ETH experiences significant divergence from BTC as Q1 drawdown widens

During the first quarter, Ethereum faced a considerable decline of 44.83% in value, contrasting with Bitcoin’s more modest 14.67% drop, as per data from IntoTheBlock.

Source: IntoTheBlock

This divergence highlights Ethereum’s susceptibility as market sentiments shift, regulatory uncertainties emerge, and interest in Ethereum-based assets diminishes.

While Bitcoin’s decline mirrors overall macroeconomic instability, Ethereum’s sharper decrease indicates a lack of confidence. Traders seem to be reallocating funds to Bitcoin, seen as the “safer” cryptocurrency option.

Even traditional markets like the S&P 500 have outperformed Ethereum, underscoring its performance as one of the key trends of the quarter.

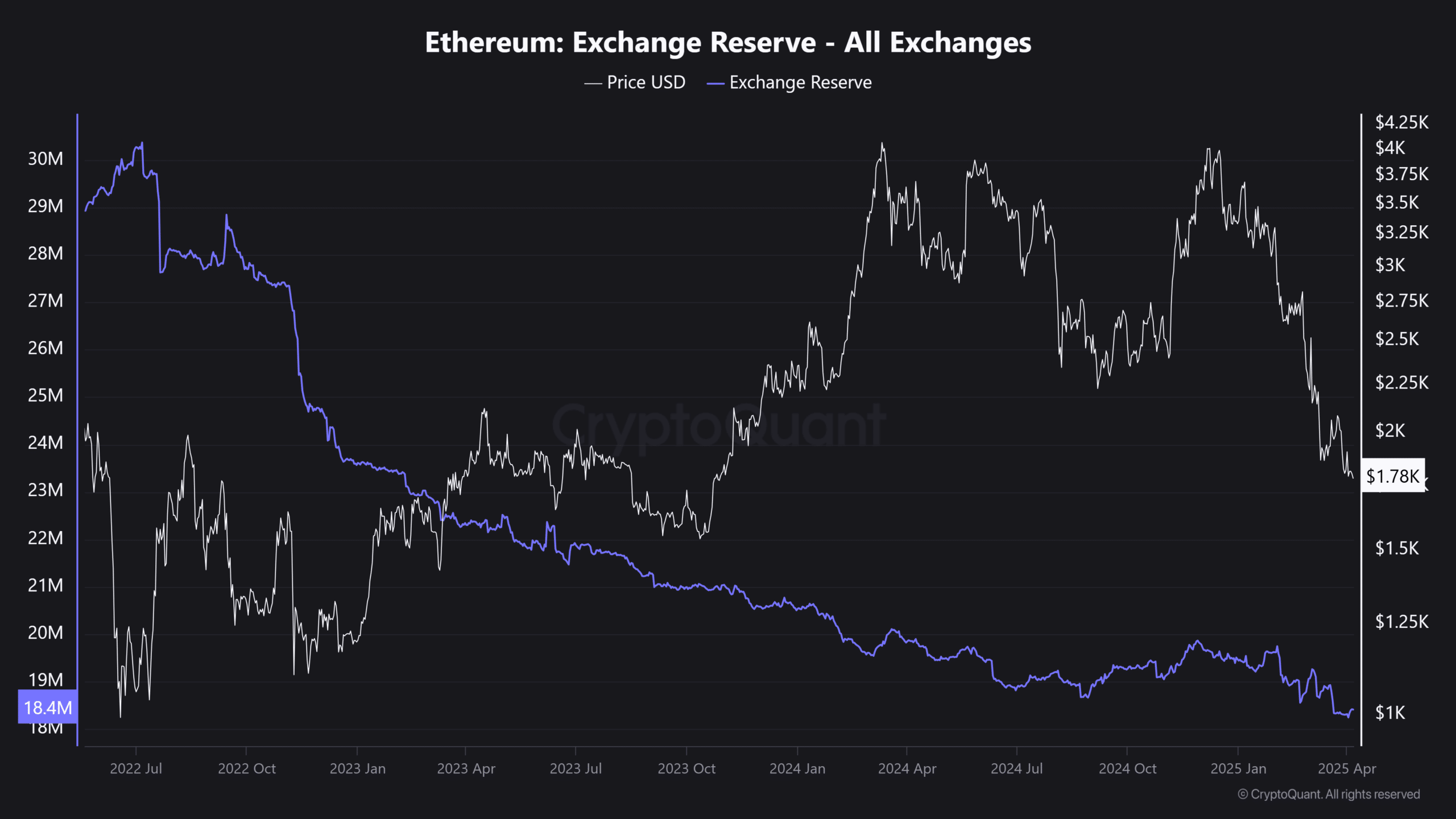

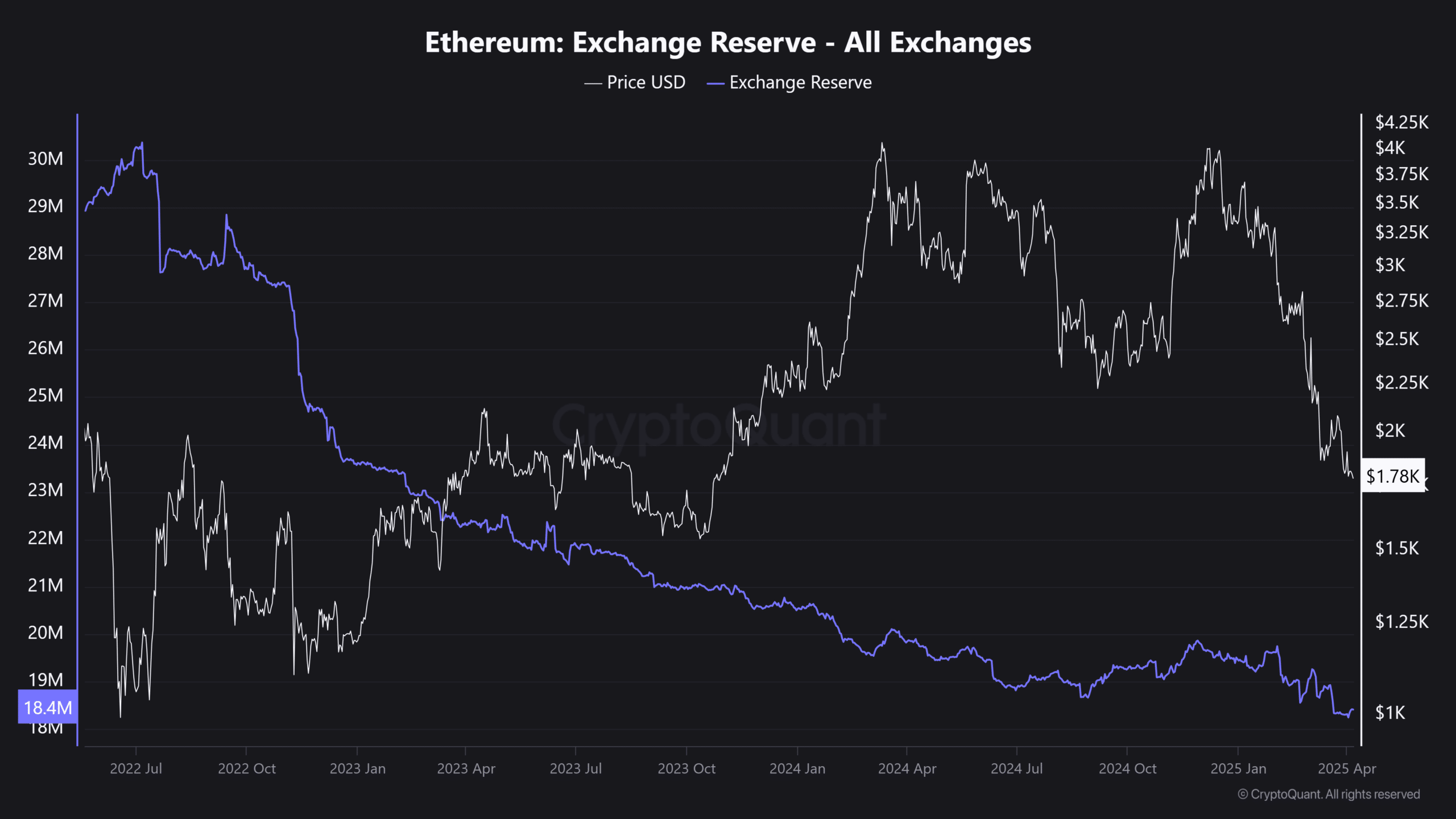

Exchange reserves reach new lows

Adding to Ethereum’s challenging quarter is a continual decline in exchange reserves, now at a mere 18.4 million ETH — the lowest level in over three years, according to CryptoQuant data.

