Discussing the ongoing struggles of low-income consumers in the face of financial challenges, analysts at Goldman Sachs advised their clients today that they were downgrading auto parts retailer AutoZone from a “Buy” to a “Sell” rating. The main reason behind this decision was the tough macroeconomic conditions affecting consumers.

Goldman’s Kate McShane and her team of analysts projected subdued growth for AZO in the coming quarters. They highlighted the retailer’s customer base, which consists largely of working-poor consumers. The analysts warned that factors like inflation and high interest rates could lead to reduced spending from this demographic, impacting sales through the winter and into early 2025.

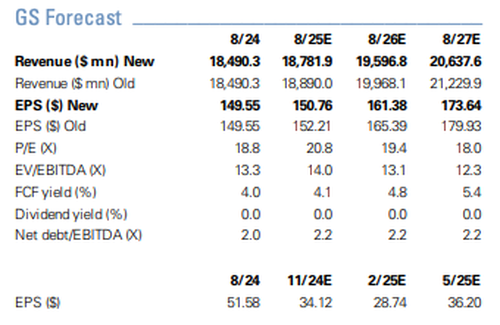

“We are revising our FY25 estimate to $150.76 (from $152.21) due to our expectation of limited growth in the near future. Our FY26 EPS estimate is now $161.38 (down from $165.39), and our FY27 EPS estimate is $173.64 (revised from $179.93) based on our lower projections for FY25.”

McShane justified the downgrade of AZO to “Sell” by emphasizing:

-

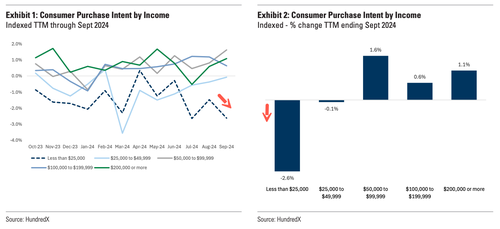

The continued financial strain on lower-income consumers, who form a significant part of AZO’s customer base.

-

The increasing affordability of cars, which poses a risk of reduced repair needs.

-

Declining NPS and NPI scores for AZO, with the NPI score nearing a three-year low.

-

The potential for higher interest expenses and/or reduced share buybacks with 2025 notes maturing.

The analysts dedicated a section of their note to discussing the diminishing sentiment among working-poor consumers, underscoring AZO’s heavy reliance on this income group.

Looking ahead, McShane’s outlook for the company remains subdued. She noted:

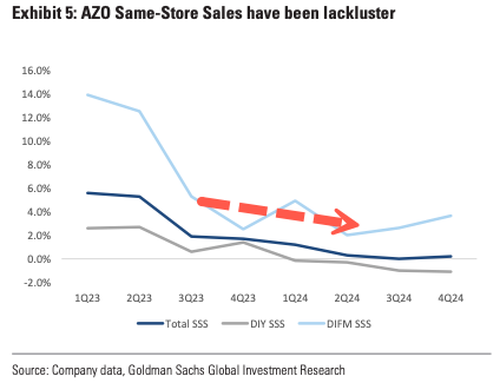

Despite past strong performance, AZO’s growth has slowed in recent quarters, even after overcoming tough comparisons. Inflation has provided less support to same-store sales, while unit growth has been sluggish as lower-income consumers delay DIY purchases and discretionary spending, which accounts for around 18% of AZO’s sales. Challenges in the commercial segment have also been highlighted as the company navigates the expansion of this business line.

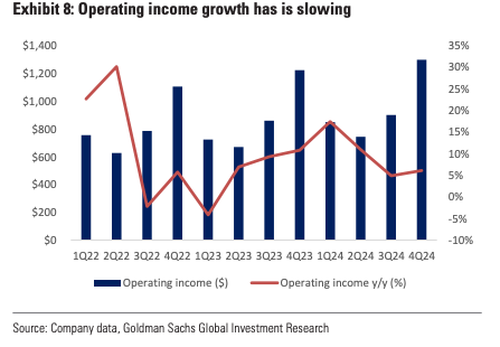

Operating income growth has slowed due to top-line pressures and increased SG&A spending on IT and payroll.

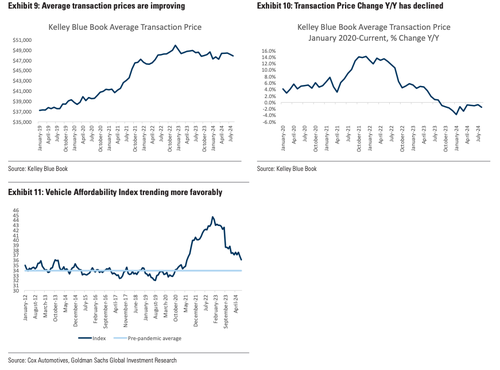

McShane pointed out that as auto affordability improves, there could be a decrease in demand for AutoZone’s products as repairs may lessen with more affordable vehicles available.

As new vehicle affordability improves, there may be pent-up demand for new cars, potentially reducing the need for aftermarket products if older vehicles are replaced.

Given these factors, McShane highlighted that AZO’s valuation remains high compared to historical levels, considering the slower growth and increased bottom-line risks.

Her revised price target for the stock is $2,917, indicating a 7% downside potential.

The key insight is that the financial strain on low-income consumers is expected to worsen towards the end of the year and into early 2025. A recent report from Goldman Sachs highlighted a trend of ‘trade-down’ among both affluent and lower-income consumers.

Loading…