- Whale dominance in Ethereum suggests strong bullish sentiment and potential price growth

- Concerns arise over concentrated holdings, posing liquidity risks and potential market corrections

The Ethereum [ETH] network is witnessing an increasing dominance by whales, with 104 wallets now holding over 100,000 ETH, representing more than 57% of the total supply.

This shift in Ethereum’s distribution raises important questions about its future, particularly in terms of market control and price movements. The accumulation by these whales indicates a strong bullish sentiment.

However, the high concentration of holdings begs the question of how this might impact Ethereum’s price trajectory going forward.

Whale accumulation and long-term holders: Bullish sign or a bear trap?

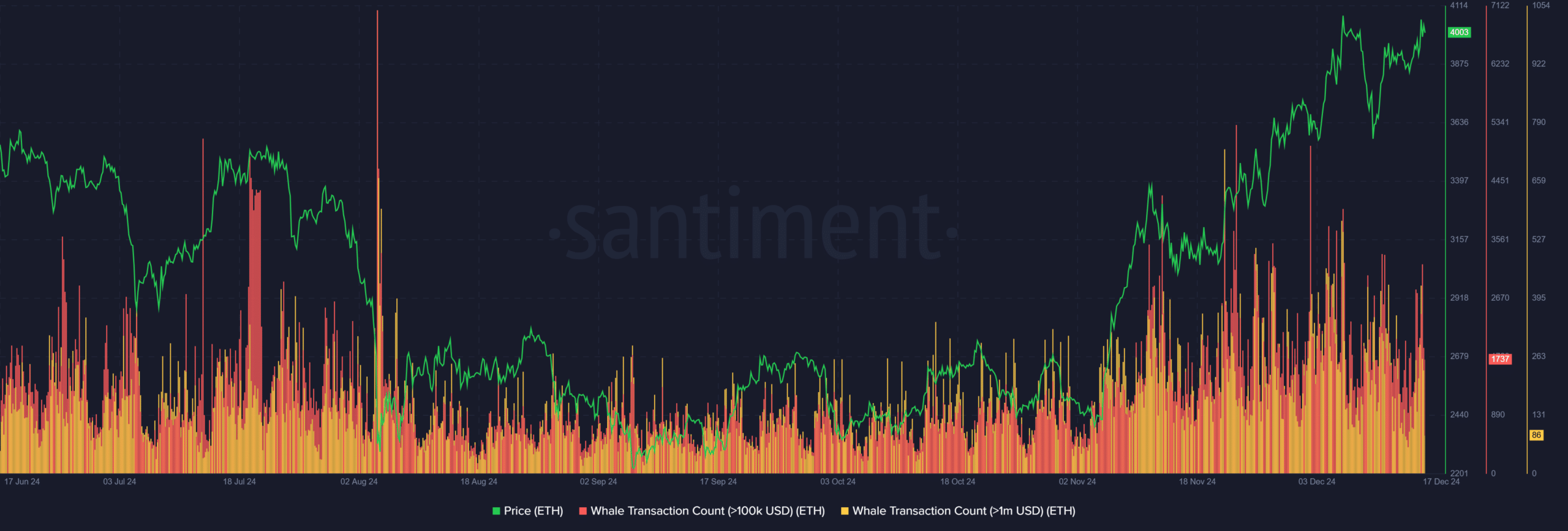

The accumulation of whales in Ethereum has intensified alongside significant price rebounds, reflected in increased whale transaction volumes exceeding $100k and $1M.

These large investors, often referred to as long-term holders (LTHs), serve as stabilizing forces during volatile cycles, mitigating supply shocks when sentiment turns bearish.

Their strategy of accumulating during market dips and holding through uncertainty aligns with Ethereum’s upward price trend in late 2024.

Source: Santiment

The concentration of holdings raises a critical question: is this a bullish sign or a bear trap? While the increasing dominance of whales suggests sustained confidence and bullish momentum, it also amplifies downside risk.

A coordinated sell-off or depletion of buying pressure could trigger sharp reversals, highlighting the delicate balance between optimism driven by accumulation and the potential correction driven by liquidity concerns.

