- Ethereum’s recent market behavior resembling past trends could signal a potential decline.

- Over 73% of ETH whales are holding onto their positions.

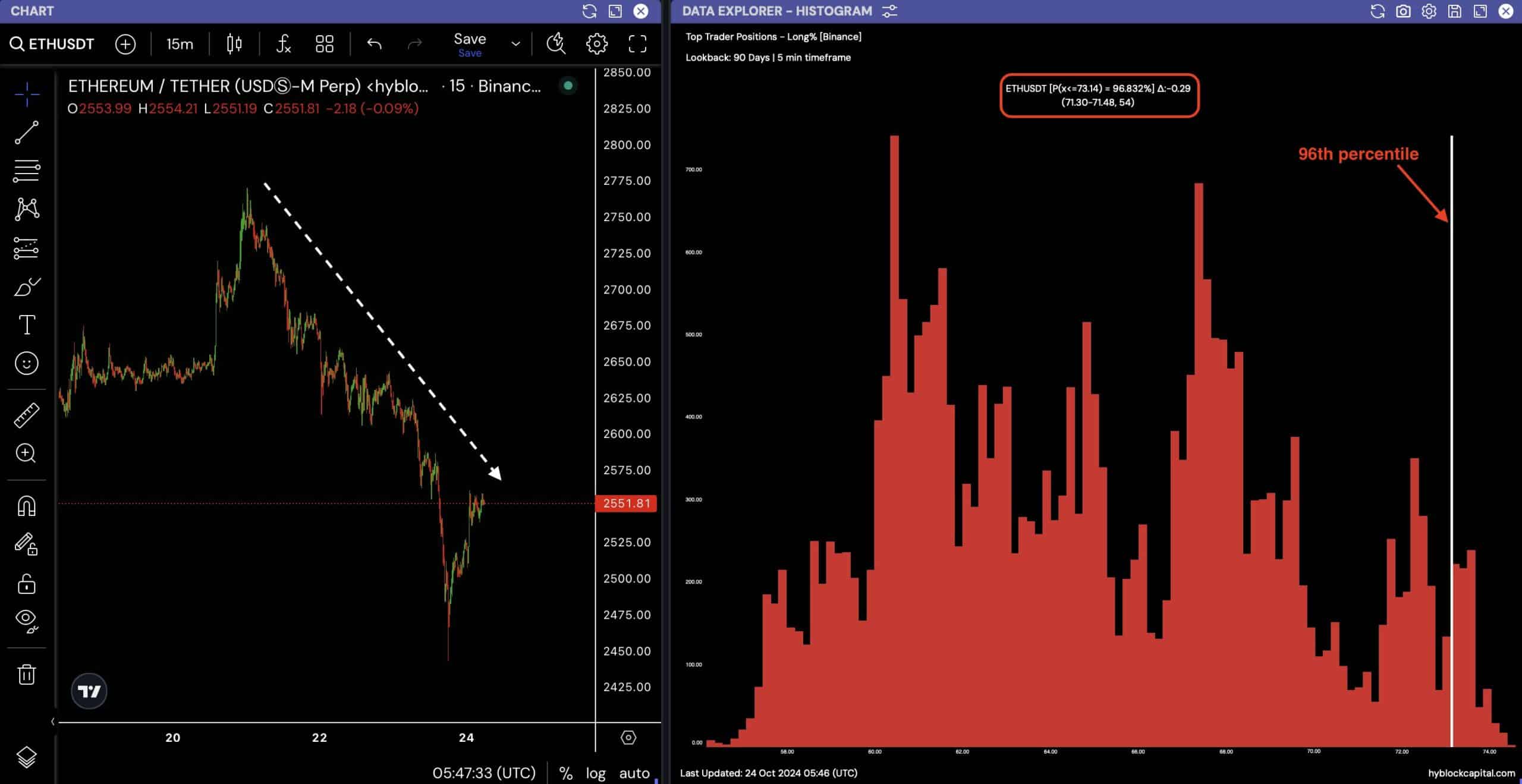

Ethereum (ETH) has been exhibiting similarities to previous market cycles as we approach the end of 2024, prompting traders to monitor closely for any potential price drops.

In 2016, ETH experienced significant declines in April, August, and December.

This year, we have already seen drops in April and August, leading analysts to speculate that a similar downturn could occur before the year ends, possibly in December.

While historical patterns indicate a possible dip, the crucial level to observe is $2,800. If Ethereum can break above and hold this level, it might avoid a deeper decline.

Source: TradingView

However, if Ethereum fails to progress towards the $2,800 level, it could potentially test $2,300 and then $2,000 before the year ends.

ETH/BTC Pair’s Challenge with the 50-day SMA

Another significant factor is the ETH/BTC pair’s struggle to surpass the 50-day simple moving average (SMA).

In previous cycles, a bullish trend typically followed once ETH/BTC crossed above this SMA. The absence of this occurrence currently suggests that the bottom may not have been reached yet.

Historical patterns indicate that traders often rush to adopt a bullish stance without waiting for confirmation.

Presently, competition from other platforms like Solana and internal ecosystem issues are exerting downward pressure on Ethereum.

