Since April, the market has been on an uphill trend, but in the last two weeks, things have taken a turn for the worse. According to Goldman TMT specialist Peter Bartlett, the market is set to have its second -2% session in 3 days, with unsettling price action under the surface.

Bartlett attributes this increased volatility to three main factors:

1. Rise in AI skepticism:

Bartlett notes a growing bearish view on the AI trade in investor conversations, despite little change in positioning. Recent comments from OpenAI about a potential “federal bail out” of AI infrastructure spending have added to the skepticism.

2. Negative earnings asymmetry:

The difficulty of profiting on long positions during earnings season has been evident in recent stock reactions. Goldman believes this asymmetry is affecting risk/reward considerations, especially given the current market positioning.

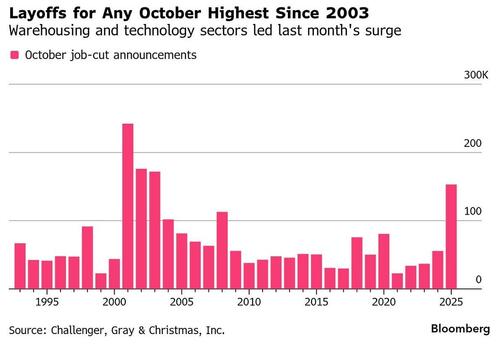

3. Concerns about Jobs market:

Reports of job cuts and hiring freezes in the US have raised concerns about the health of the job market. Factors such as AI adoption and rising costs are contributing to this trend.

Bartlett highlights the importance of how the market responds to potential job losses due to AI, suggesting that excessive job displacement could become a problem.

These developments align with the scenarios presented in a recent Twitter post, indicating potential challenges ahead for the market.

For more insights, refer to the full Goldman note.

Loading recommendations…