Bitcoin (BTC) price has surged towards $70,000 on Tuesday, February 10, marking a positive trend during the North American session. The flagship coin bounced back from a demand zone around $68.5k in the last two days, with the aim of retesting its supply zone near $71,250.

Despite the recent rebound, Bitcoin price has experienced a notable decline in its Open Interest (OI), leading to bearish sentiment. CoinGlass market data shows that BTC’s OI has fallen from over $90 billion in October 2025 to around $45.7 billion currently.

Two Main Reasons Why Bitcoin Price May Retest $85k

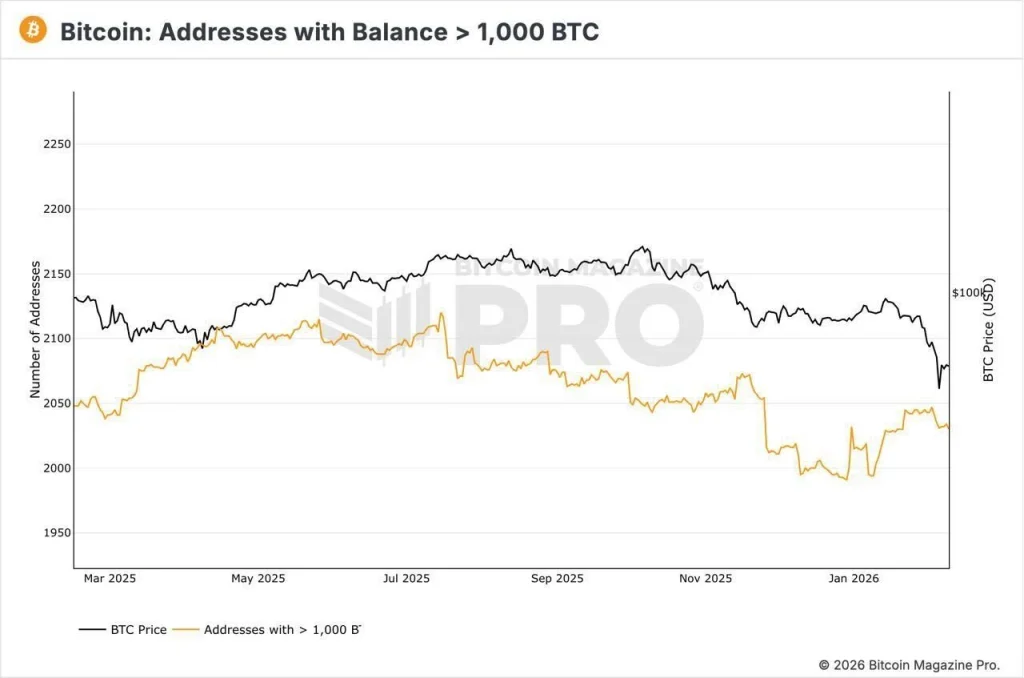

Renewed interest from whales

Recent onchain data analysis indicates that Bitcoin whales holding more than 1000 BTC have been accumulating assets this year. Additionally, the number of Bitcoin addresses with a balance of 1000 BTC has increased by 50 in the past few weeks.

Source: X

Despite retail traders showing reluctance to buy BTC at current levels due to fear of further price drops, the possibility of a Bitcoin price rebound remains strong.

BTC Price Aims to Fill Unfilled CME Gap

One significant factor that could drive Bitcoin price to $85k is the existence of an unfilled gap between $79k and $85k in Bitcoin CME Futures. Historically, such gaps have been filled in the past.

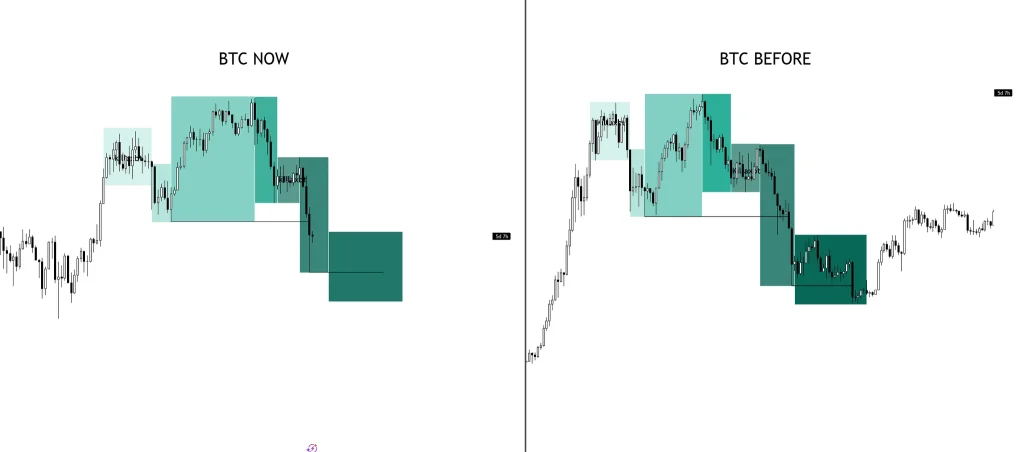

With Bitcoin price forming a potential bull flag after a significant selloff to around $60k, it is likely to rally towards $85k in the near future.

What’s the Bigger Picture?

While Bitcoin price may see a rebound to $85k soon, concerns about further price drops are evident. Some crypto traders are even predicting a scenario similar to the 2022 bear market in the coming weeks.

Source: X

Trust with CoinPedia:

CoinPedia has been providing accurate cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T. Every article is fact-checked against reputable sources to ensure accuracy and reliability.

Investment Disclaimer:

All opinions shared represent the author’s views on current market conditions. Please conduct your research before making investment decisions.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site, but our editorial content remains independent from our ad partners.