Written by Maartje Wijffelaars, Senior Eurozone Economist at Rabobank

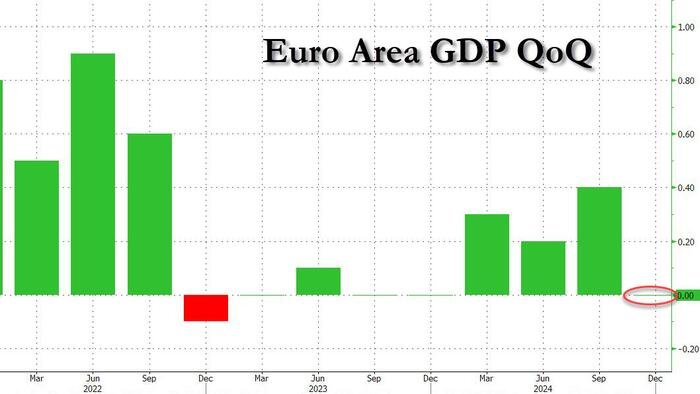

The ECB made the expected move by cutting its policy rate by 25 basis points, bringing the deposit rate to 2.75%. This decision followed similar actions by other central banks around the world. Eurozone GDP stagnated in Q4, but ECB President Lagarde remains optimistic about the ongoing recovery.

Eurozone inflation is on track to reach the 2% target, with policymakers confident in their forecasts. The ECB is gradually moving towards a neutral rate, with a research paper on the subject set to be published on February 7. Despite a plausible estimate of a 2% neutral rate, our forecast predicts a 2.25% terminal rate due to lingering inflation risks.

The ECB’s growth outlook aligns with our own, expecting consumption to drive economic performance. However, industrial weakness may persist, and various headwinds could hinder a rapid turnaround. Uncertainty surrounding Trump’s foreign policies and the outcome of the German elections add to the challenges facing the Eurozone economy.

Our consumption forecast relies on improving real wages and stable job markets across the euro area. While there are reasons to be optimistic, concerns over employment expectations and consumer confidence warrant caution.

Loading…