- The fear and greed index of the token indicated a sell signal.

- An adjustment in price could lead HBAR back to $0.14.

Hedera [HBAR] has been performing exceptionally well in the past week, surprising investors. However, significant price surges are often followed by corrections. Will HBAR experience a similar scenario this time?

Hedera’s Impressive Growth

HBAR investors had a reason to celebrate last week as CoinMarketCap’s data showed a 38% increase in the token’s price during that period.

The bullish trend continued over the past 24 hours with another nearly 24% surge in the token’s value. This pushed the price of the token to $0.205, with a market capitalization exceeding $7.8 billion.

As Hedera’s value rose, its social metrics also saw an increase, indicating growing popularity of the token in the crypto community.

Meanwhile, popular crypto analyst Crypto Tony highlighted that this price surge presented a good entry point for investors. But is that really the case?

Reasons for a Potential Price Decline

While the rapid price increase favored investors, such occurrences are often followed by corrections.

Once the hype subsides, the token may experience a slight pullback, providing a better opportunity for investors to enter new positions.

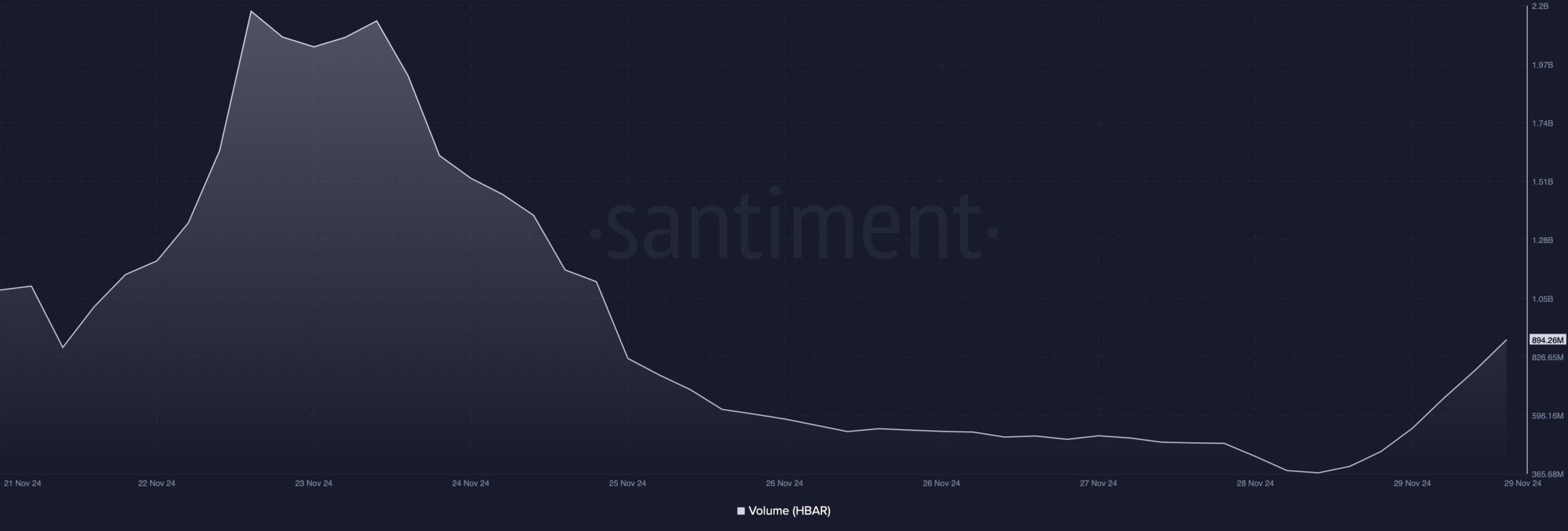

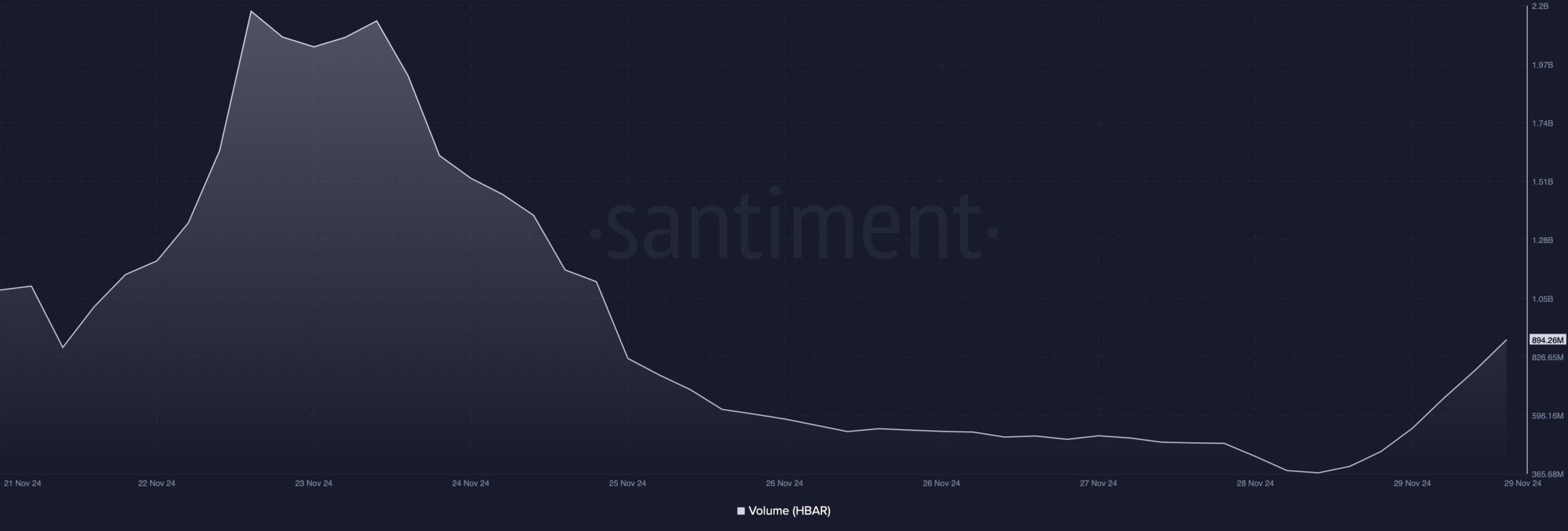

This possibility was supported by the token’s declining trading volume. According to Santiment’s data, HBAR’s volume dropped significantly while its price surged. This pattern usually indicates a reversal to a bearish trend.

Source: Santiment

Additionally, the token’s Fear and Greed Index turned bearish. At present, the metric stood at 86%, indicating an “extreme greed” market sentiment.

Such high levels often signal a sell alert, which could have a detrimental effect on the asset’s price in the short term.

