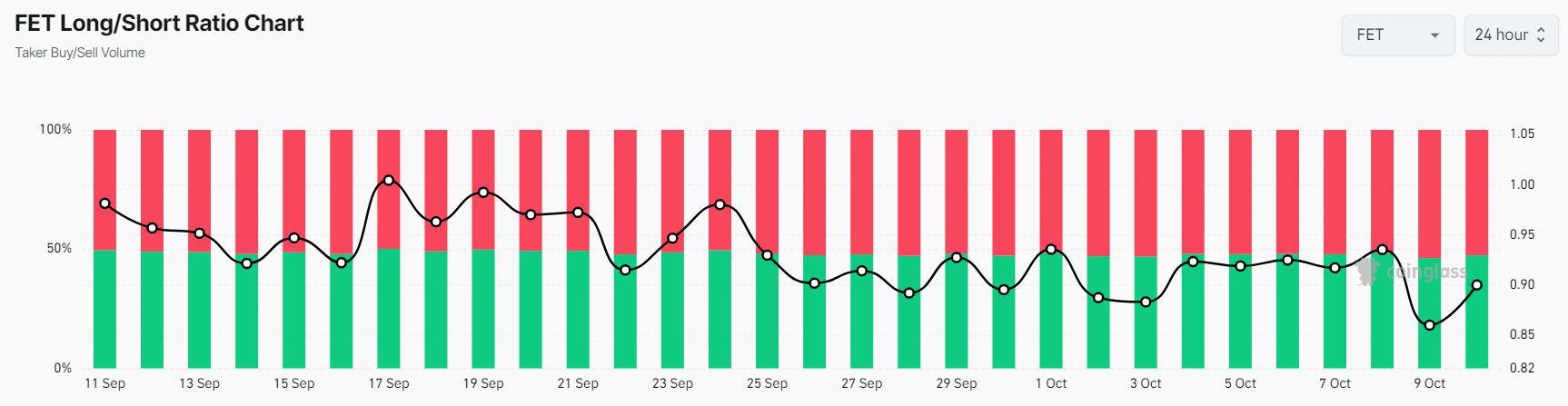

- FET’s Long/Short Ratio stood at 0.90, indicating a strong bearish sentiment in the market among traders.

- 53.2% of top traders were holding short positions, while 46.8% were holding long positions.

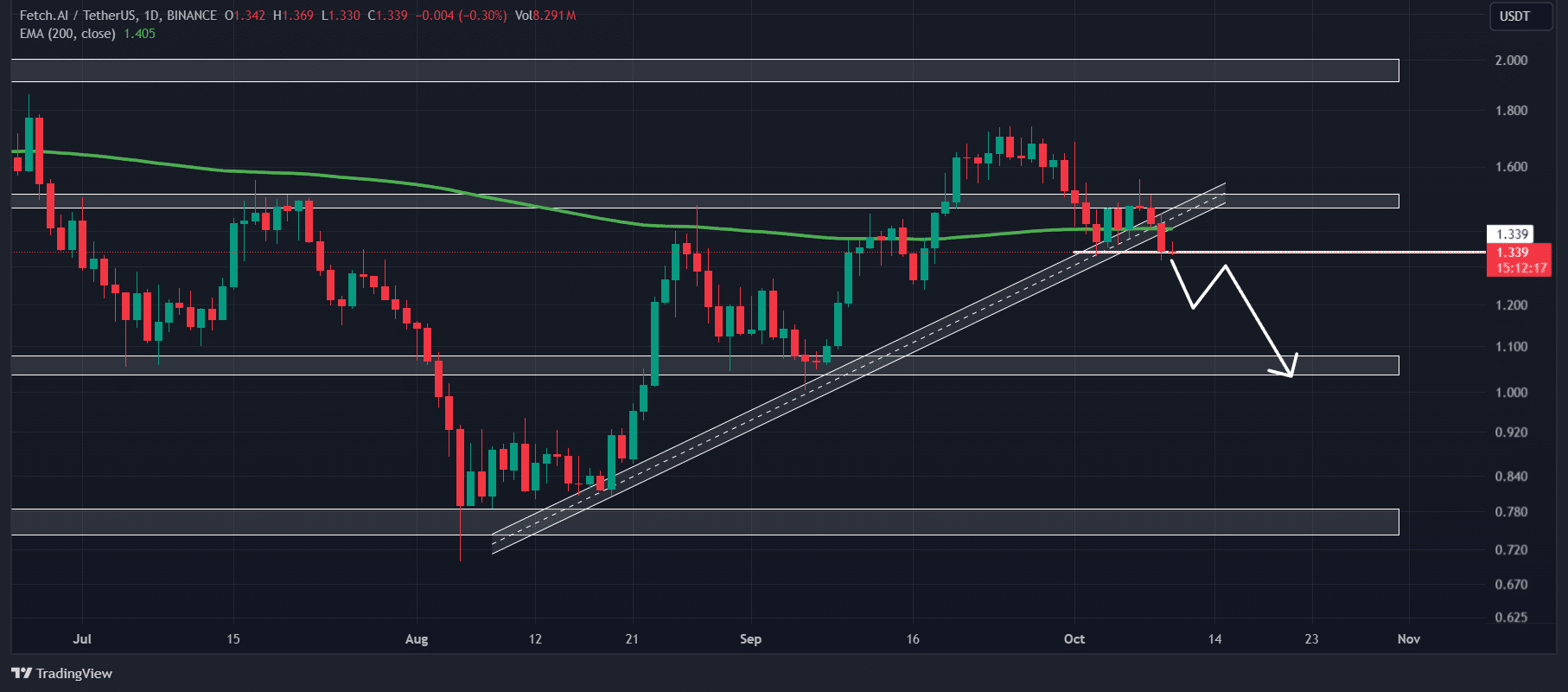

With the ongoing bearish market sentiment, the Artificial Superintelligence Alliance Price Prediction for FET suggests a significant price decline as it struggles to maintain a crucial support level.