Based on the current price action, Ethereum could face further declines in the near future.

Source: TradingView

Traders seeking to capitalize on this trend may consider short positions, as further declines appear probable.

Simultaneously, the Ethereum Foundation has reportedly continued to sell off holdings, with recent transactions of 100 ETH contributing to the prevailing bearish sentiment.

Whales Remain Bullish

Despite the parallels with past trends, Ethereum has undergone significant transformations since 2016, such as the Merge and 4844 upgrade, fundamentally altering its nature.

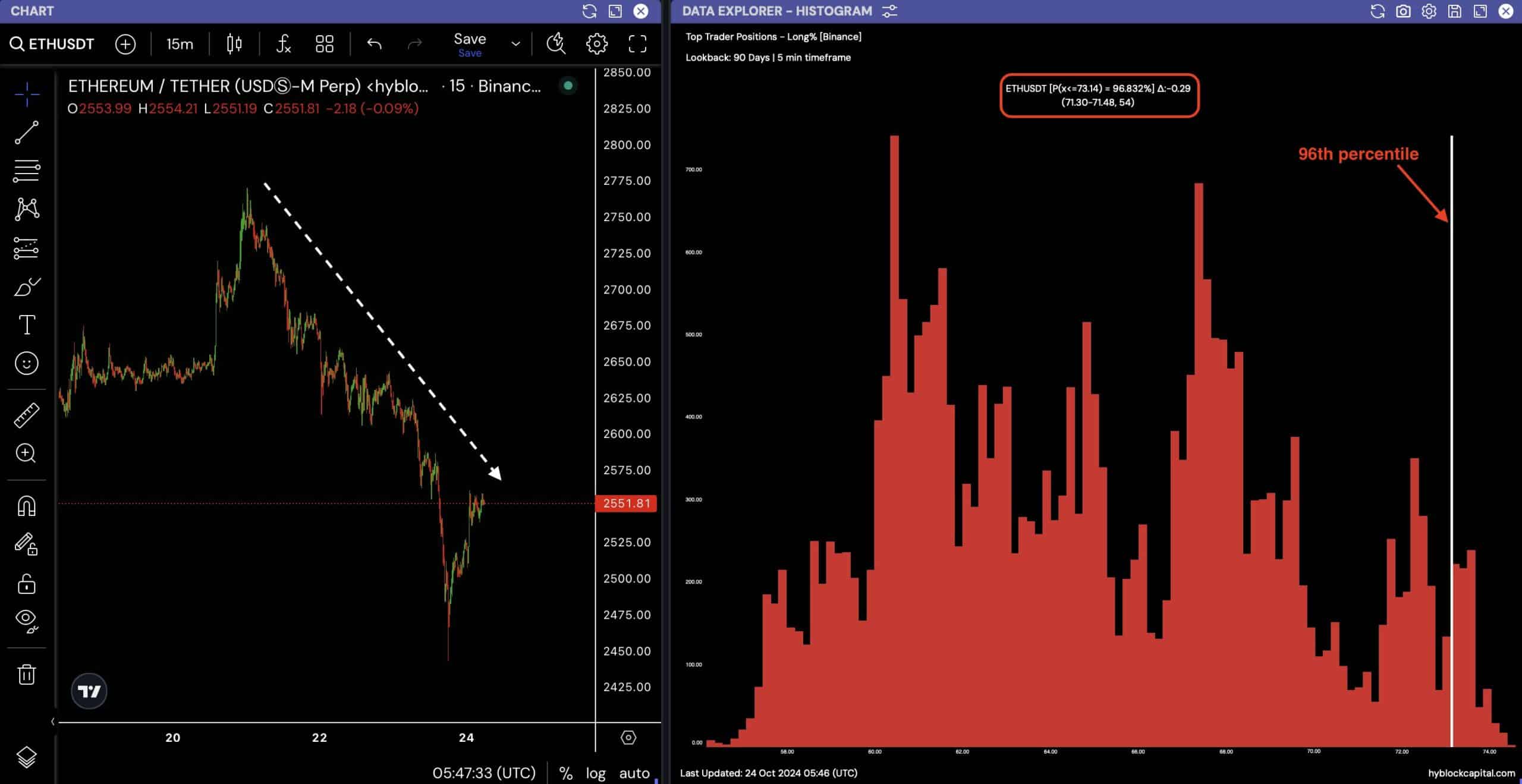

Despite the ongoing downtrend, whale activity shows little deviation.

Data from Binance indicates that 73.14% of accounts maintain long positions on Ethereum, indicating confidence in its future prospects.

Although the short-term outlook may appear bearish, the presence of these significant holders implies a belief in a potential recovery.

Once the price stabilizes and both ETH/USDT and ETH/BTC establish their respective bottoms, traders may find robust buying opportunities for the long haul.

Source: Hyblock Capital

While Ethereum may encounter another decline before the end of 2024, its long-term outlook remains positive.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Traders should exercise caution in the short term, but the possibility of a rebound presents attractive opportunities for those considering long positions once a confirmed bottom is established.

ETH’s price trajectory remains a focal point in the cryptocurrency space as we approach the year’s conclusion.

text in a more concise manner.