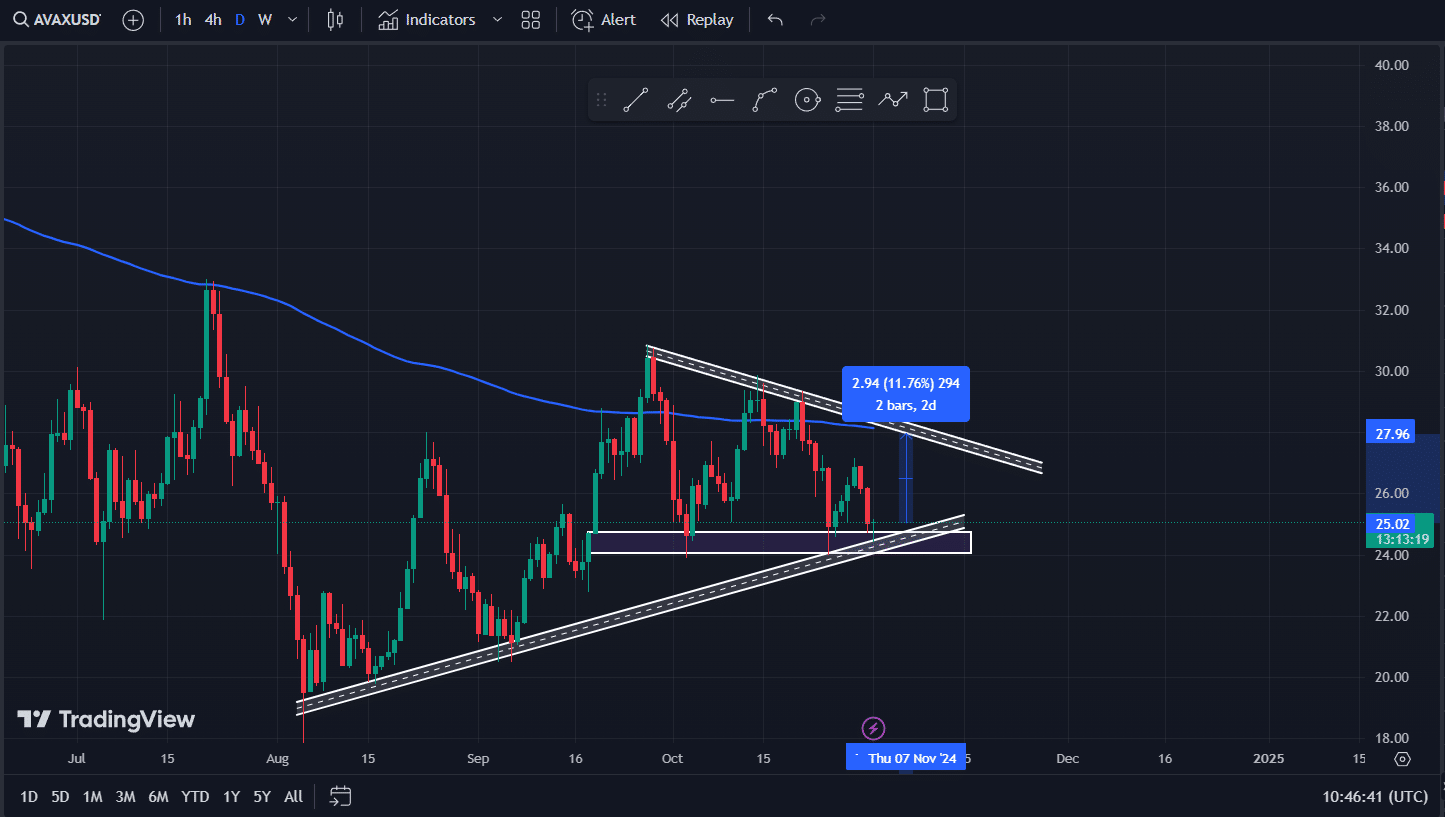

- If AVAX can maintain itself above the $24.50-level, it could potentially surge by 12% to reach $28.50

- Analysis of on-chain metrics and technical indicators indicates a bullish trend for AVAX

Market sentiment and price action play a crucial role in determining the fate of AVAX. Despite recent negative sentiment in the crypto market, AVAX appears to be gearing up for a new rally.

AVAX Technical Analysis and Key Levels

Technical analysis by AMBCrypto suggests that AVAX is poised for a 12% surge towards the $28.50 level in the near future.

Recent price movements indicate that when AVAX approaches the $24.50 support level, it experiences buying pressure and a subsequent price reversal.

Source: TradingView

In addition to the horizontal support level, AVAX is currently supported by an upward-sloping trendline that has been in place since August 2024. Price tends to rally significantly whenever it hits this trendline.

At present, AVAX is trading below the 200 EMA on the daily timeframe, signaling an uptrend. The RSI is in the oversold area, suggesting a potential upward rally.

For AVAX’s bullish scenario to hold, it must stay above the $24.50 level; otherwise, the bullish trend may falter.

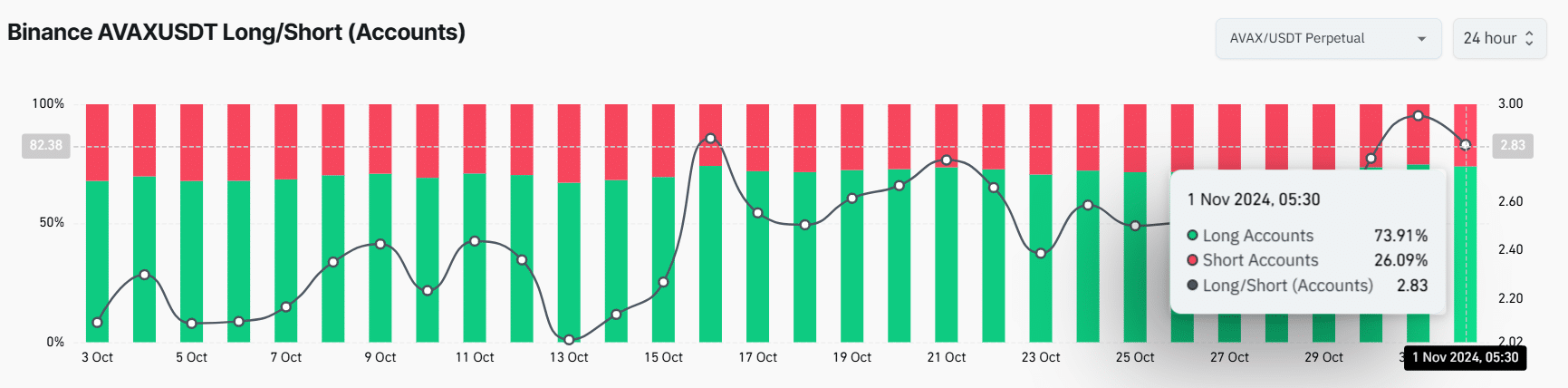

Bullish On-Chain Metrics

Apart from favorable technical analysis, on-chain metrics such as liquidation levels and Long/Short ratios further support the bullish outlook for AVAX. CoinGlass reports a Long/Short ratio of 2.83 on Binance, indicating strong bullish sentiment among traders.

Source: Coinglass

These metrics, coupled with technical analysis, indicate that AVAX bulls are currently in control, potentially fueling an upcoming rally.