Historical whale activity

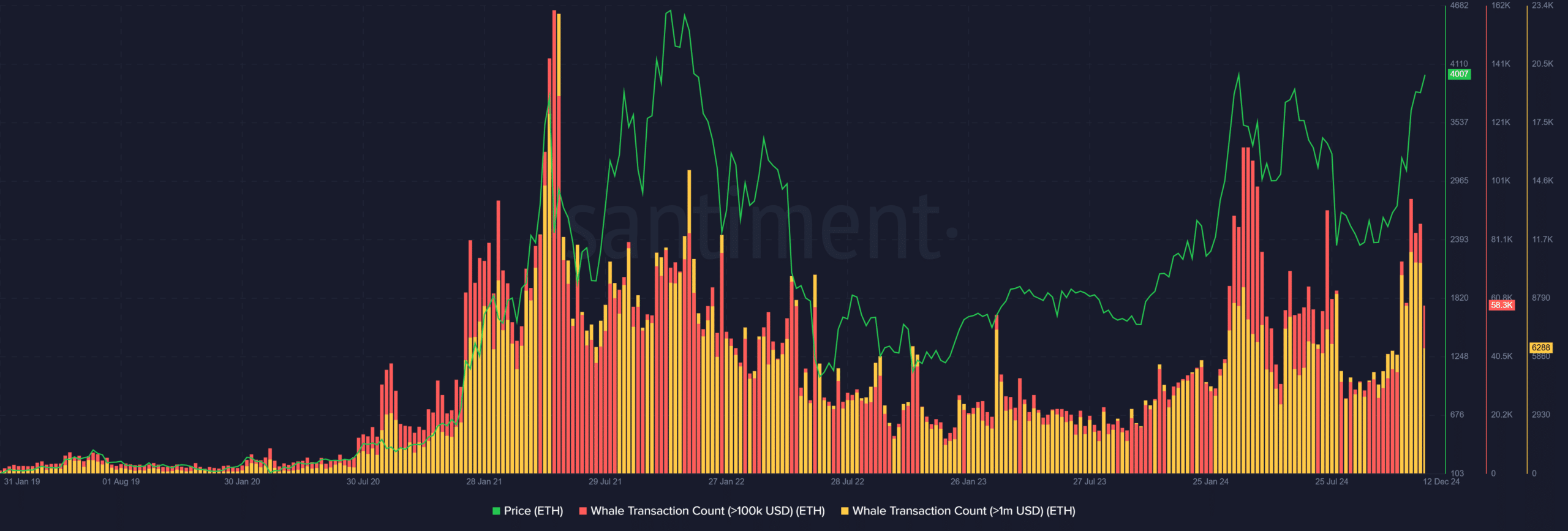

Ethereum’s historical data reveals a strong correlation between whale activity and price movements. Spikes in whale transactions, particularly those above $1M, often precede significant price rallies or corrections.

Source: Santiment

Whale-driven peaks have at times foreshadowed sell-offs, as evidenced during ETH’s pullback in 2022.

This dual impact underscores the importance of monitoring whale behavior: while accumulation often drives price growth, excessive concentration can introduce volatility if whales decide to unload their holdings, testing the market’s liquidity resilience.

Read Ethereum’s [ETH] Price Prediction 2024-25

What’s next for ETH?

