- ETH saw a slight recovery attempt, but a rally might be dampened due to weak demand.

- An analysis of the impact of increasing exchange reserves and the state of exchange flows.

Ethereum [ETH] managed to bounce back a bit from the recent sell-off pressure.

While there was some recovery over the weekend, indications suggest that the road to recovery this week might not be smooth.

After ending September on a bearish note, ETH saw a relief in sell pressure last Thursday with a 15% retracement.

This was followed by a bullish momentum over the weekend, resulting in a 7% recovery from the previous week’s lows.

ETH was trading at $2477 at the time of writing. The price action respected an ascending trend line, hinting at some accumulation.

Source: TradingView

While the weekend rally may appear positive at first glance, the money flow indicator for ETH turned downwards in the last 24 hours, indicating a potential outflow of liquidity.

Source: TradingVIew

The Money Flow Index suggests that the recent rally might be driven by weak demand, limiting ETH’s potential upside.

However, this could change based on supply-demand dynamics in the upcoming week.

Will the lack of excitement for ETH impede its growth?

The data indicates a waning interest in Ethereum, signaling that ETH may not be the top choice for short-term gains.

Furthermore, on-chain data shows a significant increase in ETH exchange reserves, possibly leading to more selling pressure.

Source: CryptoQuant

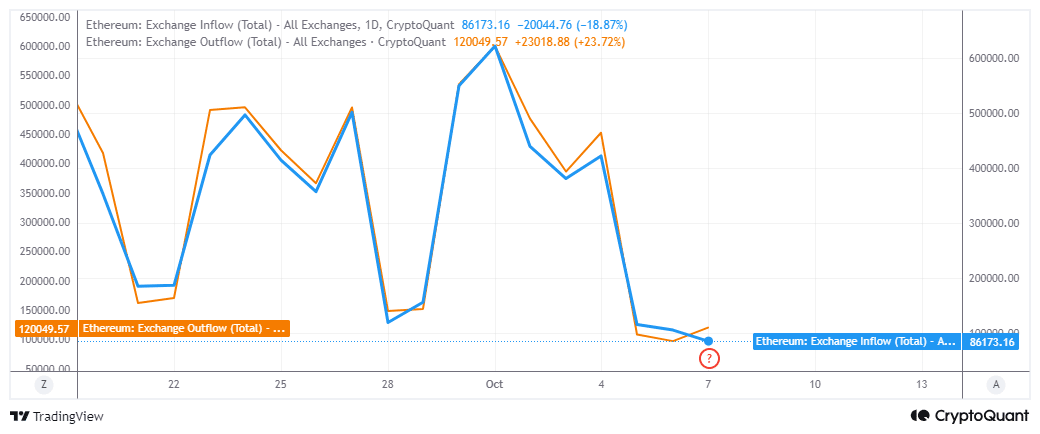

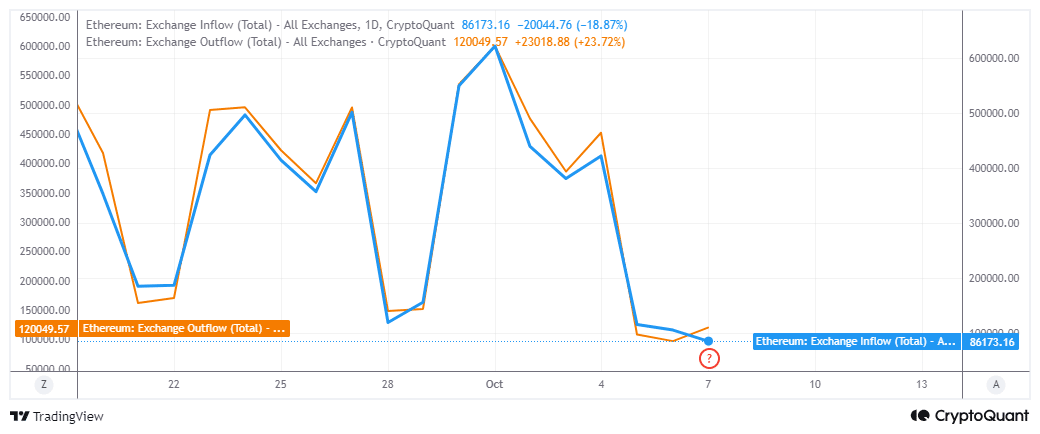

What do the exchange flows indicate about the current scenario? According to CryptoQuant, ETH’s exchange flows shifted at the beginning of the month, resulting in lower volumes.

For instance, exchange inflows peaked at 621,000 ETH at the start of October, while outflows were slightly lower at $599,778 ETH.

Fast forward to now, and inflows amounted to 86,173 ETH, with outflows surpassing 120,000 ETH.

This translates to a net demand of 33,827 ETH, equivalent to $83.5 million in demand.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

From the data, it’s evident that there is some demand for ETH, albeit in limited quantities.

In essence, the lack of enthusiasm for the cryptocurrency could lead to a subdued outcome.

sentence: The cat chased the mouse.

Rewritten sentence: The mouse was chased by the cat.