- The breakout of SAND from a falling wedge pattern suggests a potential 80% price increase if it surpasses the 100-day moving average.

- Positive momentum is backed by a rise in active addresses, lower exchange reserves, and liquidations of short positions.

The Sandbox [SAND] has successfully broken out of its falling wedge pattern, fueling expectations of a substantial upward price movement. Analysts are closely monitoring the 100-day moving average, with key price targets set at $0.31 and $0.40.

A breach above this crucial level could trigger an 80% surge in price. Will SAND maintain this momentum and initiate a prolonged rally?

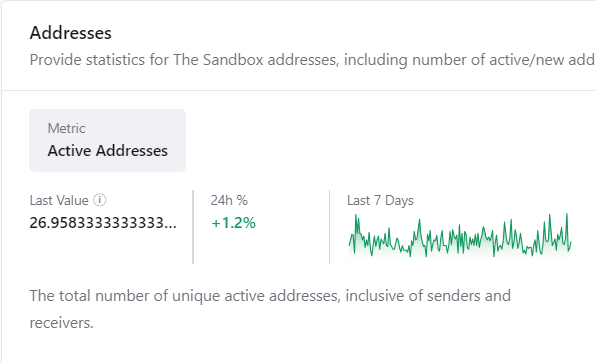

What is the current status of transactions and active addresses?

One of the essential indicators of market activity is the number of unique active addresses. As of now, SAND has 26.96 active addresses, indicating a 1.2% increase in the past 24 hours.

Source: CryptoQuant

Furthermore, transaction volume supports this positive trend, showing a 1.37% increase to 529 transactions, according to CryptoQuant data.

This consistent growth in activity indicates a growing user interaction with the network, potentially setting the stage for the anticipated price surge.

