Written by Brayden Lindrea via CoinTelegraph.com,

The Ethereum validator exit queue has reached zero, indicating a significant decrease in selling pressure and boosting confidence in Ether (ETH) as a lucrative asset for yielding returns.

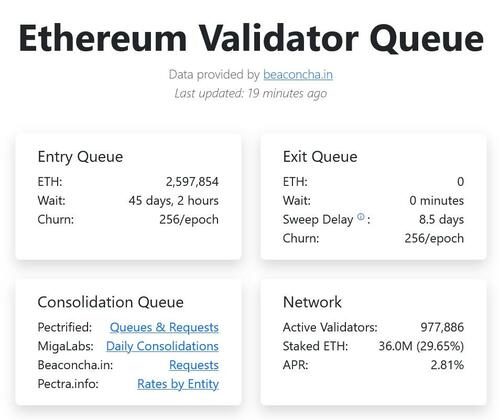

Data from Ethereum Validator Queue reveals that the exit queue has plummeted from its peak of 2.67 million Ether (ETH) in September 2025 to 0 ETH, while the entry queue has surged over five times in the past month to 2.6 million ETH, the highest since July 2023.

Entry queue wait times have now extended to 45 days, while ETH exits are processed within minutes.

Data on Ethereum staking entry and exit queues. Ethereum Validator Queue

Experts suggest that the substantial influx of staking activities enhances ETH’s supply-demand balance, potentially paving the way for continued upward price momentum in the upcoming months.

“As the entry queue transitions into active validators, the staking rate increases, heading towards new record levels,” commented Leon Waitmann, head of research at Onchain Foundation on Monday.

“A promising outlook for the months ahead.”

The surge in inflows is partly driven by institutional interest in ETH staking rewards, currently yielding around 2.8% Annual Percentage Rate.

BitMine Immersion Technologies, led by chairman Tom Lee, has staked over 1.25 million ETH, which constitutes more than a third of its total ETH holdings.

Over 46% of ETH is in PoS deposit contract

Crypto analytics platform Santiment reported that over 46.5% of the total ETH supply is now locked in the ETH proof-of-stake deposit contract, totaling 77.85 million ETH, valued at $256 billion based on current market prices.

Change in ETH Proof-of-Stake Deposit Contract since Jan. 2016. Source: Santiment

The total staked ETH amounts to approximately 36.1 million, representing around 29% of the total ETH supply, as per Beaconcha.in data.

Despite these positive indicators, ETH’s current price of $3,300 remains below its all-time high of $4,946 reached on Aug. 4, 2025, as shown by CoinGecko data.

Loading recommendations…