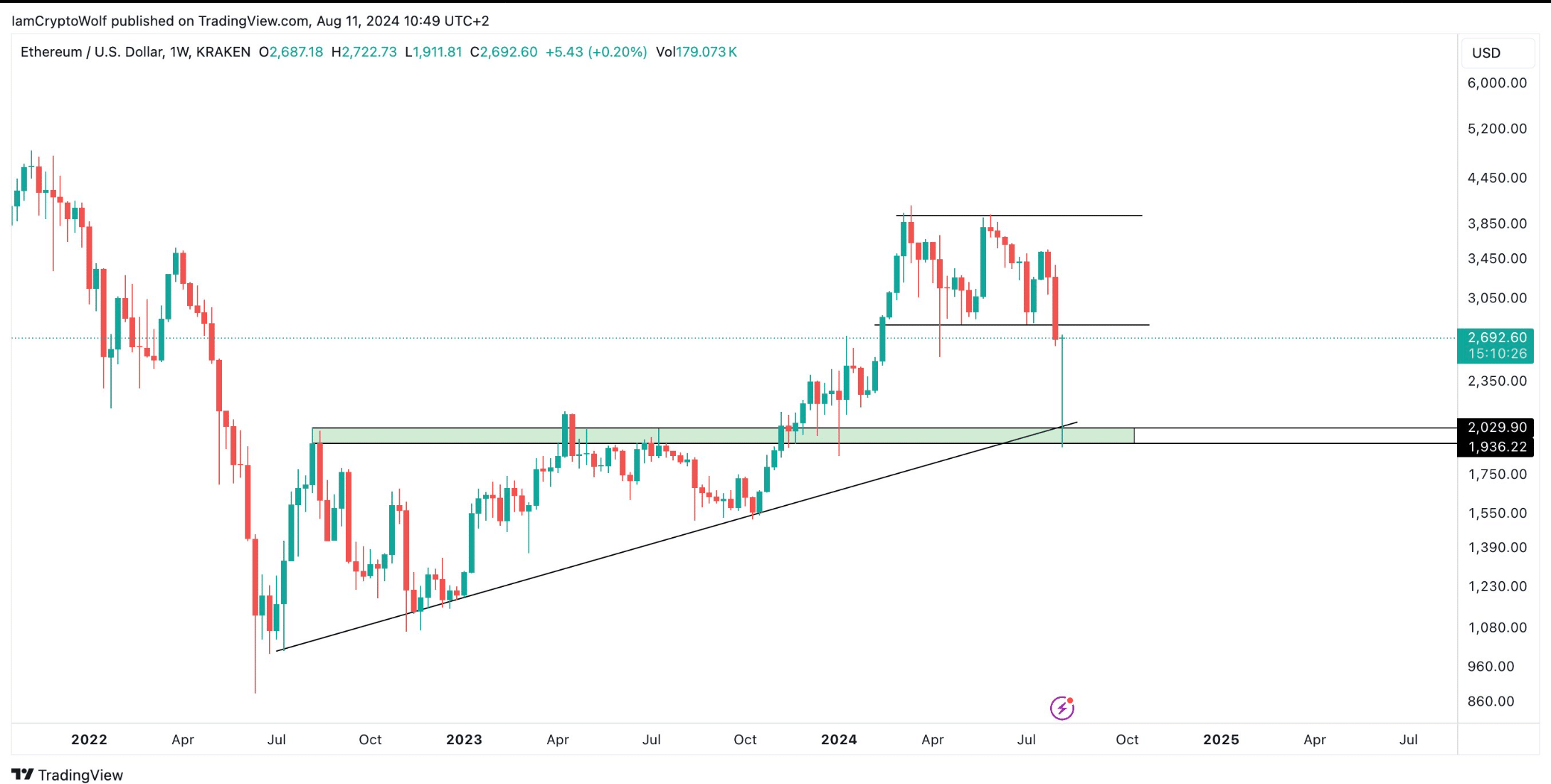

Meanwhile, a prominent crypto analyst, Wolf, shared a tweet suggesting a potential sharp decline after ETH tests its ascending triangle pattern.

This projection indicates a possible drop to $2k in the near future before initiating a long-term bullish trend.

