- Ethereum’s large holder sell pressure exceeded inflows from the same category.

- A summary of the conflicting indicators and the potential for an ETH retracement.

Holders have high hopes for Ethereum [ETH] to surpass $4,000 by the end of 2024.

Despite showing signs of sustaining the bullish momentum from November, a significant pullback may be looming.

Whale activity suggests a buildup of ETH sell pressure, a not unexpected development given the recent cooling off of strong momentum.

Additionally, ETH large holder activity is on the rise and could be contributing to bearish momentum.

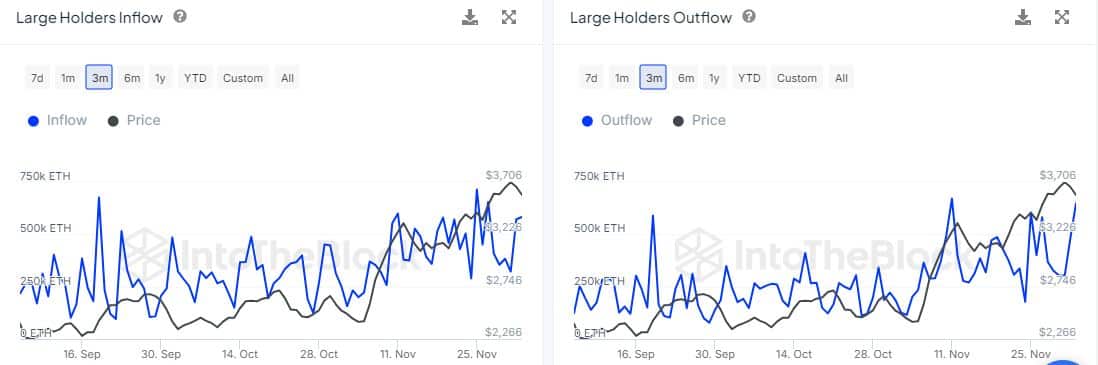

Recent data from IntoTheBlock indicates that large holder outflows peaked at 647,220 ETH on December 3rd, while inflows reached 582,710 ETH in the past three days.

Source: IntoTheBlock

The disparity between inflows and outflows suggests more sell pressure from whales than demand, highlighting bearish weakness.

While Ethereum ETF inflows have been positive this week, they have significantly decreased compared to the previous week.

On December 3rd, Ethereum ETFs recorded $132.6 million in flows, an improvement from $24.2 million the day before.

Source: Farside.co.uk

Ethereum ETFs reached $332.9 million last Friday, indicating a considerable decline in inflows.

Is bullish demand weakening?

The discrepancy in demand may fluctuate daily, but recent observations point to a slowdown in ETH bullish demand over the weekend.

While large holder flows and Ethereum ETFs signal potential declining demand, spot flows present a different perspective.

In the last 24 hours, spot inflows peaked at $285 million, aligning with ETH’s price recovery in the past two days.

Source: Coinglass

Positive spot flows have supported ETH’s price action, aiding in its recovery despite initial sell pressure earlier in the week. However, expectations of a retracement are growing.

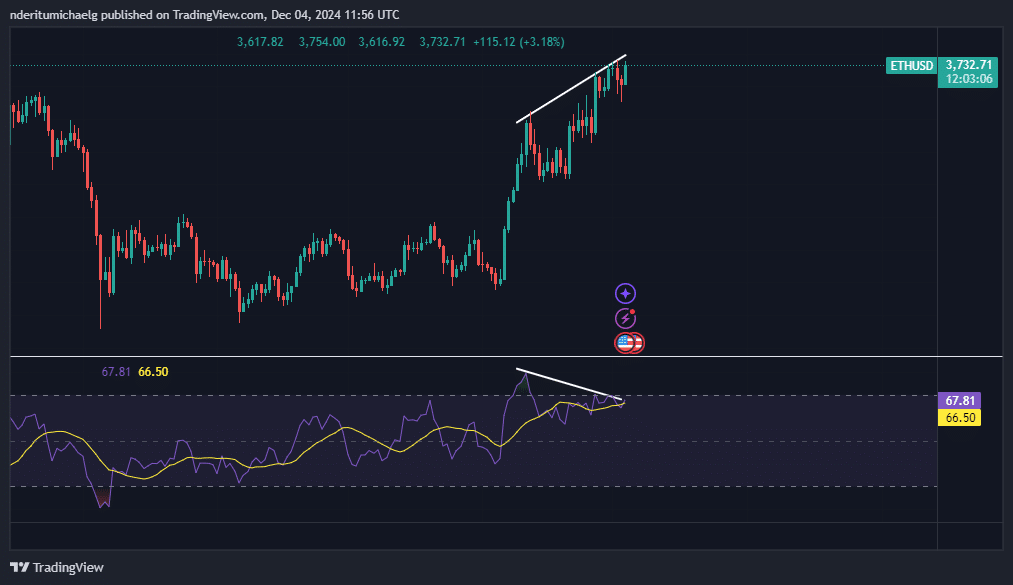

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024–2025

ETH’s price action shows a bearish divergence with the RSI, indicating a potential pullback.

A retracement from current levels could see prices drop to $3050, a key support level for the cryptocurrency.

sentence to make it more concise:

“Please ensure that you have a thorough understanding of the project requirements before beginning.”

“Please fully grasp the project requirements before starting.”