- Ethereum ETFs have officially been approved, but caution is advised as whales may manipulate the market.

- Market indicators highlight the current demand for ETH, including exchange flows.

July 23rd marks a significant day for the Ethereum [ETH] community as the U.S. Securities and Exchange Commission (SEC) greenlights S1 Ethereum ETFs for trading.

The market shows great enthusiasm for Ethereum ETFs, with experts predicting substantial capital inflows over the next year.

Following the success of Bitcoin [BTC] ETFs, it is expected that there will be strong demand for ETH as well. However, past experiences suggest a cautious approach before investing in ETH.

Are Ethereum ETFs a sell-off event?

Historically, extreme market excitement has allowed whales to manipulate prices, as seen with Bitcoin after ETF approvals. Could the same fate await ETH post-ETF approvals?

Reports indicate that a whale transferred a significant amount of ETH to Binance following the approval of nine Ethereum ETFs valued at over $30 million, hinting at potential short-term exit strategies by whales.

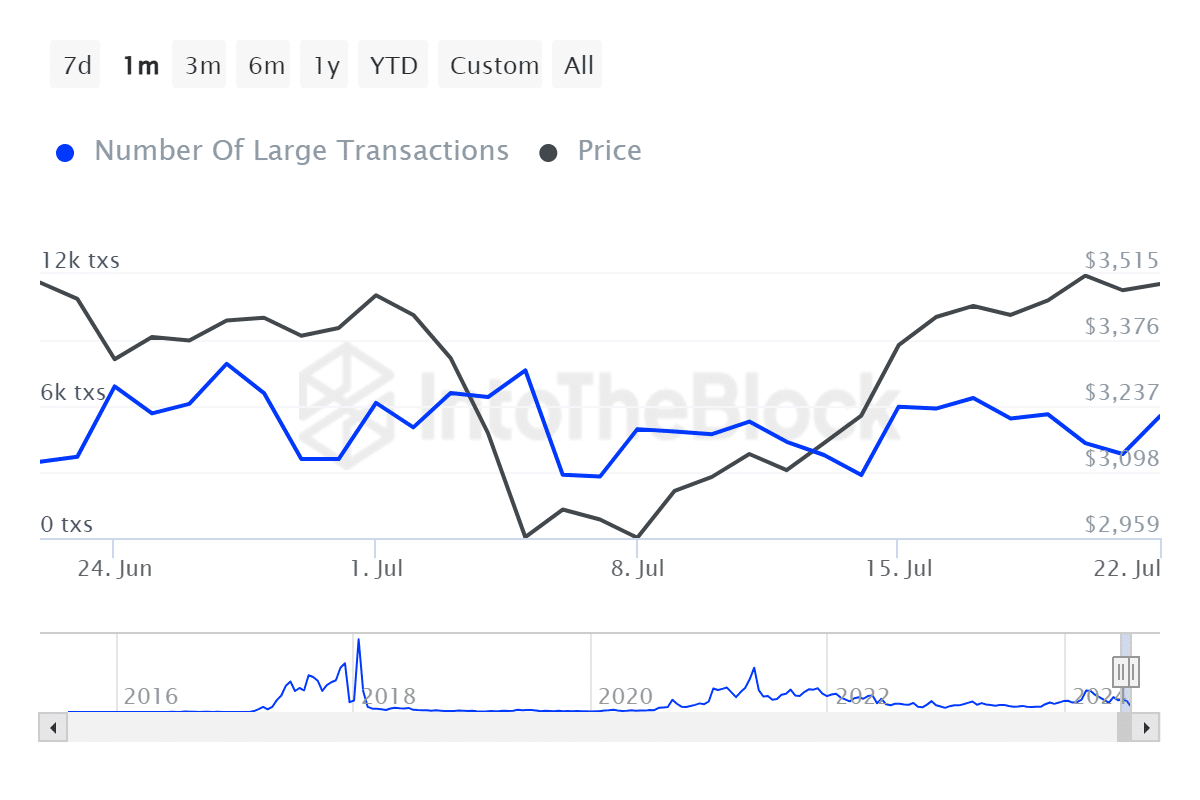

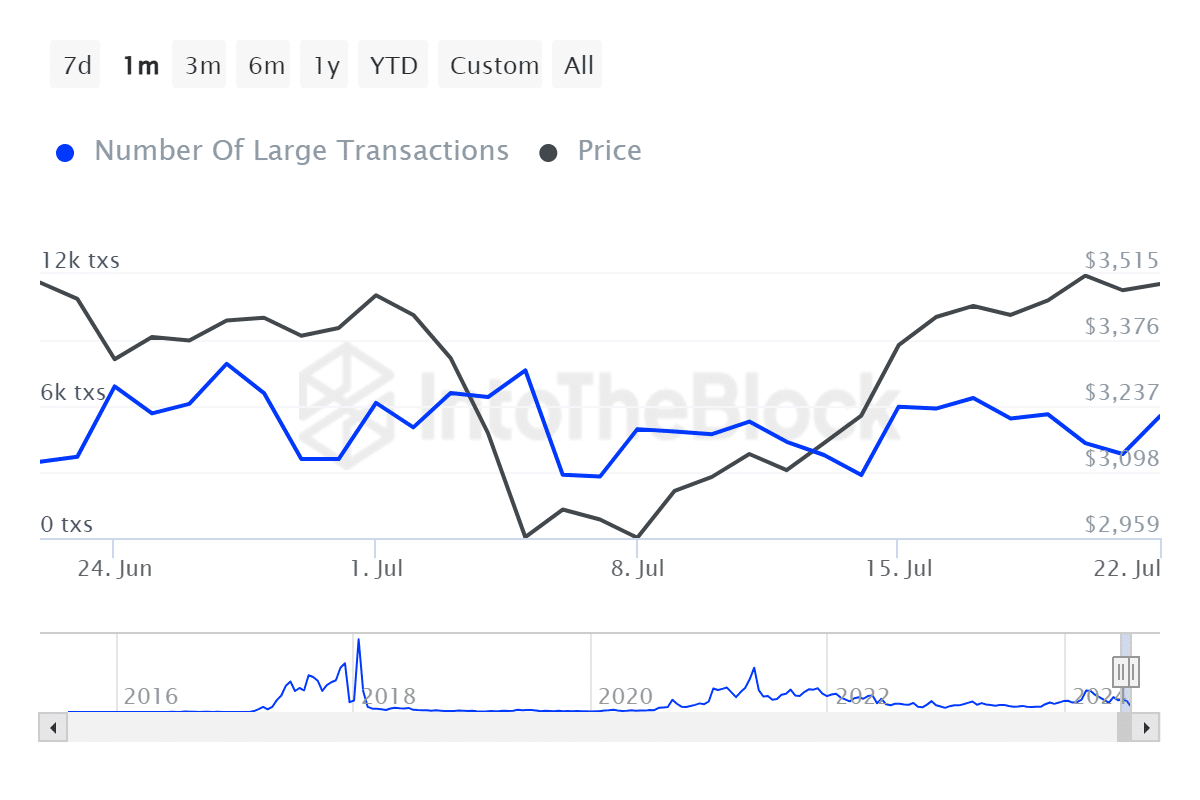

