The leading crypto asset management firm Grayscale is anticipating a significant 1,000x surge in a specific crypto subsector due to “structural shifts in digital asset investing.”

In its latest research report, Grayscale focuses on tokenized assets, which involve digitizing real-world assets like stocks, properties, or commodities on the blockchain for more convenient and efficient trading.

The company projects that this asset class could experience a remarkable growth of 1,000x, with prominent cryptocurrencies such as Ethereum (ETH), BNB Chain (BNB), Solana (SOL), and Chainlink (LINK) poised to benefit from this immense potential expansion.

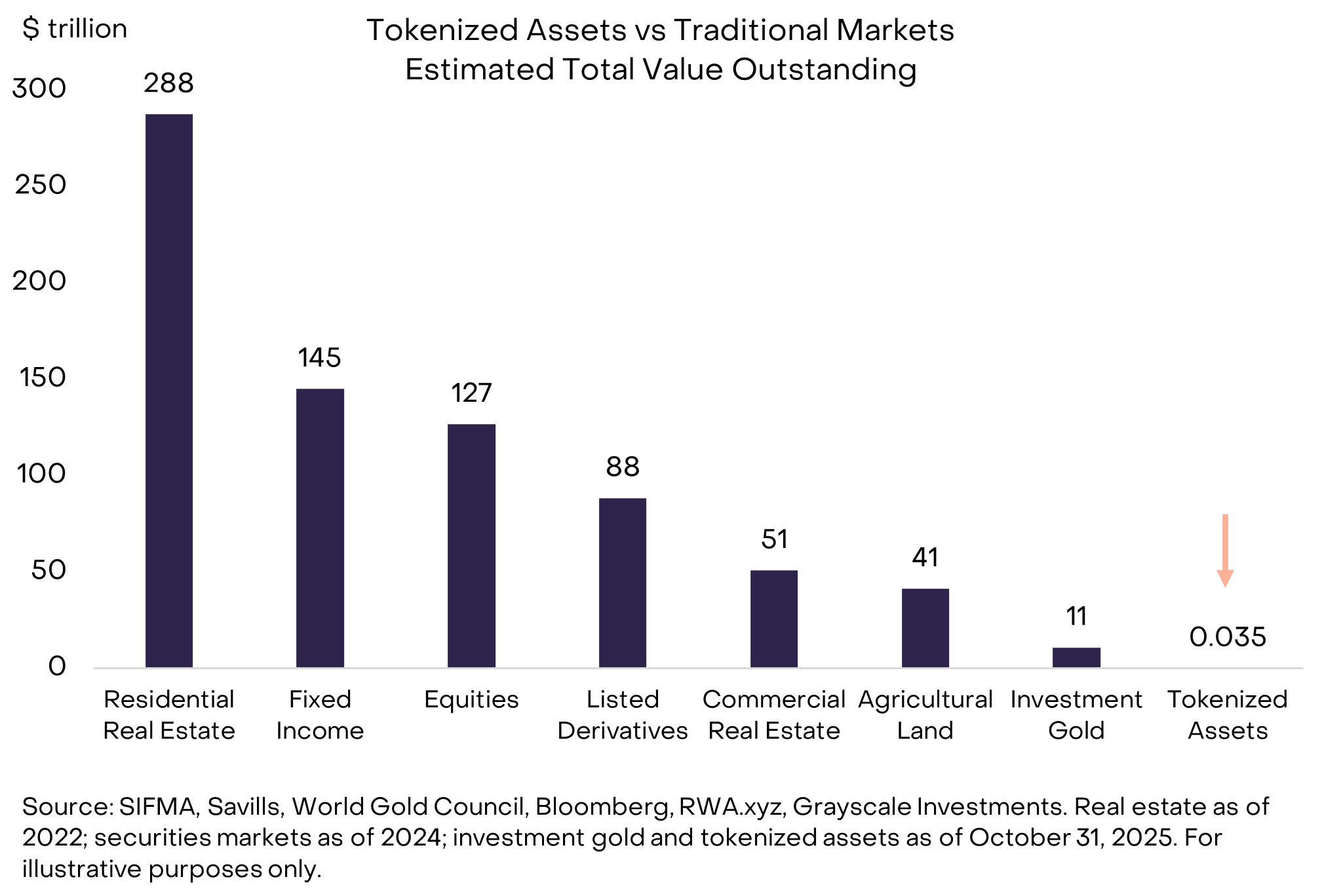

“Tokenized assets currently represent a minuscule fraction – just 0.01% – of the global equity and bond market capitalization. Grayscale foresees a rapid surge in asset tokenization in the coming years, driven by advancements in blockchain technology and enhanced regulatory clarity. By 2030, a growth of approximately 1,000x in tokenized assets is not out of the question,” states the report.

This growth is expected to bring value to the blockchain networks facilitating transactions in tokenized assets, as well as various supporting applications. Presently, Ethereum (ETH), BNB Chain (BNB), and Solana (SOL) are the primary blockchains for tokenized assets, although this landscape may evolve over time. Chainlink (LINK) is highlighted as a particularly well-positioned player in the supporting applications segment, given its unique software technologies.

Read the complete report here.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney