Digital asset custody firm Hex Trust has partnered with Etherlink, a layer 2 solution on Tezos, to provide institutional custody for xU3O8, a tokenized uranium asset issued on the network.

The collaboration is supported by Trilitech, the R&D hub for Tezos and developer of Etherlink. They are working together to connect institutional clients to xU3O8 and other assets built on Etherlink.

“Tokenized commodities like uranium are becoming increasingly popular among institutional investors as more real-world assets are digitized,” said Giorgia Pellizzari, head of custody at Hex Trust.

xU3O8, listed on various exchanges, enables users to invest in physical uranium – U308. This token is backed by Curzon, a uranium trading firm, and Archax, a UK-regulated exchange.

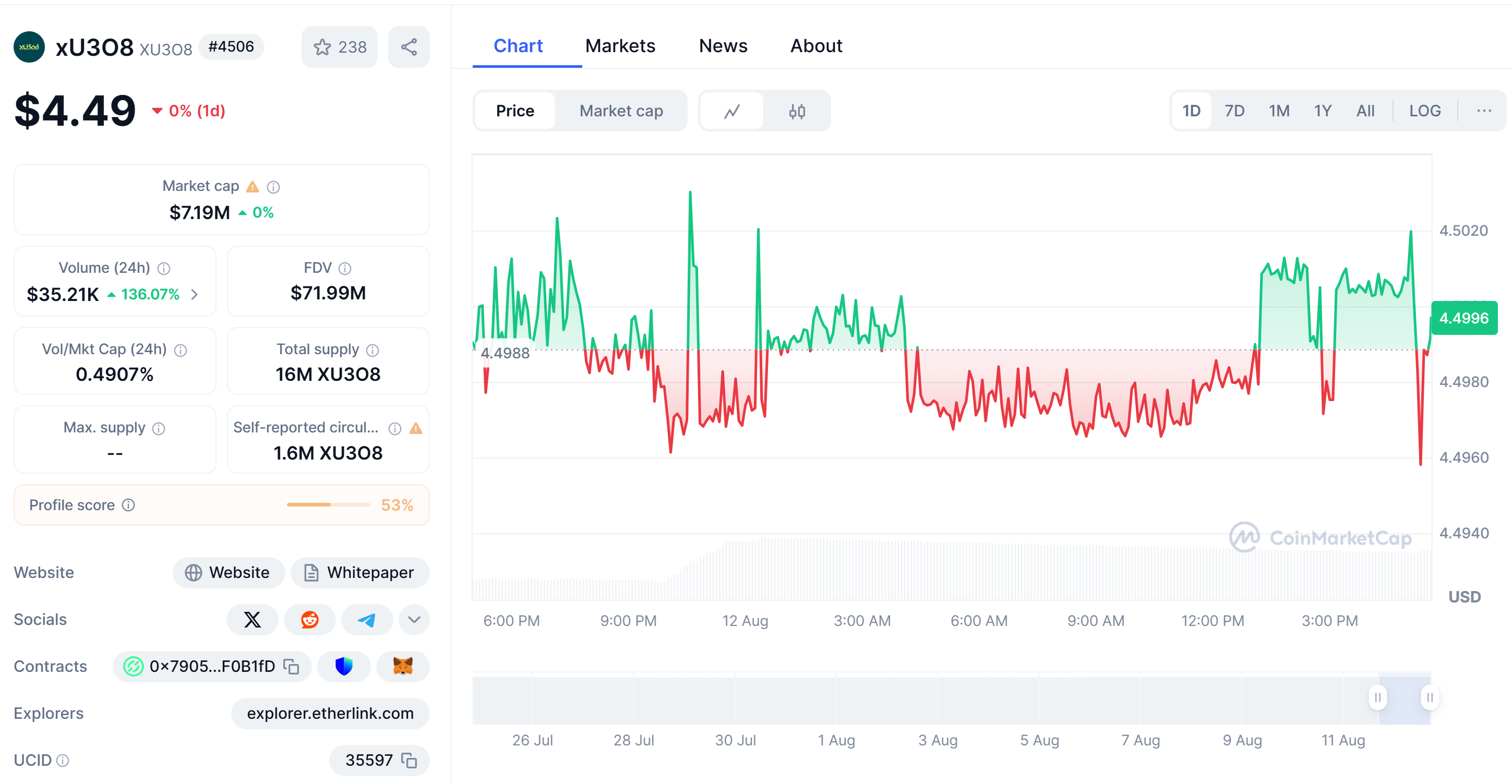

xU3O8 price. Source: CoinMarketCap

Related: Transak, Uranium.io partnership allows users to purchase tokenized uranium with cryptocurrency

Hex Trust Expands RWA Services to Uranium

The addition of uranium to its services marks Hex Trust’s expansion into real-world assets, particularly in a commodity like uranium that has been traditionally challenging for institutions to access.

Ben Elvidge, Trilitech’s head of commercial applications, highlighted the benefits of tokenizing uranium, citing improved market access and pricing transparency facilitated by blockchain technology.

Hex Trust, licensed in multiple jurisdictions, aims to provide a regulated custodial solution for institutions entering the uranium market.

Related: Growth of RWA token market as firms embrace regulated crypto increases by 260% in 2025

Uranium.io Revolutionizes Uranium Trading

Uranium.io, the first decentralized application for uranium trading, launched on the Tezos blockchain in collaboration with Curzon Uranium and Archax.

This platform aims to democratize access to the global uranium trade, historically dominated by institutional investors. Retail investors can now invest in uranium through tokenization, a process that was previously limited to institutional players with significant capital.

Earlier this year, Transak partnered with Uranium.io to allow retail investors to purchase tokenized uranium using cryptocurrency or credit cards, lowering the entry barrier significantly.

Magazine: TradFi is leveraging Ethereum L2s to tokenize trillions in RWAs – Exclusive insights