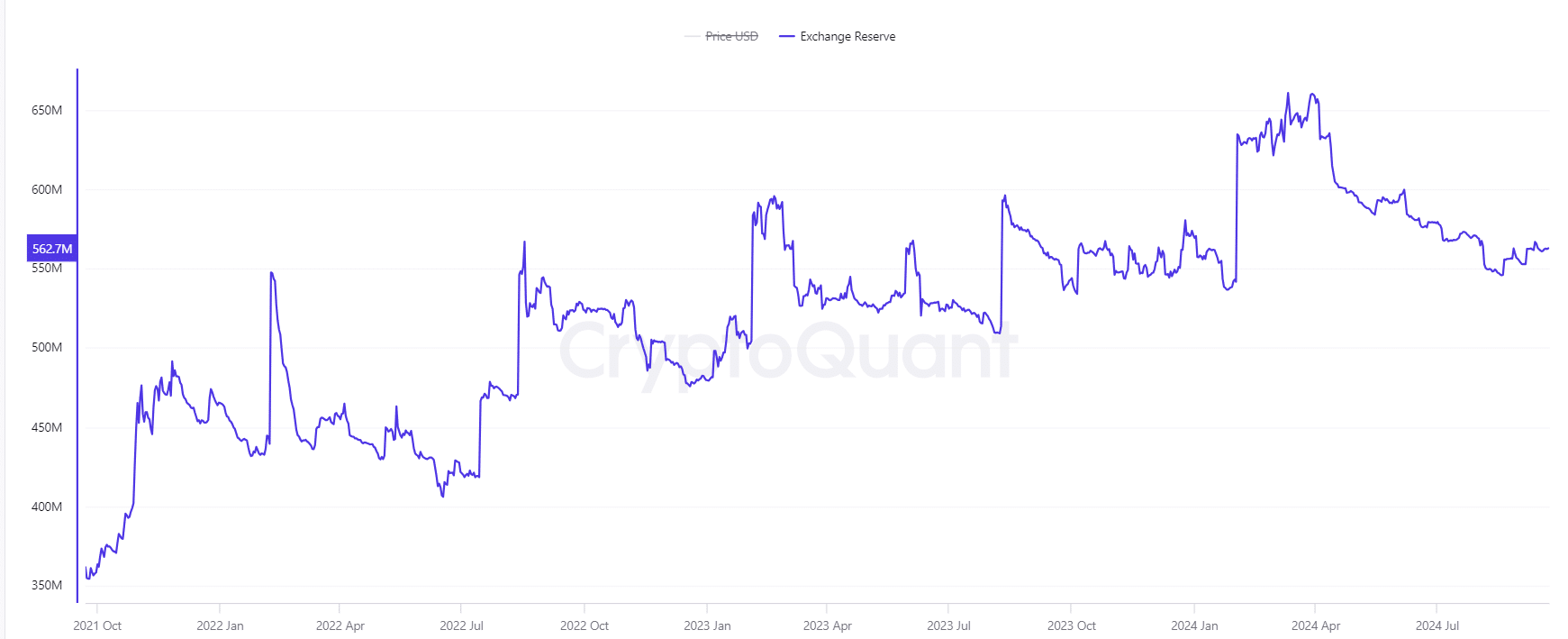

What does the analysis of exchange reserves reveal?

The exchange reserve for SAND currently stands at 562.76 million tokens. A slight 0.02% decline suggests a decrease in selling pressure.

Typically, a decreasing exchange reserve implies a scarcity of tokens available for sale, indicating that investors are holding onto their assets in anticipation of a price upsurge.

This aligns with the bullish breakout pattern observed on the daily chart, reinforcing the likelihood of an impending rally.

Source: CryptoQuant

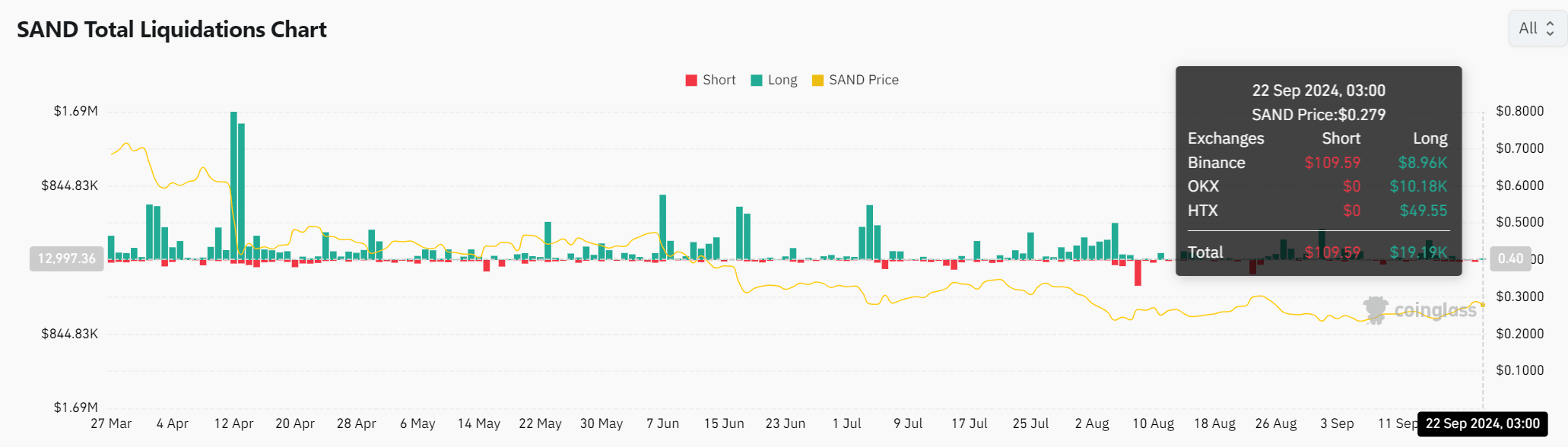

How are SAND liquidations shaping market dynamics?

Liquidation data provides a clear insight into market sentiment. Recent figures indicate that $109.59K of short positions were liquidated, compared to only $19.19K in long positions.

This imbalance suggests that traders betting against SAND are experiencing losses as the asset strengthens.

With the current price hovering around $0.279, the trend in liquidations could pave the way for further bullish momentum, potentially propelling SAND towards testing the $0.31 target and beyond.

Source: Coinglass

Whether realistic or not, here’s how the SAND market cap looks in BTC terms.

Can SAND sustain its breakout?

With rising transaction volumes, increasing active addresses, and decreasing exchange reserves, SAND’s market structure appears poised for a sustained upward trajectory. The liquidation data further supports a bullish scenario, as short positions continue to be squeezed out.

Surpassing the 100-day moving average could firmly position SAND on the path to significant gains, targeting short-term objectives of $0.31 and $0.40.

sentence: “The cat jumped onto the table and knocked over a vase.”

The cat leaped onto the table and caused a vase to fall over.