Source: X

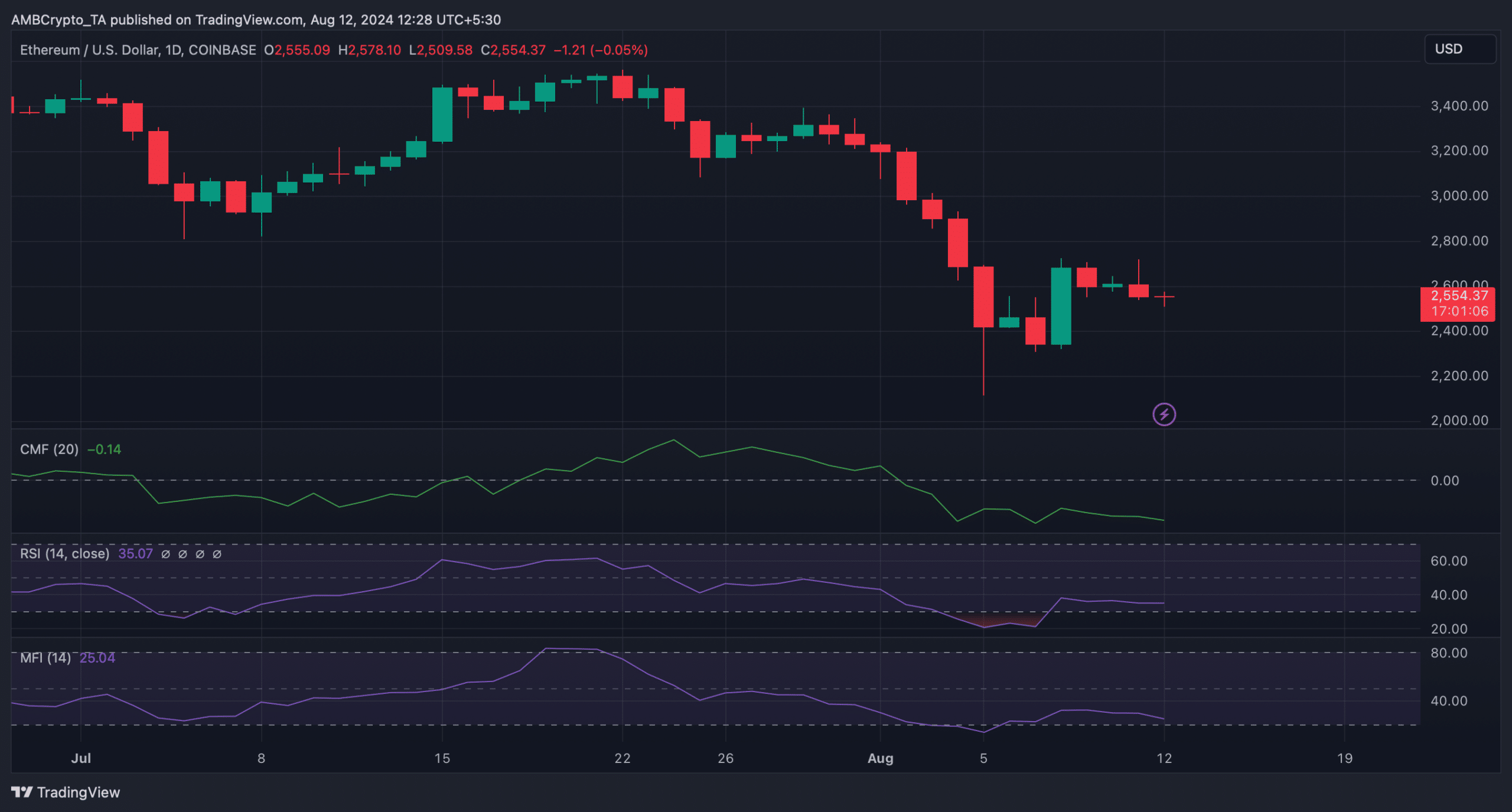

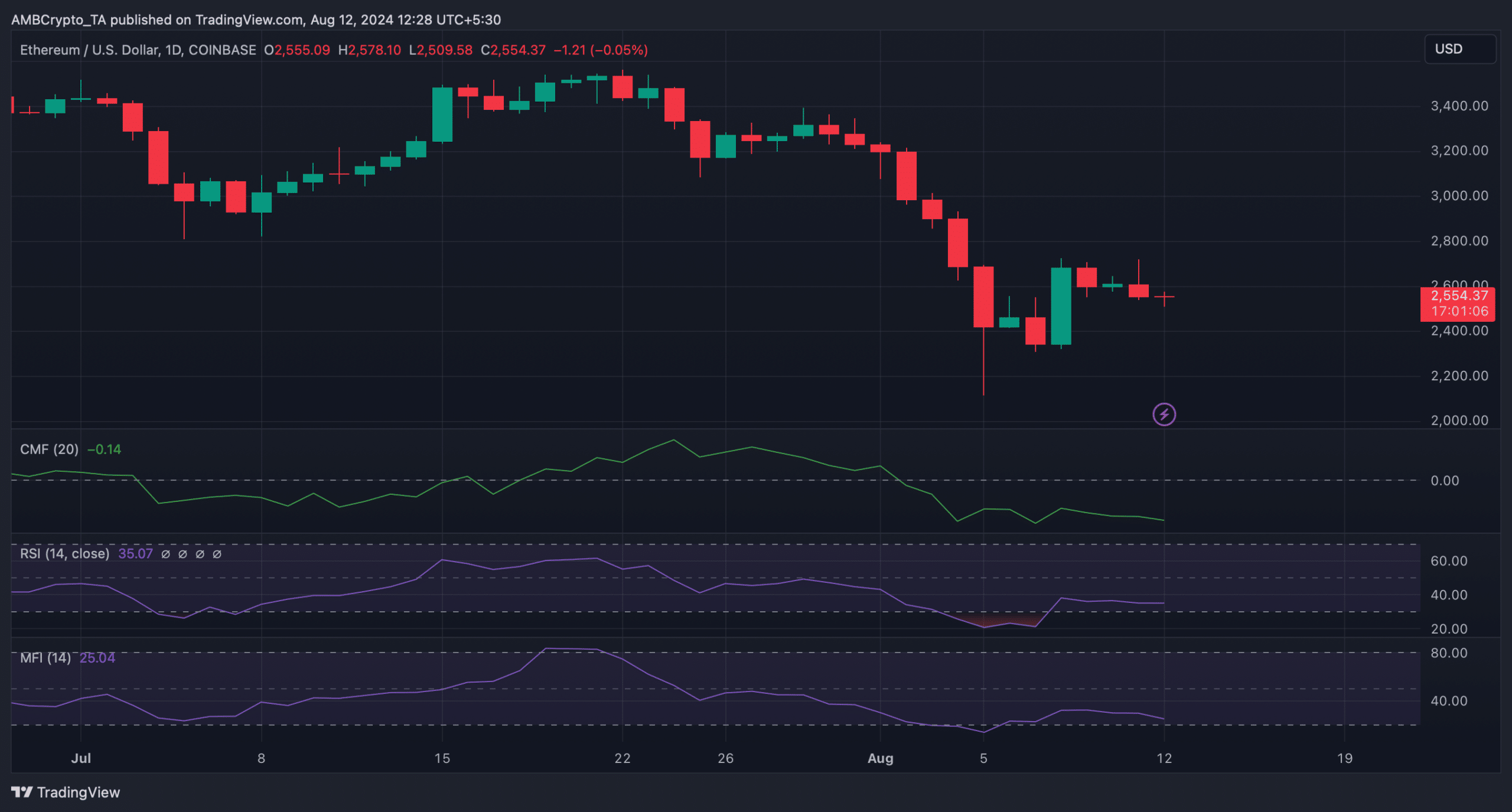

Hence, AMBCrypto aimed to analyze ETH’s daily chart to determine if market indicators align with a potential drop towards $2k.

The Relative Strength Index (RSI) stood at 35 currently, indicating a position well below the neutral 50 mark.

Read Ethereum (ETH) Price Prediction 2024-25

Furthermore, the Chaikin Money Flow (CMF) trended downwards, suggesting a probable continued price decline.

On the other hand, the Money Flow Index (MFI) was on the verge of entering the oversold territory, which could potentially boost buying pressure and elevate ETH’s price.