- Ethereum’s MVRV and realized price signaled a potential early recovery, with $2,300 acting as a strong resistance level

- Whale interest has increased, but rising reserves and decreasing gas usage suggest caution in the short term

Ethereum [ETH] recently surpassed its realized price of $2,040, indicating a positive sentiment in the market. This milestone could mark the beginning of a recovery phase for Ethereum after a period of bearish trends.

Currently, Ethereum is trading at $2,064.80, experiencing a minor 0.10% decline over the last 24 hours.

Historically, crossing its realized price has led to bullish trends for Ethereum, making this a crucial turning point for ETH. However, there are still obstacles that could impede its progress.

Analysis of Ethereum’s MVRV Ratio

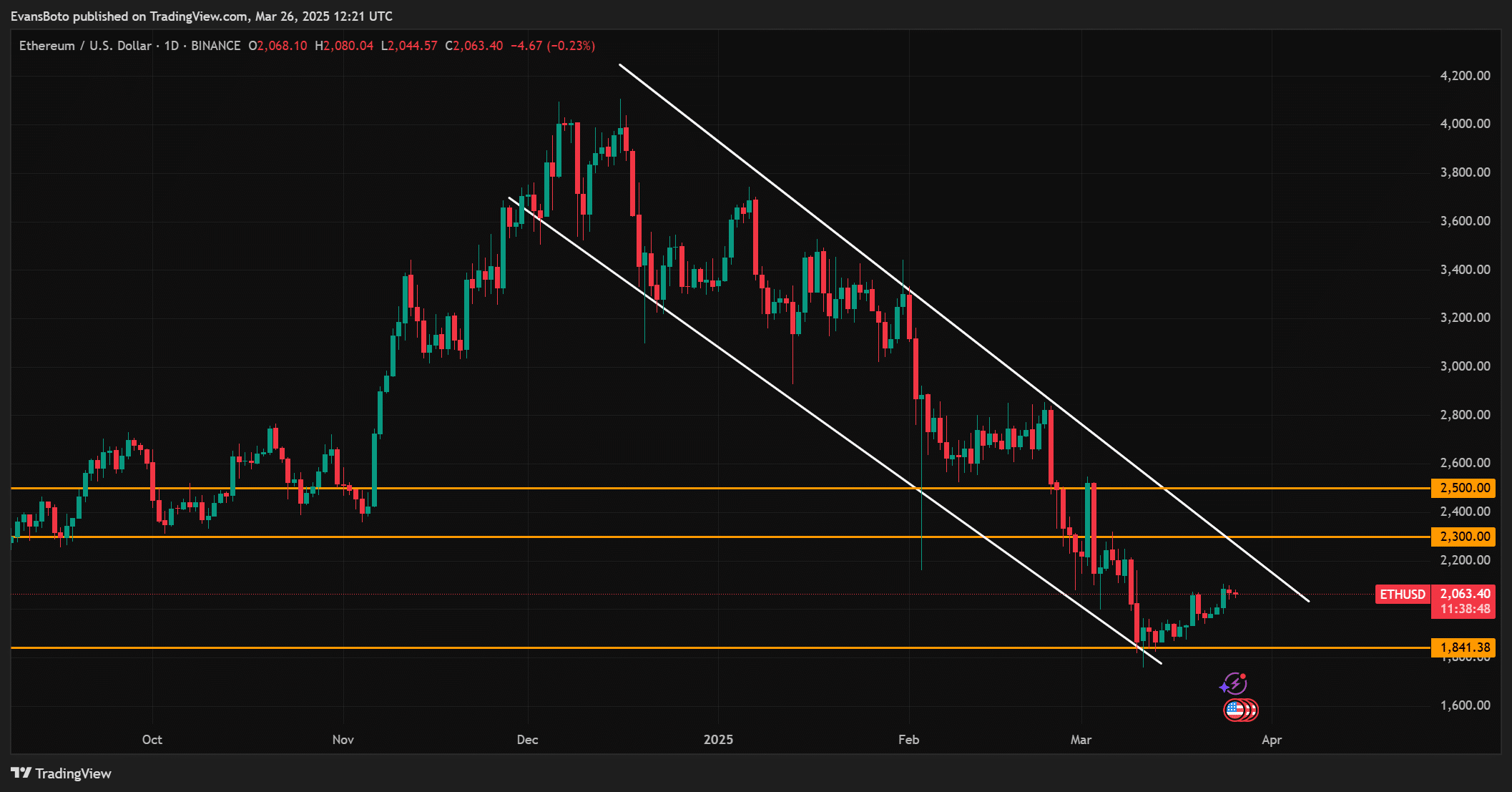

Ethereum’s MVRV ratio is currently around 1.02, indicating a potential market bottom as it enters a recovery phase without being overvalued. However, the $2,300 level poses a significant resistance, according to the MVRV Extreme Deviation Pricing Bands, which could impact Ethereum’s bullish momentum.

