The Fantom blockchain experienced a mix of results in the second quarter of the year, with key financial indicators cooling down amidst the broader cryptocurrency market downturn and the rebranding of the Fantom Foundation as Sonic Labs, as per a recent report from data intelligence firm Messari.

FTM Market Cap, Revenue, And Token Economics

Following a strong performance in Q1, Fantom’s circulating market cap dropped by 41% quarter-over-quarter from $2.8 billion to $1.7 billion. Nonetheless, the token’s market cap remains 94% higher year-over-year compared to Q2 2023.

Related Reading

Revenue, which measures gas fees collected by the network, declined by 42% QoQ from 1.8 million FTM to 1.0 million FTM. In USD terms, revenue dropped by 38% QoQ from $1.2 million to $0.8 million.

This drop followed a spike in Q3 2023 due to NFT activity, but according to Messari, revenue is expected to recover as on-chain activity increases across the broader crypto space.

The report also noted changes to Fantom’s token economics in Q2. The Ecosystem Vault and Gas Monetization program, introduced in Q4 2022, reduced the burn rate of transaction fees from 30% to 5% and reallocated the remaining 25%.

By the end of the second quarter, the circulating supply of FTM reached 2.8 billion, with an annualized inflation rate of 3% – up 25% quarter-over-quarter.

Fantom On-Chain Activity Slows

Fantom’s on-chain activity decreased in Q2. Daily transactions averaged over 223,000, down 10% QoQ from 247,000. Daily active addresses dropped by 21% QoQ to 31,900, although the trend reversed towards the end of the quarter.

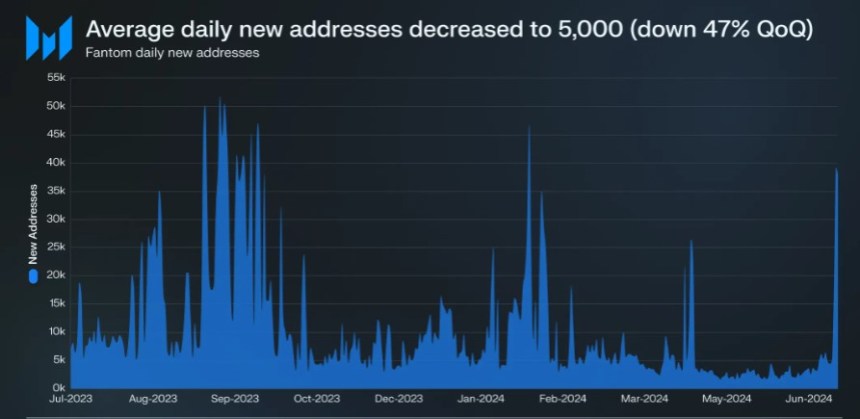

New address growth also slowed, decreasing by 47% QoQ to an average of 5,000 per day. However, the report highlighted positive developments, including an increase in active validators on the network.

Related Reading

Following a governance proposal that reduced the staking requirement, the number of active validators increased by 6% QoQ to 58, with 14 having less than 500,000 FTM self-staked.

Staked FTM saw inflows for the second consecutive quarter, rising by 5% QoQ to 1.3 billion tokens. However, the total dollar value of staked FTM decreased by 39% QoQ to $780.4 million due to the token’s price depreciation.

Fantom’s total value locked in DeFi applications declined by 28% QoQ to $91.2 million, ranking it 42nd among blockchain networks. Nevertheless, TVL denominated in FTM increased by 22% QoQ, indicating capital inflows despite the token’s price decrease.

At present, FTM is trading at $0.3345, showing a 1% increase in the last 24 hours. Over the monthly timeframe, the coin has declined by 27% in the midst of the broader market downturn.

Featured image from Shutterstock, chart from TradingView.com