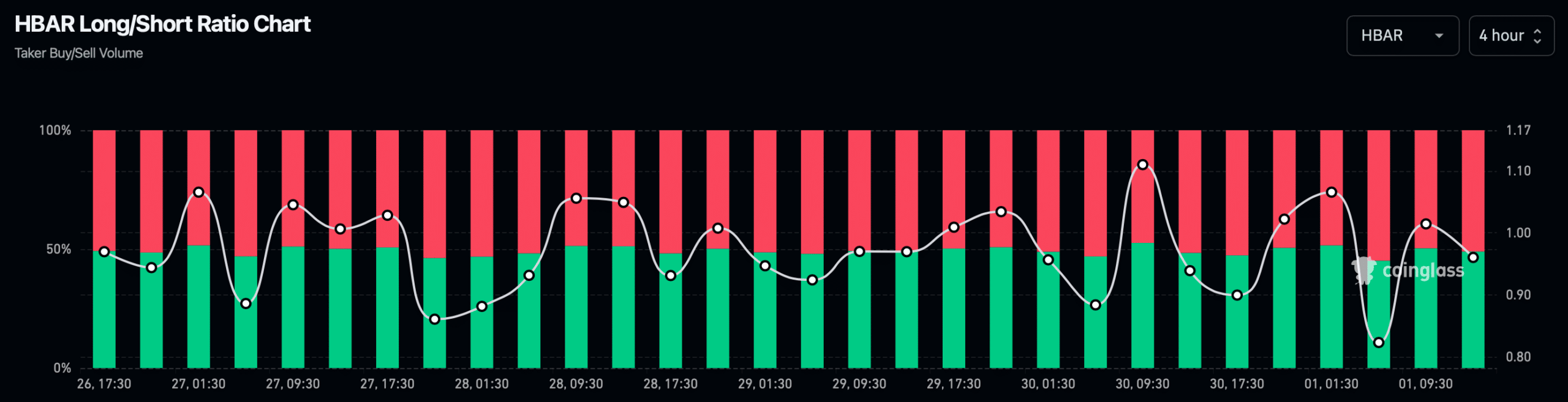

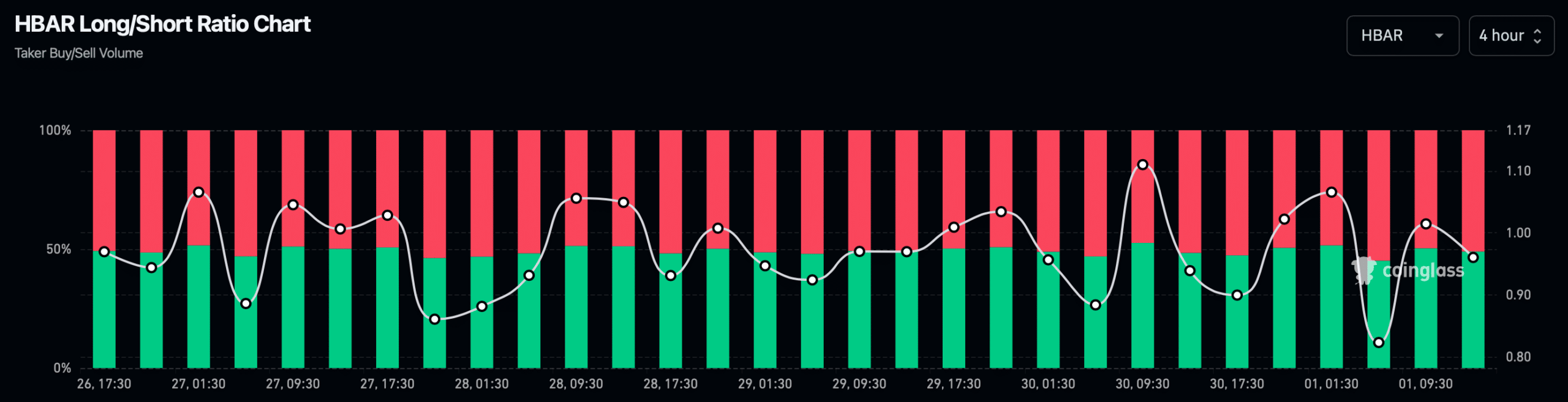

Furthermore, Hedera’s long/short ratio saw a decline in the 4-hour timeframe.

This clearly suggested a higher number of short positions compared to long positions in the market, indicating a growing bearish sentiment.