Similarly, major cryptocurrencies like Bitcoin and Ethereum have also been facing challenges, experiencing notable price drops in the last 24 hours.

Current Price Analysis

Currently, FET is trading around $1.35, down by over 4.7% in the last 24 hours. The trading volume has also decreased by 4.9%, indicating reduced participation from traders and investors.

FET recently broke below crucial support levels, including a strong consolidation zone and the 200 EMA on a daily timeframe.

The closing of a daily candle below the consolidation zone confirms a successful breakdown.

Source: TradingView

Based on historical price trends, there is a high likelihood of FET’s price dropping by 20% to reach $1.03 in the near future.

Despite the bearish outlook, the RSI indicates an oversold condition, suggesting a potential price recovery. However, given the current bearish sentiment, a recovery seems unlikely at this point.

Bearish On-chain Metrics

The negative outlook for the altcoin is further supported by on-chain metrics.

According to Coinglass, FET’s Long/Short Ratio was at 0.90, indicating a strong bearish sentiment among traders.

Source: Coinglass

Additionally, Futures Open Interest for FET decreased by 6.7% in the last 24 hours, signaling ongoing bearish sentiment.

Currently, 53.2% of top traders have short positions, while 46.8% have long positions.

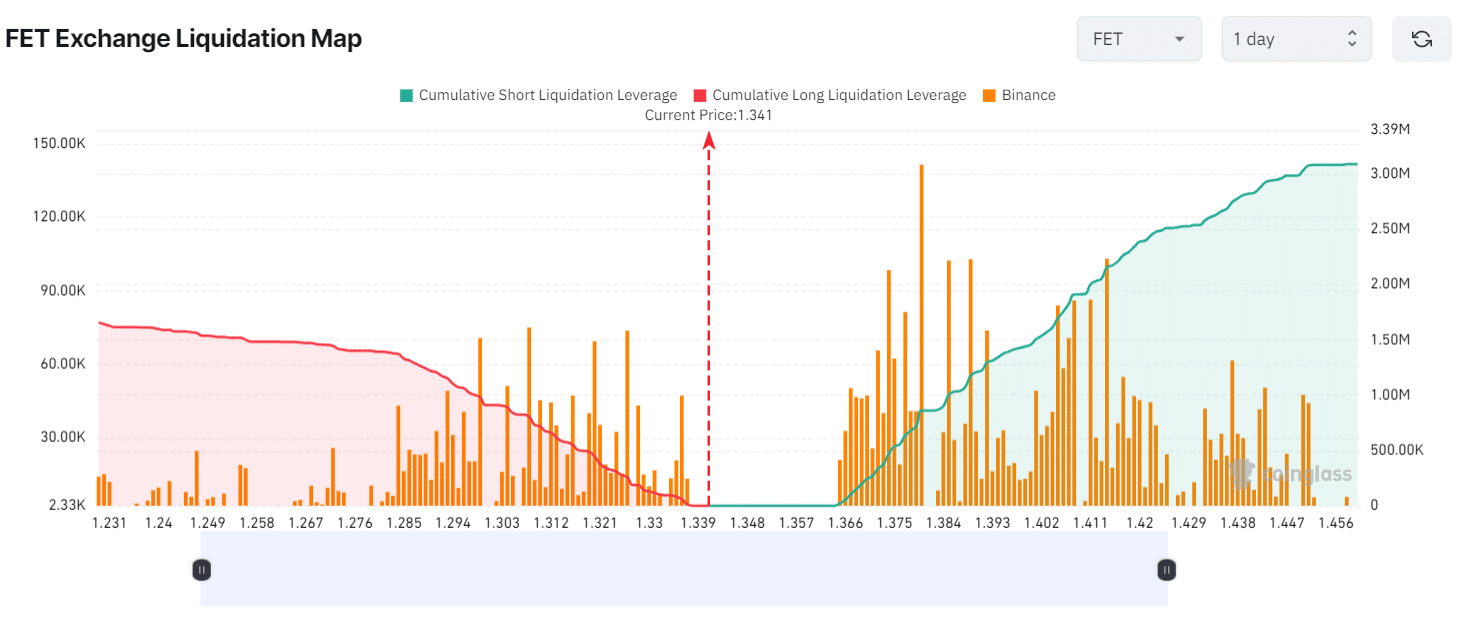

Major liquidation levels are at $1.30 and $1.38, with traders being over-leveraged at these levels, according to Coinglass data.

Source: Coinglass

If FET’s price drops to $1.30, around $807,000 worth of long positions will be liquidated. Conversely, a rise to $1.38 could lead to liquidation of approximately $2.17 million worth of short positions.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

The data indicates that short sellers have been actively betting on short positions in the past 24 hours. The combination of technical analysis and on-chain metrics suggests that bears currently have the upper hand, potentially leading to a significant price decline.

phrase “I am unable to attend the meeting” in a different way.