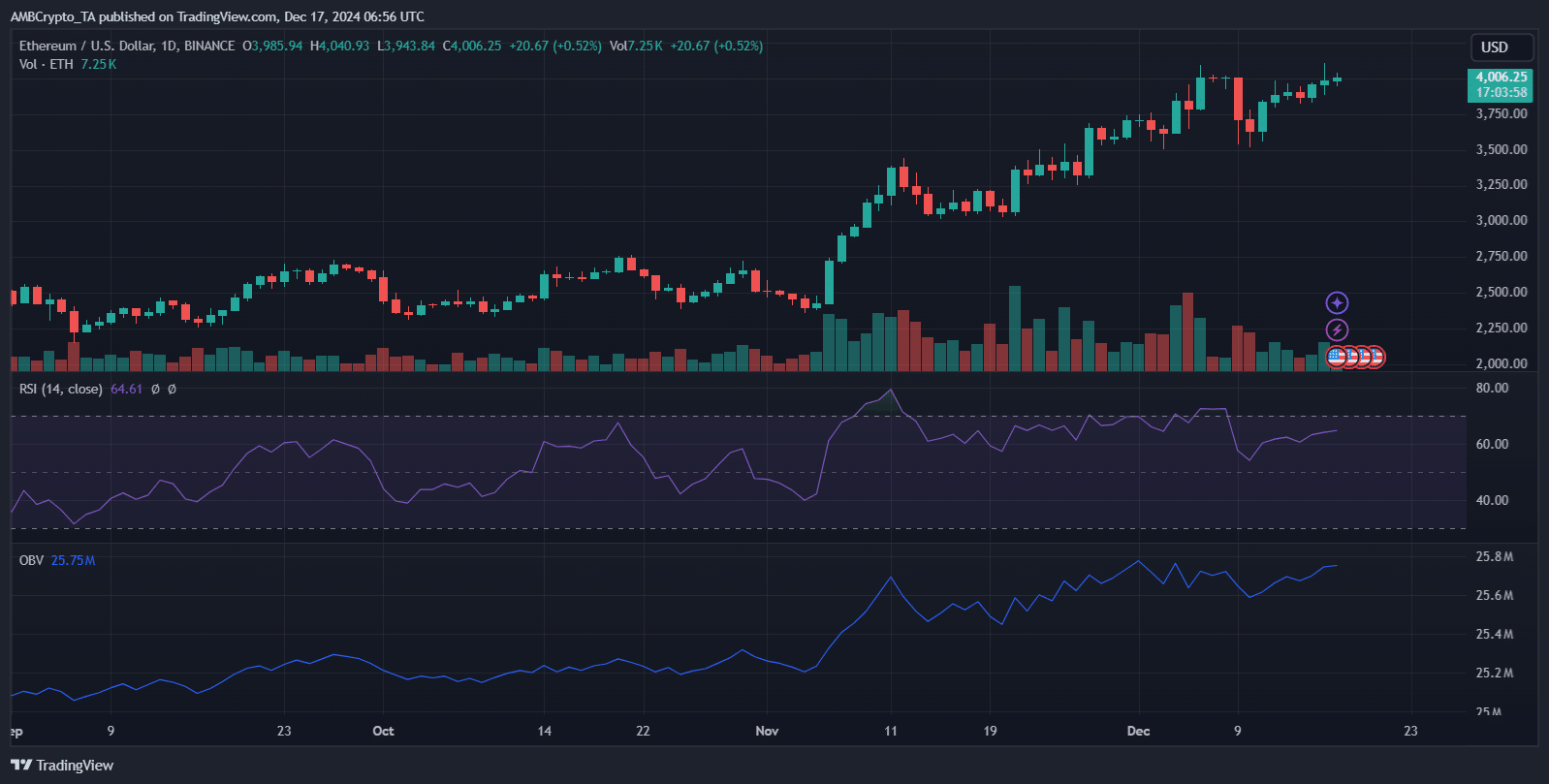

Ethereum’s rally driven by whales has pushed its price above the $4,000 mark, with strong buying volume reinforcing bullish sentiment.

The RSI stands at 64.61, indicating that ETH is still below overbought territory, suggesting further upside potential. OBV continues to rise, indicating that demand is fueling the uptrend.

Source: TradingView

If whale accumulation persists, Ethereum could target the $4,500-$5,000 range next. However, the concentration of holdings remains a double-edged sword.

While continued accumulation fuels optimism, past experiences warn of sharp corrections if whales decide to liquidate significant positions, testing liquidity and retail confidence. The upcoming weeks will determine whether this rally solidifies or encounters a reversal.

statement: “The company is implementing new procedures to improve efficiency.”

“The company is introducing new protocols to enhance productivity.”