Authored by Thomas Kolbe

Friedrich Merz finally sees a positive headline. In December, industrial orders experienced a surge. However, beneath the surface of this costly statistical recovery lies nothing more than the accumulation of debt-financed defense sector activities.

After some delay, the Chancellor now has a success story to tell. Germany’s Federal Statistics Office reported a 7.6% month-on-month increase in industrial orders for December 2025. November had already shown a boost with a rise of over 5% amidst a severe economic crisis.

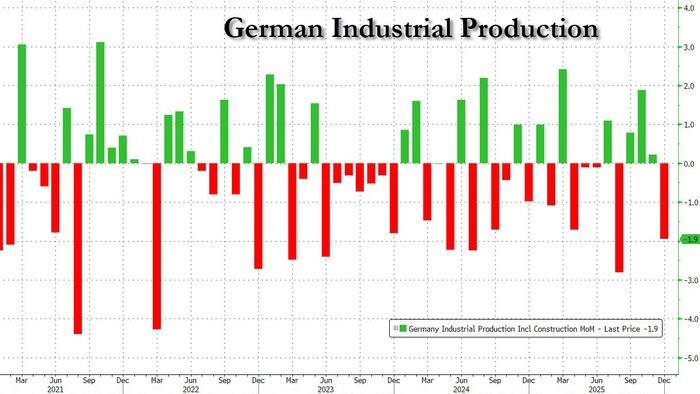

On the other hand, industrial production fell by 1.9% in December, slipping back into negative territory—a detail largely overlooked in the media’s positive coverage. The significant 6.3% decrease in orders for the once-dominant German automotive industry was also overshadowed amidst the general relief.

However, upon closer examination of the data and exclusion of large orders, a different narrative emerges. The apparent surge in orders diminishes to a mere 0.9%.

What drove this shift? It can largely be attributed to “Other Vehicle Manufacturing,” which experienced a significant increase of around 9.5%. This category is predominantly associated with defense equipment, indicating that the federal government’s debt-financed special fund has funneled into German military production.

In essence, the government can now celebrate a public victory after indebting citizens to generate a short-term statistical effect in the crucial election year of 2026. This move aims to avoid complete failure in the public eye.

What appears as an economic revival is actually a statistical facade masking the shift from market-based orders to a debt-driven administrative economy.

The military expansion represents the final phase of a policy persistently attempting to fill the voids in Germany’s industrial economy with a “managed economy” approach. This strategy ties up resources and manpower, diverting crucial capital needed for genuine investment under more favorable circumstances.

Goods are being produced without market demand, benefiting only a few elites—classic clientelism in the Berlin-Brussels fashion. This pattern is not unprecedented in the Western world.

The Real Economic Landscape

The true state of the German economy is reflected in the construction sector. The HCOB Germany Construction PMI, a leading monthly indicator, dropped to 44.7 points in January. Values below 50 indicate contraction.

Following a brief uptick to 50.3 in December, primarily driven by energy network investments, the German construction industry regressed into recession in January, mirroring the broader Eurozone trend.

For the past four years, this vital economic sector has remained stagnant. Investments are withheld, and new projects, especially commercial ones, are scarce. The sector continues to grapple with prolonged stagnation.

High energy costs, complex regulations from Brussels and Berlin, and restrictive measures like rent controls form the recipe for an entrenched recession.

Anticipate billion-euro initiatives for subsidized public housing soon, solely to create a statistical illusion of recovery.

Critique Aligned with the System

The federal government can now exhale. Despite the hefty cost for taxpayers, the political gains seem worthwhile. Applying Keynesian principles to the defense industry ranks among the most misguided political decisions. Plunging a nation deeper into debt to manufacture goods that either decay or fuel destruction epitomizes maximal political nihilism bordering on insanity.

The media’s celebration of this so-called “recovery” signifies two things: complete media compliance with governmental agendas and statistical justification to continue molding German society into a green, militarized command economy.

The absence of dissent from German business leaders indicates that politics has morally shielded this strategy. The propagated narrative of an imminent Russian invasion now legitimizes the military expansion.

Similarly, the Green Deal has ingrained the notion of saving the world through CO₂ reduction deeply into public consciousness, with a majority of voters still supporting this trajectory. Criticism is now viewed as climate-hostile, irresponsible, and anti-scientific.

Compliance is no longer enforced through coercion but by reshaping business rationality. Each new regulation or CO₂ levy breeds companies that can only survive within the state’s subsidy framework.

Consequently, discussions on “bureaucracy relief” are dominated by media-friendly, calibrated language. It represents system-aligned fine-tuning subtly orchestrated by Brussels. In this highly restrictive media environment, no one dares risk reputational damage.

Businesses have learned to temper criticism to avoid upsetting the establishment while remaining eligible for support. This conditioned deference is gradually steering us towards a new form of socialism.

* * *

About the author: Thomas Kolbe, a German graduate economist, has over 25 years of experience as a journalist and media producer for clients across various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events through the lens of capital markets. His publications adhere to a philosophy centered on individual rights and self-determination.

Loading recommendations…