- ETH faced strong selling pressure as prices retraced from recent highs.

- Ethereum whales sold off 5,677.7 ETH tokens worth $14.03 million.

Following a market recovery, Ethereum [ETH] prices surged from a low of $1.7k to a local high of $2.6k. However, after reaching these levels, the altcoin experienced a retracement, recording three consecutive days of losses.

Currently, Ethereum is trading at $2457, marking a 3.97% decline on daily charts.

With ETH on the decline, the question arises: what is causing the drop in prices?

Ethereum’s Increased Selling Activity

Analysis by AMBCrypto reveals significant profit realization among Ethereum investors, with many taking profits after being underwater for two months.

This trend is particularly noticeable among Ethereum whales, as reported by OnChainLens.

One whale withdrew 4,677.7 WETH from Aave V3 and sold it for 11.52 million USDC at $2,463 per ETH, making a substantial profit.

Another whale deposited 1,000 ETH worth $2.51 million into Kraken after holding it for four years.

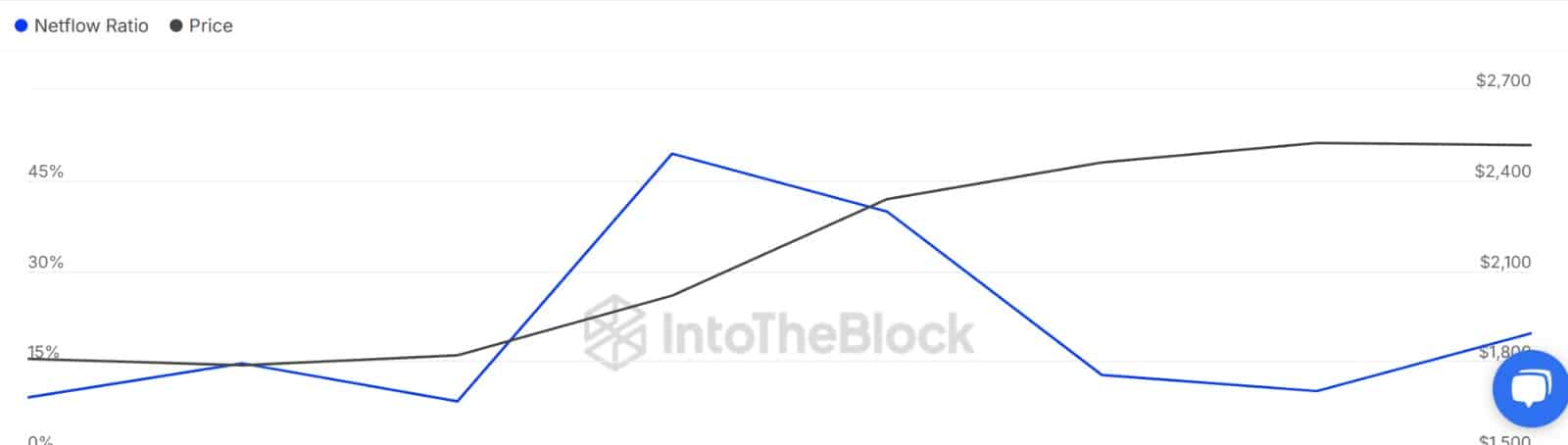

Source: IntoTheBlock

Selling activity has spread among Ethereum’s large holders, with the Large Holders Netflow to Exchange Netflow Ratio dropping to 10% at $2.5K.

As prices declined, large holders resumed selling, pushing whale exchange flow up to 19%.

Source: CryptoQuant

Whales selling off their holdings has led to increased selling activity across the market, as reflected in recent trends.

A positive netflow on Ethereum exchanges indicates higher selling activity due to more deposits than withdrawals.

Source: Santiment

The ETH Stock-to-Flow Ratio has decreased from 47 to 18, signaling a growing supply on exchanges, which typically leads to lower prices.

Future Outlook for ETH

The increased whale sell-offs have impacted ETH markets negatively, driving prices lower as investors secure profits or avoid losses.

If the current selling activity continues, ETH could face further declines, possibly finding support around $2,188. However, there is still growth potential if buyers view the retracement as an entry opportunity.

In that scenario, ETH could aim for a rise towards $2,864.

The answer to this question is 42.