Authored by Lance Roberts via RealInvestmentAdvice.com,

Market activity once again sees retail investor greed taking center stage, reminiscent of past speculative behaviors during risk-on phases. Retail investors are displaying a heightened risk appetite across various metrics, including options trading and leveraged ETF flows, seemingly unconcerned about valuation or macroeconomic challenges.

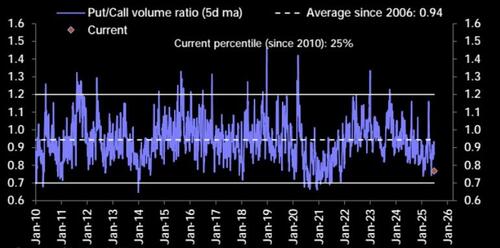

The current put/call ratios are indicating strong bullish sentiment, with the SPY ratio around 0.79, signaling a preference for calls over puts.

It is investor greed that primarily underpins this skew, particularly evident in names and sectors associated with high momentum or popular narratives.

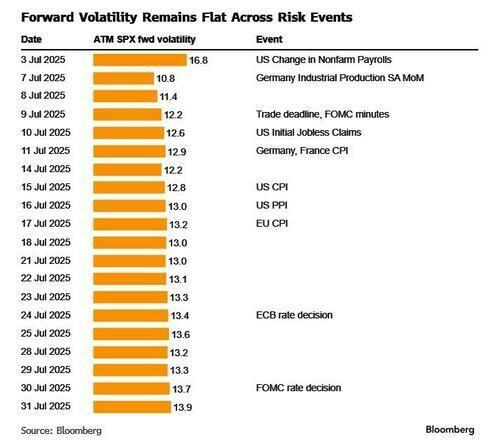

“Despite the looming July 9th trade negotiation deadline, not much is priced into the SPX vol surface for the event, suggesting investors either expect a positive resolution or for the deadline to be extended. Interestingly, the flattening in skew was mostly concentrated in the front-month, suggesting this was mostly positioning-driven FOMO-type call buying. Longer-dated skew remains steep in comparison.” – CBOE

The surge in call option volumes is particularly notable in semiconductor plays, especially in leveraged vehicles like SOXL, the 3x bullish semiconductor ETF, where open interest in call options far surpasses puts. Similar trends are emerging in thematic ETFs like RETL (3x retail) and DRN (3x real estate), witnessing elevated daily volume despite mixed performance. This appetite for leverage is further fueled by the rise of single-stock leveraged ETFs, such as HIMZ, a leveraged play on HIMS, which experienced a significant 70% decline following a corporate announcement, underscoring how retail speculation often disregards risk.

Investor greed is also evident in flows towards speculative and BW Reader stocks. Retail inflows into U.S. equities have exceeded $70 billion year-to-date, with a significant portion directed at highly volatile names like Palantir, MicroStrategy, and other crypto-related or AI-linked plays. Penny stocks and small caps, typically favored by risk-seeking traders, have experienced substantial gains in short bursts, driven mainly by social media hype and retail momentum chasing. Additionally, investors are doubling down on speculative trades even after short-term losses, demonstrating a “buy-the-dip” mentality that prioritizes quick gains over fundamental analysis.

Supporting this trend are broader ETF flow dynamics. Retail-focused providers like Vanguard have seen their share of total U.S. ETF inflows rise to 37%, up from 27% a year earlier. Leveraged equity ETF flows hit a five-year high in the spring and have remained elevated through Q2. Furthermore, tighter bid-ask spreads and increased retail-friendly platforms are facilitating higher trade volumes with lower friction, further driving this behavior.

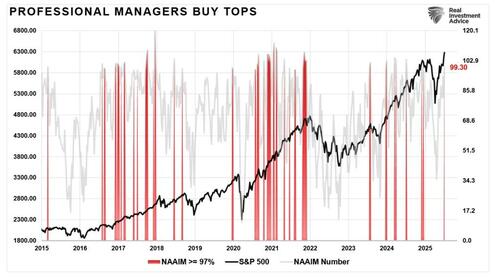

Nevertheless, it’s not just retail investor greed propelling the market. While somewhat delayed, professional investor sentiment and positioning have also surged, contributing to the recent market highs.

While the combined exuberance of retail and professional investors has fueled the market’s ascent, it has also introduced fragility. Leveraged ETFs are susceptible to compounding decay in volatile markets, while speculative trades can unravel swiftly, as evidenced by HIMZ. While momentum can prolong rallies, the subsequent reversals are often abrupt when sentiment shifts.

Optimism currently favors the Bulls, but signs of overextension are mounting. A significant price correction may be imminent, possibly as early as next week.

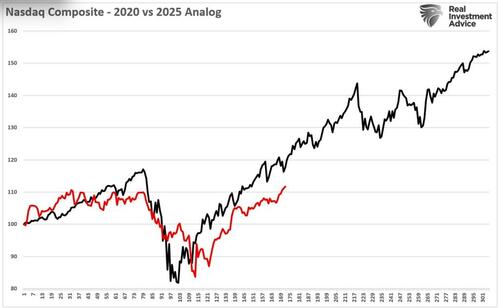

📈 Nasdaq 2025 Tracking 2020

I have consistently expressed my disdain for market analogs due to their reliance on cherry-picked data points to establish correlations. However, analogs can sometimes illustrate similarities between market performance periods and investor sentiment. The comparison between the Nasdaq in 2020 and 2025 is a compelling example of this. The onset of the pandemic triggered a 35% decline in March of 2020, followed by a robust rally into the end of that year and beyond. In 2025, we observe a similar pattern with a decline in March and early April, succeeded by a rebound through the end of June.

While this analogy may embolden the Bulls, suggesting ample opportunity for further gains in 2025, it is crucial to recognize the limitations of such comparisons. The absence of supporting data from the previous rally undermines the predictive power of analogs. Additionally, the disparities between 2020 and the present must not be overlooked. In 2020, the absence of sporting events and the Federal Reserve’s unprecedented interventions significantly influenced market dynamics.

The current market climate in 2025 mirrors the speculative fervor of 2020, despite a starkly different backdrop. With the Fed maintaining higher interest rates, unwinding its balance sheet, and diminishing fiscal support, the market continues its rally with seemingly unchecked exuberance.

Will the 2025 analog persist in echoing 2020? Possibly, but given elevated valuations and economic deceleration, the analog is likely to diverge sooner rather than later.

Exercise caution when interpreting historical analogs.

Loading…