Story Highlights

- The Live Price Of MYX Is $ 3.08694067

- With innovation in cross-chain derivatives and rising on-chain activity, MYX could reach $30 by 2026 and up to $50 by 2030 if similar momentum continues.

- MYX surged over 20,000% from June lows to September highs, making it one of the year’s best performers.

MYX Finance is establishing itself as a next-generation decentralized perpetual futures exchange, catering to traders seeking on-chain transparency while maintaining leverage and execution speed.

Amidst increasing regulatory scrutiny on centralized exchanges, decentralized perpetual exchanges like MYX are attracting users in search of non-custodial alternatives.

Despite the overall cryptocurrency market facing downward pressure, MYX Finance’s native token (MYX) is moving in the opposite direction. The token has seen a 15% increase in the last 24 hours, trading around $3.5, while other major cryptocurrencies are experiencing declines.

During a period of weak market sentiment, MYX’s robust price action has caught the attention of investors, sparking curiosity about the token’s growth trajectory and future prospects.

Given this context, let’s delve deeper into our MYX Finance (MYX) price forecast for the years 2026 to 2030.

MYX Finance Price Today

| Cryptocurrency | MYX Finance |

| Token | MYX |

| Price | $3.0869 |

| Market Cap | $ 776,283,538.55 |

| 24h Volume | $ 35,961,060.2026 |

| Circulating Supply | 251,473,423.70 |

| Total Supply | 1,000,000,000.00 |

| All-Time High | $ 19.0135 on 11 September 2025 |

| All-Time Low | $ 0.0467 on 19 June 2025 |

Coinpedia’s MYX Price Prediction 2026

MYX’s price displayed strong bullish momentum, reaching $7.56 in January before encountering resistance. A pullback to around $3.00 suggests potential for increased demand and a subsequent rebound. Key resistance lies at $7.56, with a potential breakthrough leading to $9.0 by late February 2026. Failure to surpass this resistance could result in a slower recovery throughout the year.

What is MYX Finance?

MYX Finance is a decentralized futures exchange designed to enhance accessibility, efficiency, and user-friendliness in derivatives trading.

Unlike traditional platforms, MYX features a unique Chain-Abstracted Wallet that enables seamless movement across blockchains without manual bridging.

Its innovative two-layer account model ensures user fund custody while facilitating gasless transactions through a relayer network.

Another compelling feature of MYX is its support for leverage up to 50x with zero slippage, powered by its matching pool mechanism, which enhances efficiency and reduces trading risks.

MYX Finance (MYX) Price Prediction 2026

The consolidation observed in Q4 2025, followed by a significant surge to $7.56 in January, underscores the strong bullish momentum in MYX. Despite facing resistance in the last week of January, it appears poised to approach the ascending trendline support. The breach of the $5.00 support level could lead to a retreat to the trendline around $3.00, setting the stage for a robust rebound in the coming weeks.

Market movements typically exhibit fluctuations rather than unidirectional trends, with patterns suggestive of manipulation in the presence of strong influences. Given MYX crypto’s history of pump-and-dump schemes, investors must remain cautious as another such incident could impact its long-term credibility. Nonetheless, a healthy recovery from the current juncture seems probable, with steady progress anticipated from this support level.

The critical resistance level currently stands at $7.56. A successful breach and maintenance of this level could propel prices to $9.0 by the end of February 2026, with a realistic possibility of revisiting the all-time high by the quarter’s end. Conversely, a market downturn in February may lead to a retest of the trendline around $3.00, resulting in a more prolonged recovery throughout the year.

Fundamental Growth and Ecosystem Strength Remain Intact

Despite the October market downturn, the narrative that MYX is finished is far from accurate. While current price action may not reflect this, the platform’s fundamentals are stronger than ever.

MYX Finance’s impressive growth is rooted in robust on-chain fundamentals, transcending mere speculation. The platform has witnessed substantial growth in user activity, as evidenced by a significant surge in monthly trading volume. From $51 billion in January 2025, the trading volume more than doubled to $128.43 billion by late December.