Source: TradingView

Impact of Whale and User Activity on Ethereum

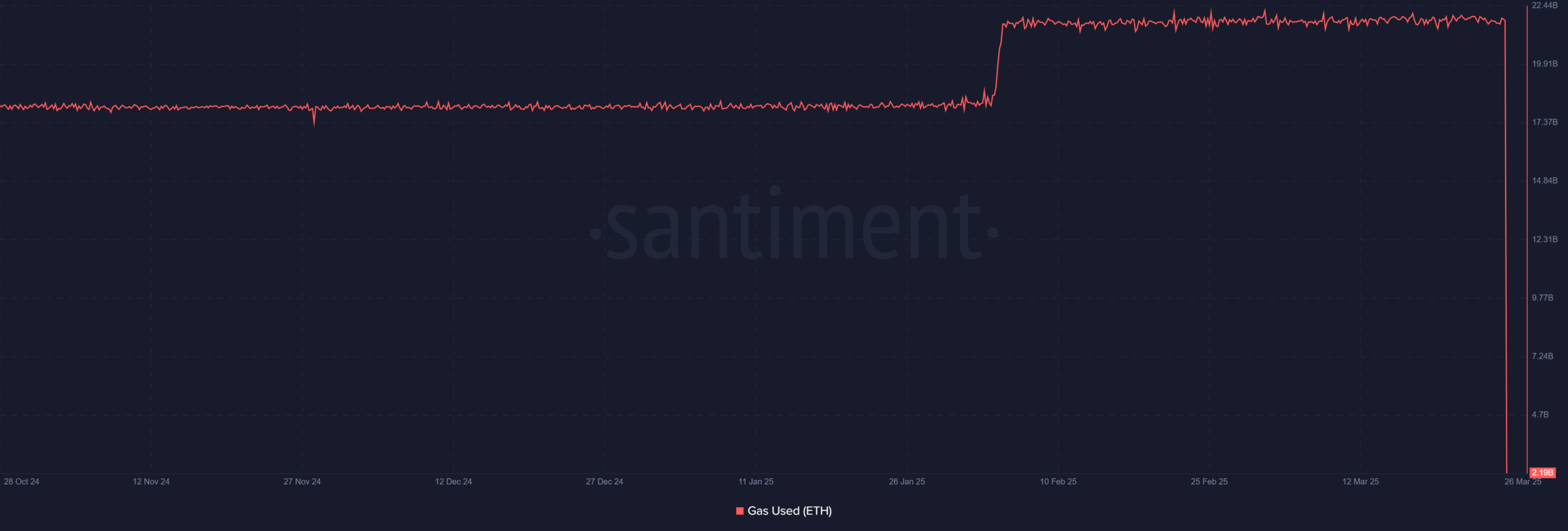

Whale activity, such as BlackRock accumulating 1.25 million ETH, showcases institutional interest in Ethereum. However, rising exchange reserves and declining gas usage suggest potential profit-taking and a short-term cooldown in network activity.

Source: Santiment

Challenges Ahead for Ethereum

Ethereum is currently facing resistance between $2,200 and $2,250, with a breakthrough potentially leading to a retest of the $2,400 level. However, a pullback to the $2,000 support level is also possible if momentum falters.

Conclusion

Ethereum shows promising signs of recovery, but the $2,300 resistance level remains a significant obstacle. Overcoming this hurdle will require sustained buying momentum and overcoming key barriers, which may prove challenging in the short term.

following sentence:

The quick brown fox jumps over the lazy dog.

The lazy dog is jumped over by the quick brown fox.

![Ethereum’s [ETH] short-term price targets – Is the $2,300 resistance too strong?](https://doorpickers.com/wp-content/uploads/2025/03/Evans-1-min-1000x600.png)