Source: Cryptoquant

Despite the decrease in exchange reserves, the decline in ETH’s price paints a different picture. The reduction in tokens on exchanges has not stimulated increased buying activity.

Instead, it may signify a broader disinterest among investors, a shift towards passive holding, staking, or even potential exit strategies.

While the supply dwindles, investor trust seems to be waning as well.

Ethereum: Stuck in a challenging position?

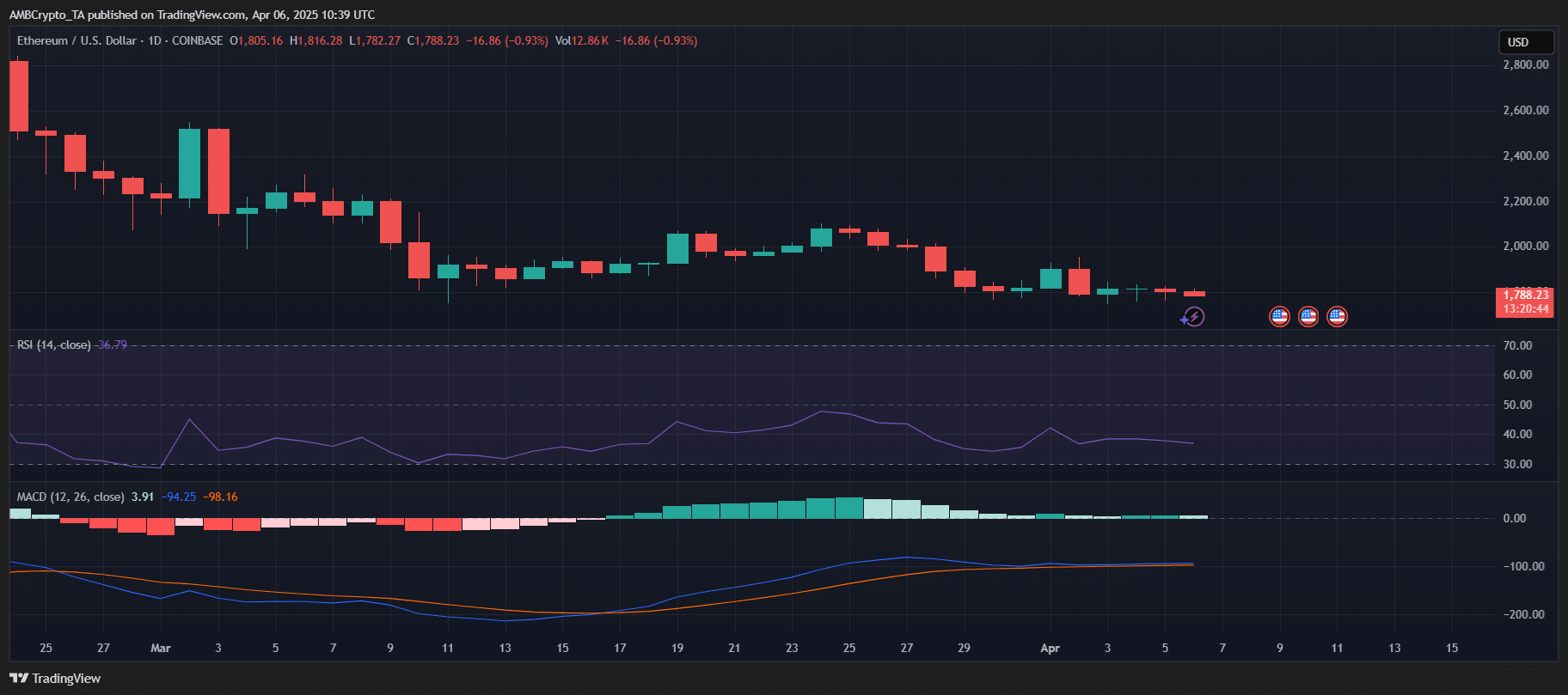

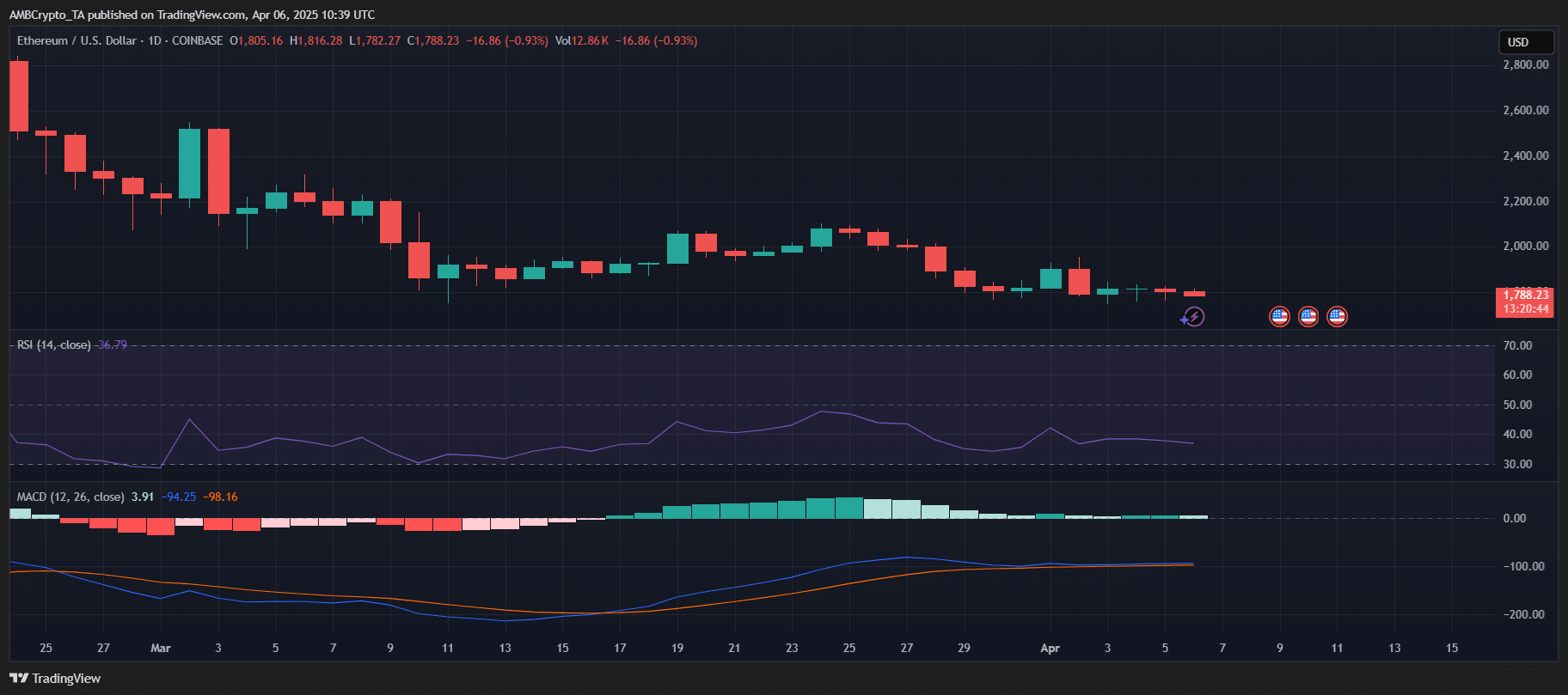

Currently trading at $1,788, ETH is hovering just above the critical psychological level of $1,750, with no clear indications of bullish momentum.

The RSI stands at 36.7 — approaching oversold territory but lacking sufficient buying pressure for a turnaround. Meanwhile, the MACD shows weak upward movement, with the histogram barely turning green.

Source: TradingView

The price has been range-bound for over two weeks, suggesting uncertainty rather than accumulation.

Unless ETH can reclaim the $1,850-$1,900 range with robust volume support, the downside risk persists. In the short term, a drop below $1,750 could trigger a retest of $1,650.