Earnings have also more than doubled during the same period, rising from $18 million to $57.45 million.

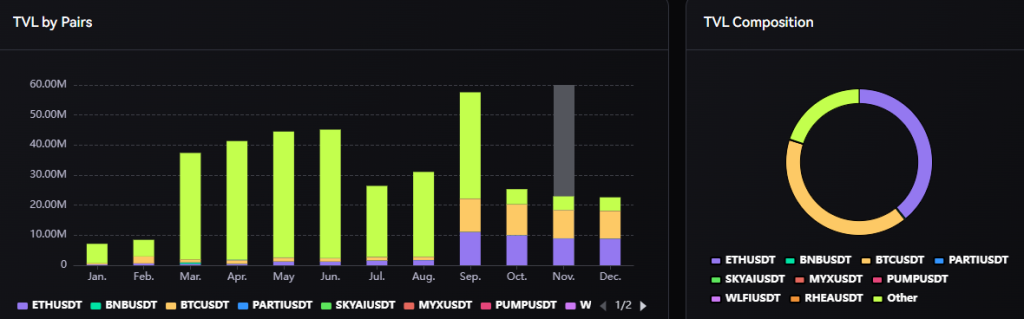

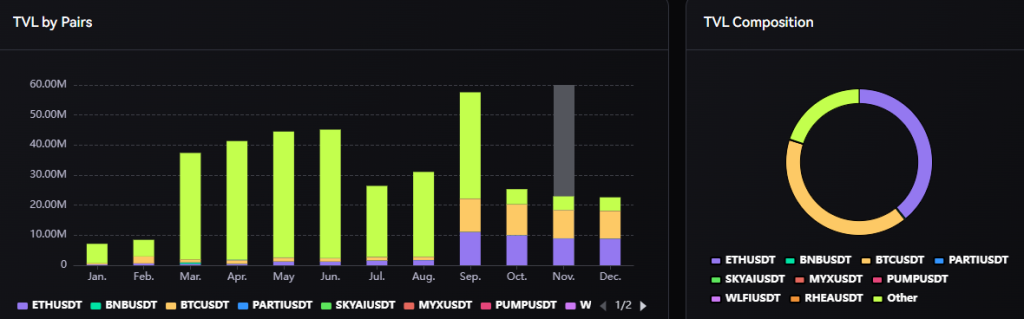

While the TVL experienced a significant drop from its previous peak of nearly $58 million in September, plummeting to $22.60 million by December.

If this momentum persists, MYX Finance could witness further TVL fluctuations. However, an increase in adoption coupled with any price catalyst for MYX could see a resurgence in TVL levels in 2026.

MYX Finance Price Prediction 2026 – 2030

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $10.50 | $18.00 | $30.00 |

| 2027 | $12.00 | $24.50 | $37.00 |

| 2028 | $15.50 | $29.00 | $42.00 |

| 2029 | $19.00 | $35.00 | $46.00 |

| 2030 | $21.00 | $38.00 | $50.00 |

What Does The Market Say?

| Year | 2026 | 2027 | 2030 |

| CoinCodex | $9.50 | $14.99 | $40.87 |

| Pricepredictions | $6.3 | $11.8 | $28.09 |

| DigitalCoinPrice | $7.41 | $18.71 | $37.75 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

MYX Finance is a decentralized perpetual futures exchange offering up to 50x leverage, gasless trades, and non-custodial accounts across blockchains.

MYX’s long-term potential depends on trader adoption, platform reliability, and growth of decentralized derivatives markets through 2026–2030.

For 2026, MYX is projected to trade between $2.8 and $10.44, depending on user growth, market conditions, and protocol performance.

If MYX becomes a major on-chain derivatives platform with strong liquidity and revenue, long-term forecasts suggest prices near $40–$48 by 2030.