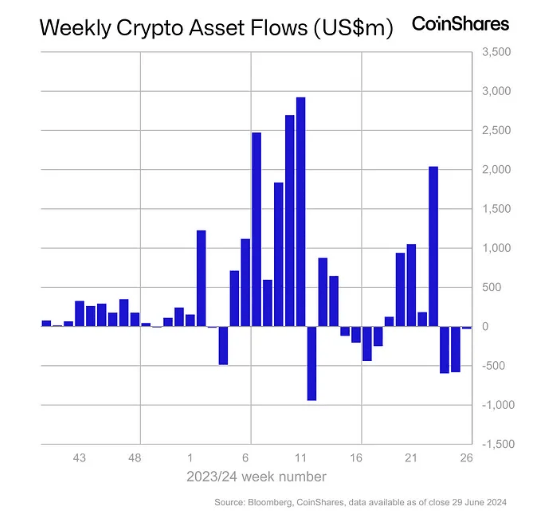

The digital asset market is experiencing a wave of investor caution, with Ethereum leading the charge. CoinShares reports show a third consecutive week of outflows, with Ether sustaining the biggest damage. This negative sentiment in the top altcoin, coupled with sluggish trading volumes and regional outflows across the market, paints a picture of a market searching for direction.

Related Reading

Ethereum Faces Headwinds Despite Upcoming Milestone

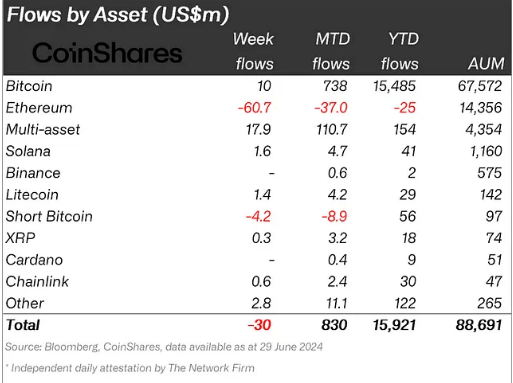

Ethereum, the world’s second-largest cryptocurrency, has seen the worst outflows of any digital asset this year, reaching a staggering $61 million last week. The dismal figure could be attributed to the delay in approving a spot Ethereum ETF, a highly anticipated event that has been in the works for nearly three years.

According to CoinShares, digital asset investment products saw $30 million in outflows last week, the third consecutive week of outflows. Ethereum saw its largest outflow since August 2022, totaling $61 million, making it the worst performing digital asset investment product so…

— Wu Blockchain (@WuBlockchain) July 1, 2024

The long wait for regulatory greenlight might be causing investors to hold off on commitments, creating uncertainty in the Ethereum market. However, the upcoming launch on July 4th remains a pivotal moment. Analysts are closely watching to see if this long-awaited development triggers a surge in Ethereum adoption or if it simply cannibalizes existing Bitcoin ETF investments.

Mixed Signals: Regional Divergence And Altcoin Interest

While the overall trend points towards caution, there are regional variations in investor sentiment. The United States, for example, defied the global trend and witnessed inflows of $43 million, suggesting continued American interest in the digital asset space.

Similarly, inflows into multi-asset and Bitcoin Exchange-Traded Products (ETPs) indicate a preference for diversification and established players. This highlights the ongoing appeal of a broader exposure to the digital asset landscape, rather than a singular focus on any one cryptocurrency.

Interestingly, amidst the Ethereum outflow woes, some altcoins are experiencing a resurgence. Solana and Litecoin, for instance, saw inflows, suggesting that investors are seeking opportunities beyond the top two cryptocurrencies. This diversification could be a sign of a maturing market where investors are conducting a more thorough risk assessment and exploring undervalued gems within the vast digital asset ecosystem.

Related Reading

Navigating Uncertain Waters

The current state of the digital asset market is one of cautious optimism. While outflows and Ethereum’s struggles are undeniable concerns, positive inflows in specific regions and products offer a counterpoint.

The upcoming Ethereum ETF launch is a wild card, potentially acting as a catalyst for further adoption or simply reshuffling existing investments. Investors are likely to remain watchful in the near future, carefully weighing risk and reward before making significant commitments.

Featured image from Parents, chart from TradingView