Reports from the Ripple Swell 2025 conference indicate a growing interest in XRP, with traders and fund managers closely monitoring developments in November.

Related Reading

Speakers at the event highlighted several anticipated moves that could drive more investment into the token in the near future.

Canary Capital ETF Timetable

Canary Capital’s spot ETF is scheduled to launch following an updated S-1 filing, potentially automatically going live on November 13 after the removal of an amendment clause that would have delayed its release.

Although the timeline could still be subject to change pending SEC inquiries or governmental shifts, November 13 remains a significant date to watch.

Retail And Whale Activity Cool

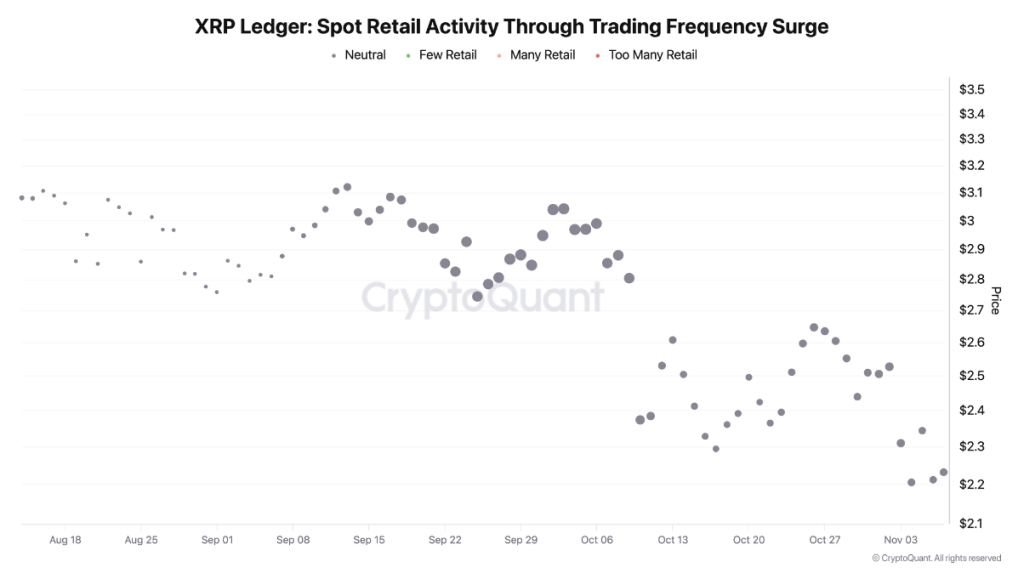

Recent data from CryptoQuant shows a decrease in retail trading activity following a major sell-off on October 10, signaling a more cautious approach among small investors. Additionally, large on-chain transactions to exchanges have declined, indicating fewer big sellers moving funds to exchanges at the moment.

“The last half of November is going to be big for $XRP and @Ripple,” said @TeucriumETFs CEO @GilbertieSal during a recap of #RippleSwell Day 1. Head on a swivel ladies and gentlemen… Believe! ✨ pic.twitter.com/mw9VLuRUCB

— rayfuentes (@RayFuentesIO) November 5, 2025

Institutional Signals

Speakers at the Swell conference highlighted a growing institutional interest in XRP, with projections suggesting significant potential for tokenized assets and planned moves by traditional financial players.

Circle is also gearing up to trade public equities in early December, further signaling a shift towards mainstream involvement in the cryptocurrency space.

Advice From Market Players

Market experts advise focusing on the long term and remaining optimistic about XRP’s future despite short-term volatility. Historical data suggests that ETF listings and institutional involvement have a significant impact on asset valuation.

Related Reading

What To Watch Next

Market observers will closely monitor the SEC process, additional filings, and any potential impacts from the government calendar on the ETF launch date. On-chain data such as whale transfers and exchange flows will also provide valuable insights into market dynamics.

Featured image from Unsplash, chart from TradingView