Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The recent surge in bullish momentum in the cryptocurrency market towards the end of April resulted in the Ethereum price closing the month above $1,800. Despite this, the altcoin did not end the month in profit, marking April as its fourth consecutive month with a negative performance. According to the latest on-chain data, Ethereum’s price appears to be holding above a crucial support level that could dictate its trajectory in the coming weeks.

ETH Price Vulnerable to Dropping to $1,772

In a post dated May 3 on the X platform, notable crypto analyst Ali Martinez suggested that Ethereum’s price is at a pivotal point that could determine its short-term outlook. Based on the latest on-chain data, the altcoin faces the risk of falling to around $1,500 if it fails to hold onto this support level in the upcoming days.

This on-chain analysis of Ethereum’s price revolves around the average cost bases of various Ethereum investors. Cost-basis analysis in crypto trading assesses a price level’s ability to act as support or resistance based on the volume of coins acquired by investors in that range.

Related Reading

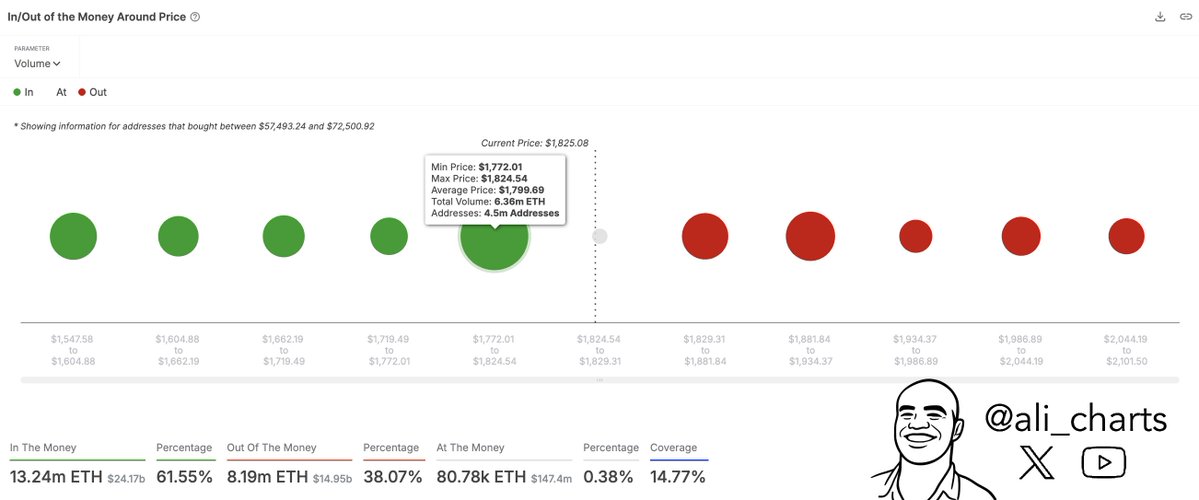

As illustrated in the chart above, the size of the dot (green and red) indicates the number of Ether tokens purchased within a price range. A larger circle signifies a higher volume of tokens bought in and around the price zone, strengthening the level of resistance or support.

According to data from IntoTheBlock, over 6.36 million ETH tokens were bought by 4.5 million addresses within the price bracket of $1,772 and $1,824 (at an average price of $1,799). The significant buying activity in this price zone has established a major support level just below the current price.

It is anticipated that the Ethereum price will rebound when it reaches this level. The reasoning behind this expectation is that when the ETH price returns to approximately $1,772, investors with their cost bases around this level are likely to protect their positions by acquiring more tokens, helping to sustain the price within the support range.

However, the chart indicates that the price levels below the $1,772 support level have considerably less investor activity. This indicates that if $1,772 is breached, Ethereum’s price could drop to around $1,500 without finding significant support. Conversely, if this support level remains intact, ETH’s price could climb as high as $2,100, with no major resistance ahead.

Ethereum Price Overview

At the time of writing, the ETH token is valued at approximately $1,830, reflecting an almost 1% increase in the past 24 hours.

Related Reading

Featured image from iStock, chart from TradingView