Authored by Mathew Piepenburg via VonGreyerz.gold,

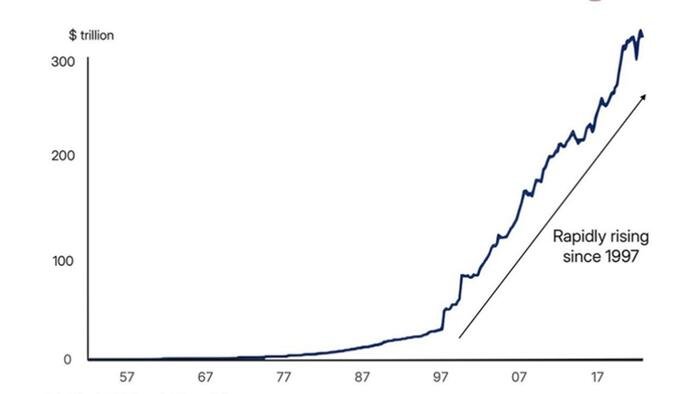

As we step into 2026, reflecting on the knowns of 2025 while bracing for the uncertainties ahead, there is no need for panic. The global financial system is burdened by unprecedented debt, making it vulnerable to a collapse.

Preparation vs. Timing

Despite the changing times, the underlying issues remain the same. The weight of debt and its consequences cannot be ignored. The continuous printing of trillions to cover debts only leads to currency devaluation. It’s not about timing the crisis, but rather preparing for its inevitable arrival.

History has shown that policymakers resort to manipulation, dishonesty, and lack of accountability when faced with worsening economic conditions.

This pattern is likely to continue in 2026 as the monetary model faces increasing pressure.

Gold and silver owners have long recognized the risks associated with the current monetary system. The risks posed by banking and currency systems in decline suggest that real money will hold more value than fiat currency.

Looking Back

2025 began with promises of spending cuts and emergency measures from the US government to revive a struggling economy.

“Our Currency, Your Problem.”

For decades, the US relied on its currency as a global standard, shifting the burden of its overspending onto other nations. However, with escalating debt levels and a weakening dollar, the US is no longer the dominant force it once was.

The failed attempts to impose tariffs in 2025 highlighted the changing dynamics of global finance. The lack of interest in US Treasury auctions and declining trust in the dollar signal a shift in the perception of the once-dominant currency.

Our Currency, Our Problem

The US’s reliance on debt and foreign investment has left it vulnerable to economic shifts. As other countries reduce their holdings of US debt, the US is forced to confront its financial reality.

Market trends indicate a growing preference for investments outside the US, leading to a decline in the dollar’s global influence.

AI Will Save Us?

The reliance on AI to drive market gains is a risky strategy, as the technology remains unproven and overvalued. The inflated market values driven by AI investments are unsustainable in the long run.

A Ticking Credit Time Bomb

The rising trend of private credit and bad loans poses a significant risk to the financial system. The lack of transparency and regulation in the shadow banking sector could lead to a credit crisis.

The Markets Will Save Us?

The manipulation of stock prices through buy-back schemes highlights the artificial nature of market gains. The overreliance on Fed interventions to prop up markets is a short-term solution to a long-term problem.

Looking Ahead

The Fed’s role in stabilizing the bond market is crucial for the US economy. The need to maintain low interest rates to manage debt levels will likely drive further QE measures in 2026.

The Fed’s Real Mandate & Problem

The Fed’s focus on bond market stability exposes the underlying weaknesses of the US economy. The reliance on debt and foreign investors to support the dollar’s value is unsustainable in the long run.

The Dollar—Weaker or Stronger in 2026?

The debate over the dollar’s strength in 2026 reflects the uncertainty surrounding global currencies. Regardless of the outcome, the long-term trend favors real assets like gold and silver.

Gold’s Endgame: More Important than Timing

While the future of gold and silver prices remains uncertain, the long-term outlook for precious metals is positive. The ongoing devaluation of fiat currencies will drive demand for real assets.

Preserving wealth in gold and silver offers a hedge against currency devaluation and economic instability.

Golden Light-House Cutting Through the Fog

The shift towards gold as a store of value is a clear indication of the declining faith in fiat currencies. Central banks and investors are increasingly turning to gold as a safe haven asset.

The current financial landscape points towards a fundamental shift in the perception of wealth and value.

Conclusion

As we navigate the uncertainties of 2026, the importance of diversifying wealth into real assets like gold and silver cannot be overstated.

While market trends and economic indicators may fluctuate, the long-term value of precious metals remains consistent.

Investing in gold and silver is not just a financial decision, but a strategic move to protect wealth and preserve purchasing power in an uncertain world.