Source: Coinglass

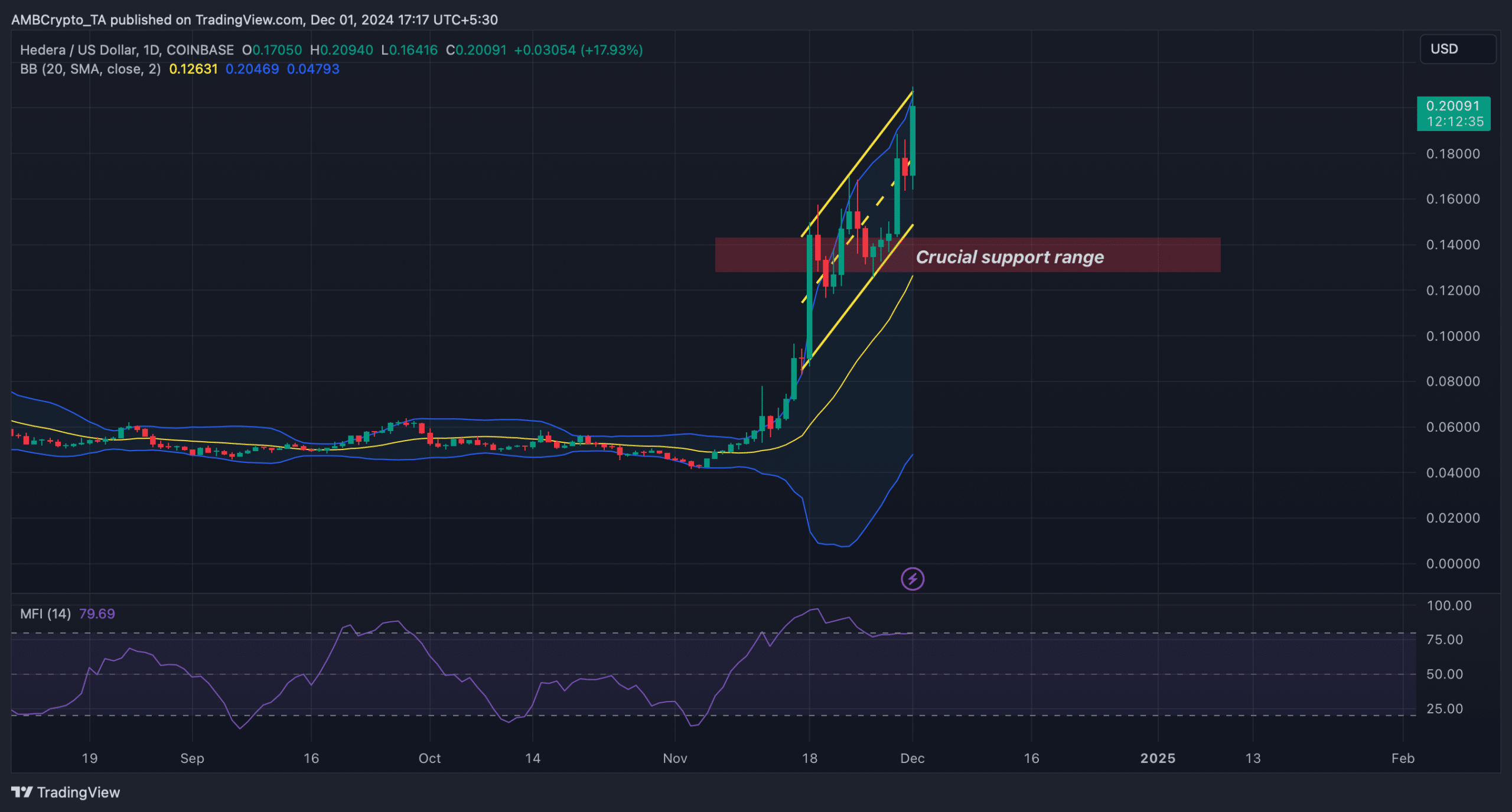

Similar signs of a price correction were indicated by Hedera’s technical indicators. HBAR’s price was moving within a steep up-channel.

This resulted in the price touching the upper limit of the Bollinger Bands, typically leading to price adjustments.

Is your portfolio looking positive? Explore the HBAR Profit Calculator

The Relative Strength Index (RSI) technical indicator was hovering close to the overbought territory. An entry could raise selling pressure, potentially driving the price down.

Should that occur, investors may witness HBAR dropping towards its critical support levels of $0.142 and $0.128.

Source: TradingView

content in a more engaging way

Let’s spice up the content and make it more exciting!

![Hedera [HBAR] rallies 37% in a week, but signs point to $0.14 drop](https://doorpickers.com/wp-content/uploads/2024/12/HBAR-awaits-a-correction-1000x600.webp)