After a significant decline in 2022, the capital markets have shown remarkable resilience in the past 20 months. Since January 2023, the S&P 500 and Nasdaq Composite have recorded total returns of 48% and 66% respectively (as of the time of this article). While the recent performance may be enticing, prudent investors understand the importance of taking profits and exploring more stable investment opportunities.

Why is that? September is historically a challenging month for the stock market, characterized by increased selling pressure. Factors such as tax planning, shifts in monetary policy by the Federal Reserve, and the uncertainty surrounding the upcoming presidential election in 2024 can lead to heightened market volatility and selling activity.

Given these circumstances, investors may want to consider shifting focus towards more reliable investment options rather than volatile growth stocks. One such option is investing in consistent dividend-paying stocks. In this article, we will discuss a high-yield dividend stock that stands out in the telecom industry and why September could present an opportune time to invest in this particular company.

This telecom stock offers a unique advantage

While the telecom sector may not be as flashy as technology stocks, companies in this industry provide essential services that are in demand. Despite facing pricing pressures due to commoditization, Verizon (NYSE: VZ) stands out as a compelling investment opportunity, especially for income-focused investors.

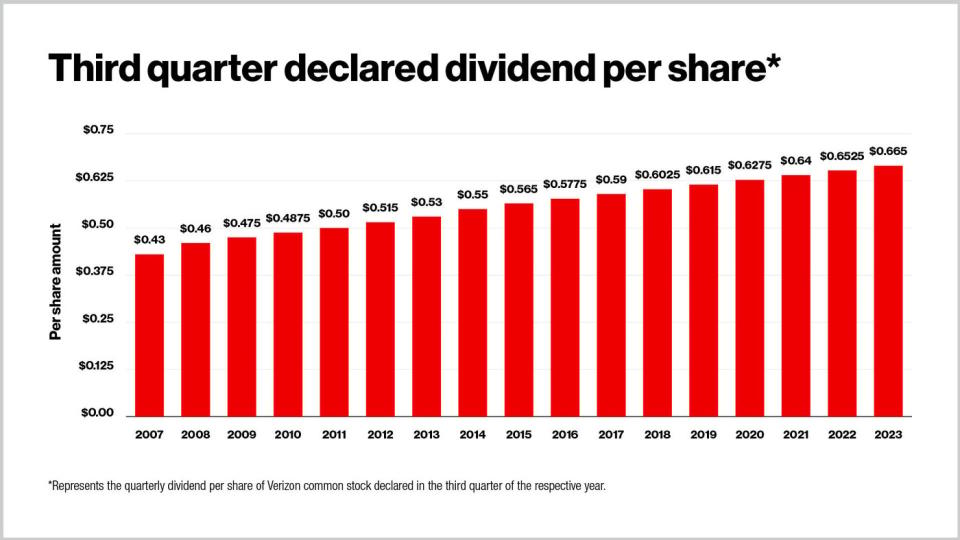

Verizon has a track record of increasing its dividend for 17 consecutive years, with a history of announcing dividend raises in September. This consistency in rewarding shareholders sets Verizon apart from many other companies in the market.

Reasons to expect another dividend raise from Verizon

While historical patterns can provide insights, it’s important to conduct a thorough analysis of Verizon’s financial health and market dynamics before making investment decisions. Despite fluctuations in revenue and free cash flow growth in recent years, Verizon has consistently generated substantial cash flow, enabling it to sustain and increase its dividend payouts.

As of the first half of 2024, Verizon has reported $65.8 billion in total revenue, showing a modest year-over-year increase. Furthermore, the company’s free cash flow has grown by 6.9% compared to the same period last year, indicating financial stability and potential for dividend growth.

Considering Verizon’s current dividend yield of 6.2% and its attractive valuation compared to the broader market, now could be an opportune time to invest in the company. While the anticipation of a dividend raise is speculative, recent market trends suggest that investors are optimistic about Verizon’s future prospects.

Is Verizon a good investment right now?

With a high dividend yield and a favorable valuation, Verizon presents an appealing investment opportunity for income-oriented investors. The company’s solid financial performance and consistent dividend history make it a reliable choice in uncertain market conditions.

Given the potential market volatility in the coming months, diversifying into stable investments like Verizon could provide a cushion against downturns. Investors looking for a reliable income stream and long-term growth potential may find Verizon to be an attractive addition to their portfolio.

Consider investing in Verizon Communications

Before making any investment decisions, it’s essential to conduct thorough research and consider all factors. While Verizon Communications offers a compelling investment opportunity, exploring other potential options is advisable.

For more insights and investment recommendations, consider consulting with financial advisors or subscribing to reputable investment advisory services like the Motley Fool Stock Advisor. By staying informed and diversifying your portfolio, you can make well-informed investment decisions that align with your financial goals.