Infura, a blockchain infrastructure firm owned by Consensys, is expanding its API data marketplace, the Decentralized Infrastructure Network (DIN), to run on EigenLayer, a protocol that allows Ethereum stakers to reuse their staked ETH to secure external services.

In a press release shared with The Defiant, Infura announced that this is the first large-scale RPC and API marketplace to operate as an EigenLayer Autonomous Verifiable Service. This means that the service is now supported by stakers who can earn rewards for its successful performance or lose part of their stake if it fails, incentivizing operators to stay online.

E.G. Galano, co-founder of Infura, expressed that utilizing EigenLayer enables the team to implement their vision on a “proven restaking standard backed by the strongest asset in crypto: restaked ETH.”

DIN has been actively processing real user requests since February 2024, managing over 13 billion requests per month across more than 30 networks and platforms, including Ethereum mainnet, Layer 2 network Linea, and web3 wallet MetaMask, according to the release.

DIN connects blockchain applications to multiple node providers, ensuring seamless request routing in case one provider goes offline. With the integration of EigenLayer, Infura introduces economic accountability to enhance reliability, making downtime costly to overlook.

Fighting Centralization

Through the new service, the Consensys-owned blockchain infrastructure firm aims to tackle a significant vulnerability in web3 infrastructure, as it highlights that “70-80% of RPC traffic currently flows through a few centralized providers.”

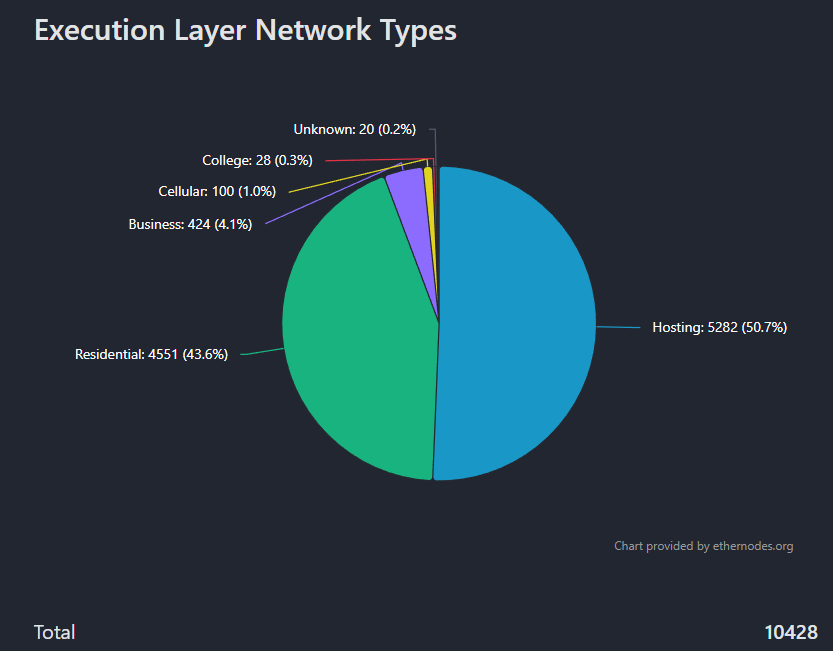

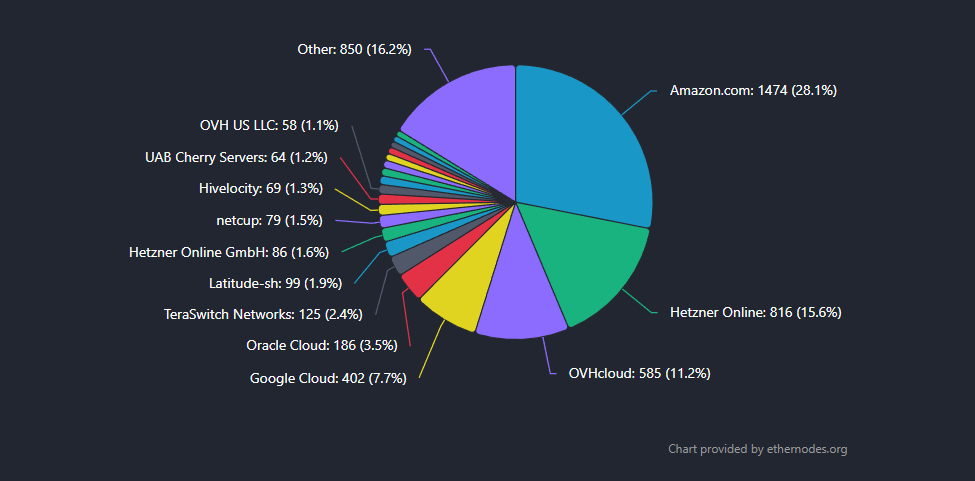

Data from Ethernodes reveals that over half of Ethereum’s “execution nodes,” responsible for processing blockchain data, are hosted by cloud providers.

Approximately 28% of these nodes operate on Amazon’s cloud services, while 15.6% run on the European data center Hetzner.

Although blockchains are intended to be decentralized, a significant portion of their traffic relies on a small number of centralized cloud platforms, with Amazon Web Services (AWS) being a key player. The industry has already witnessed the impact of this centralization.

In late October, AWS experienced a prolonged outage that disrupted major websites and applications, including Coinbase, its Layer 2 network Base, cross-chain stablecoin USDT0, and even Infura, which reported a “widespread outage” affecting multiple Infura networks and services. This incident on AWS followed a similar outage in April.