Analysis of on-chain data reveals a spike in large transactions, indicating increased whale activity coinciding with the Ethereum ETFs news.

Source: IntoTheBlock

This surge coincided with the Ethereum ETFs news, prompting further investigation by AMBCrypto to determine if whale activity is driving sell pressure.

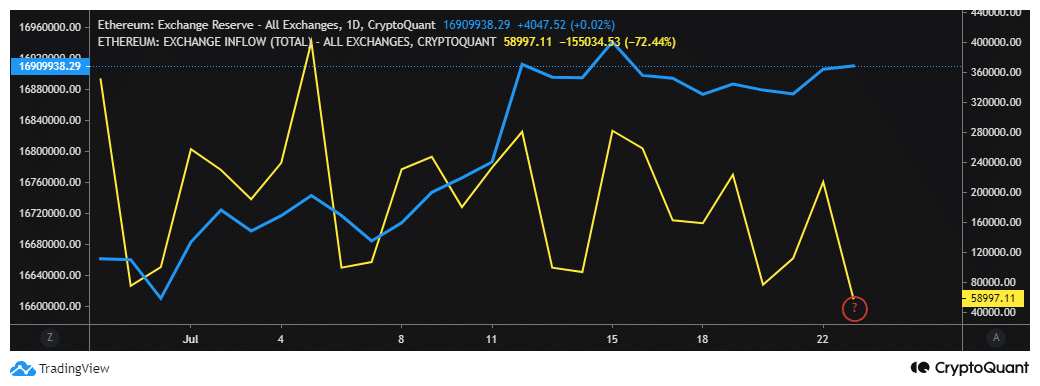

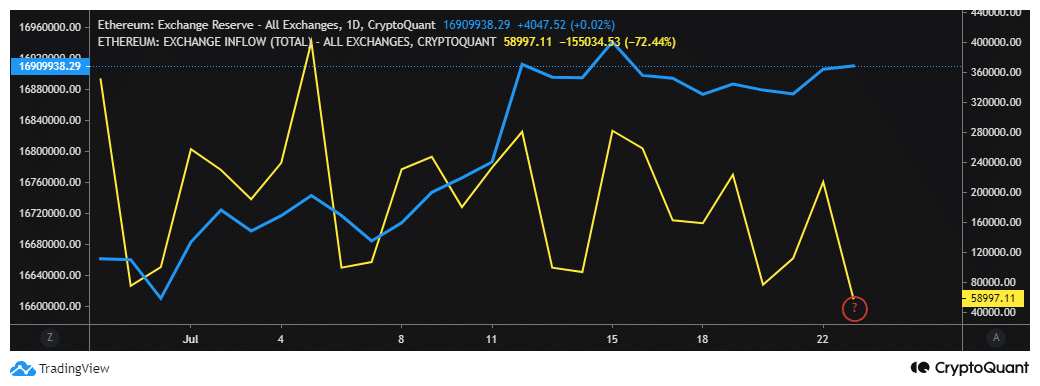

CryptoQuant’s exchange reserve data shows an increase in reserves, suggesting potential sell pressure from addresses holding ETH on exchanges.

Source: CryptoQuant

Are ETH whales selling off?

Recent metrics do not conclusively point to whale-induced sell pressure in the past three days. However, the uptick in exchange reserves suggests potential sell-offs by ETH holders on exchanges.

Conversely, the slowdown in exchange inflows indicates that whales holding ETH in private wallets may not be selling their holdings yet.

Read Ethereum’s [ETH] Price Prediction 2024-25

It is still early days post-announcement, allowing whales and the market to react. While history suggests a possibility of sell pressure triggering downside for ETH, the current market conditions could lead to a different outcome.