- Following a 550% surge, Fartcoin experienced a 6.93% drop, prompting caution among traders.

- Decreased social mentions and dominance have weakened the memecoin’s viral momentum.

Fartcoin [FARTCOIN] has seen a remarkable 550% increase over the last two months, grabbing attention in the crypto market. However, recent data developments call for closer examination.

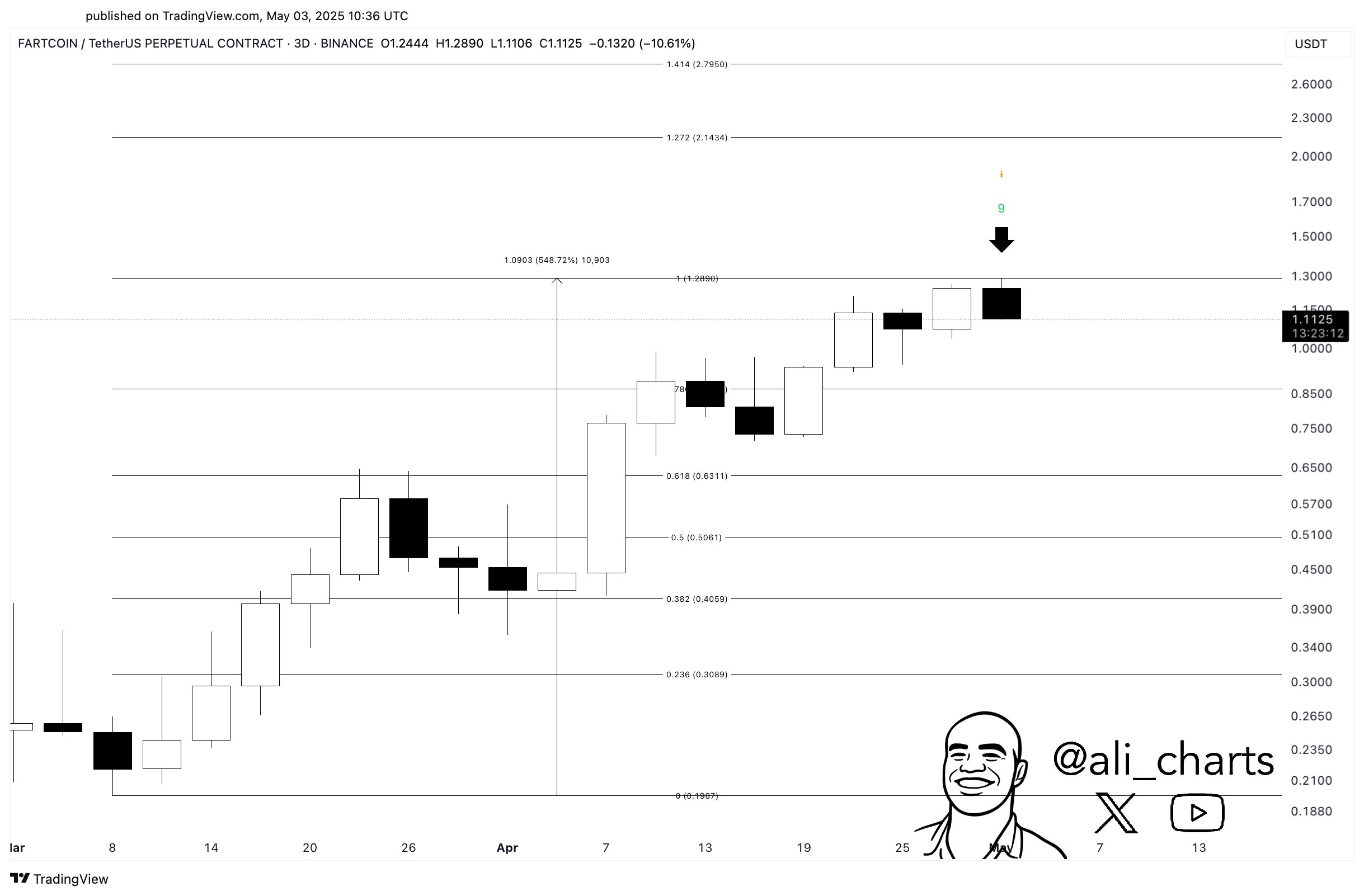

The TD Sequential indicator has signaled a 9-count sell signal on the 3-day chart, a pattern that usually precedes local peaks and short-term corrections.

Source: X/Ali Charts

Currently, Fartcoin is trading at $1.11, down by 6.93% in the last 24 hours.

With traders reassessing their positions, various market signals could influence the coin’s next move.

Is the fading hype dampening Fartcoin’s momentum?

The excitement around Fartcoin is rapidly diminishing.

According to Santiment data, Weighted Sentiment has dropped to -0.126, indicating a shift from greed to fear—a common sign of dwindling confidence.

This change in sentiment often precedes corrections.

As bullish interest wanes, many participants are scaling back. In fact, the decline in Fartcoin’s social traction reflects this loss of confidence.

Source: Santiment

Social engagement with Fartcoin has also declined significantly, indicating a loss of retail enthusiasm.

Currently, Social Volume stands at just 13 mentions, while Social Dominance has dropped to 0.186%, marking one of the lowest engagement levels since the uptrend began.

This decrease in visibility and conversation highlights a reduction in speculative interest, which had previously been driving much of the token’s momentum.

As memecoins heavily rely on viral buzz and herd mentality, diminishing social metrics weaken the foundation of the rally.

Are bulls losing their grip on the market?

In the derivatives market, signs of weakness have emerged.

Long Liquidations surged to $619.16K, while shorts amounted to only $30.6K—indicating a significant imbalance in trader positions.

This suggests that over-leveraged bulls were caught off guard by the recent price decline and had to quickly exit their positions.

Liquidation cascades like these often escalate volatility and increase downside risk.

Source: CoinGlass

Spot market activity further indicates growing caution among Fartcoin participants.

On May 3rd, net Exchange Outflows reached nearly half a million dollars, with $955.70K leaving exchanges compared to $496.59K in inflows.

This movement suggests that holders may be transferring funds to private wallets, possibly securing profits or preparing for market turbulence.

Significant outflows during downturns often indicate reduced trust in short-term price stability.

Can Fartcoin avoid a deeper correction?

With bearish sentiment, declining social engagement, net Exchange Outflows, and aggressive Long Liquidations converging, Fartcoin seems increasingly exposed.

The recent TD Sequential sell signal adds technical credence to the potential for a short-term correction. While the overall trend remains strong, these metrics suggest a weakening momentum.

Unless sentiment and activity shift dramatically, Fartcoin may struggle to sustain current levels in the days ahead. Thus, the risk of a deeper pullback now surpasses the likelihood of an immediate recovery.

following sentence:

The cat slept peacefully on the windowsill.

The cat was peacefully sleeping on the windowsill.