- Solana surged by 4.5% in the past 24 hours, reaching levels not seen since April 2024.

- As of now, bullish sentiment outweighs short selling, indicating exhaustion among short sellers.

The overall cryptocurrency market appeared bullish, with top crypto assets performing well.

In particular, Solana [SOL], the fourth-largest cryptocurrency globally, gained significant attention as it broke through the key resistance level of $187.

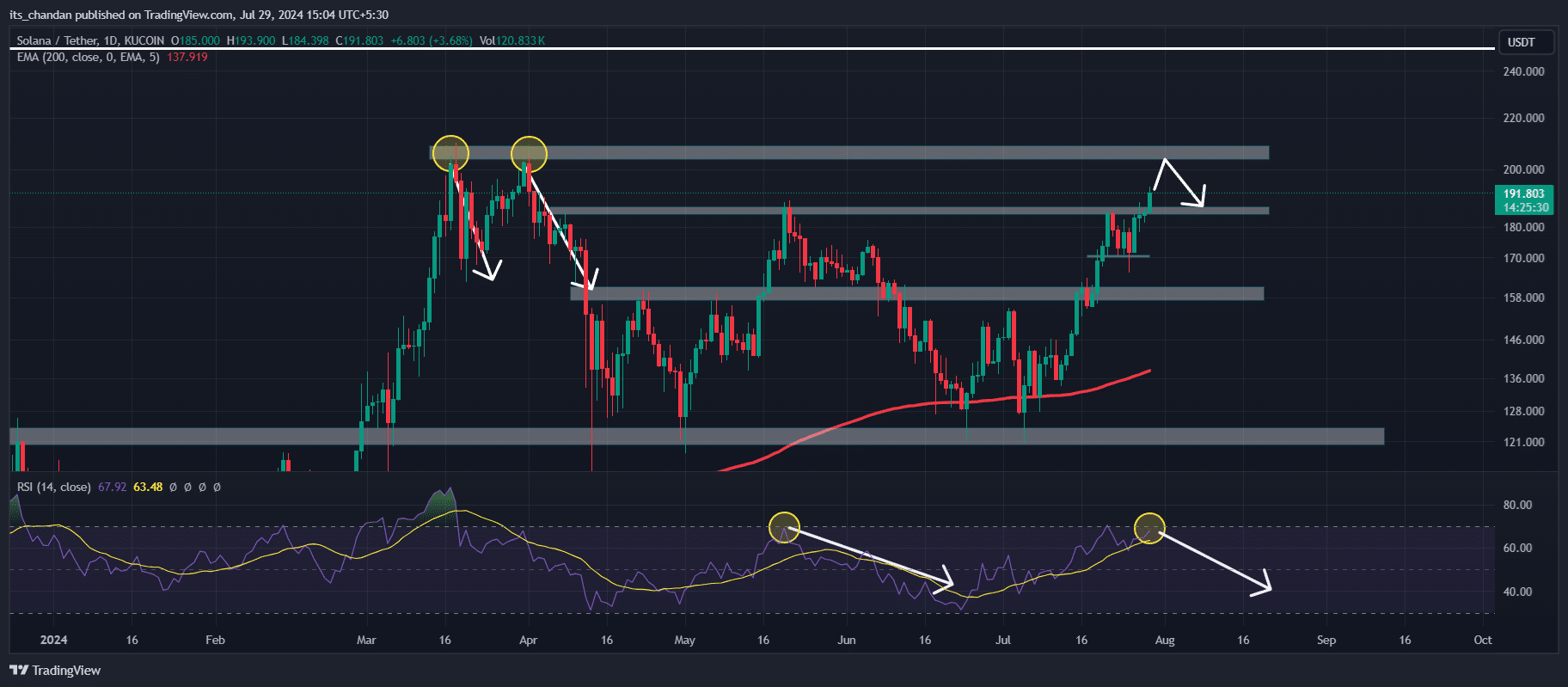

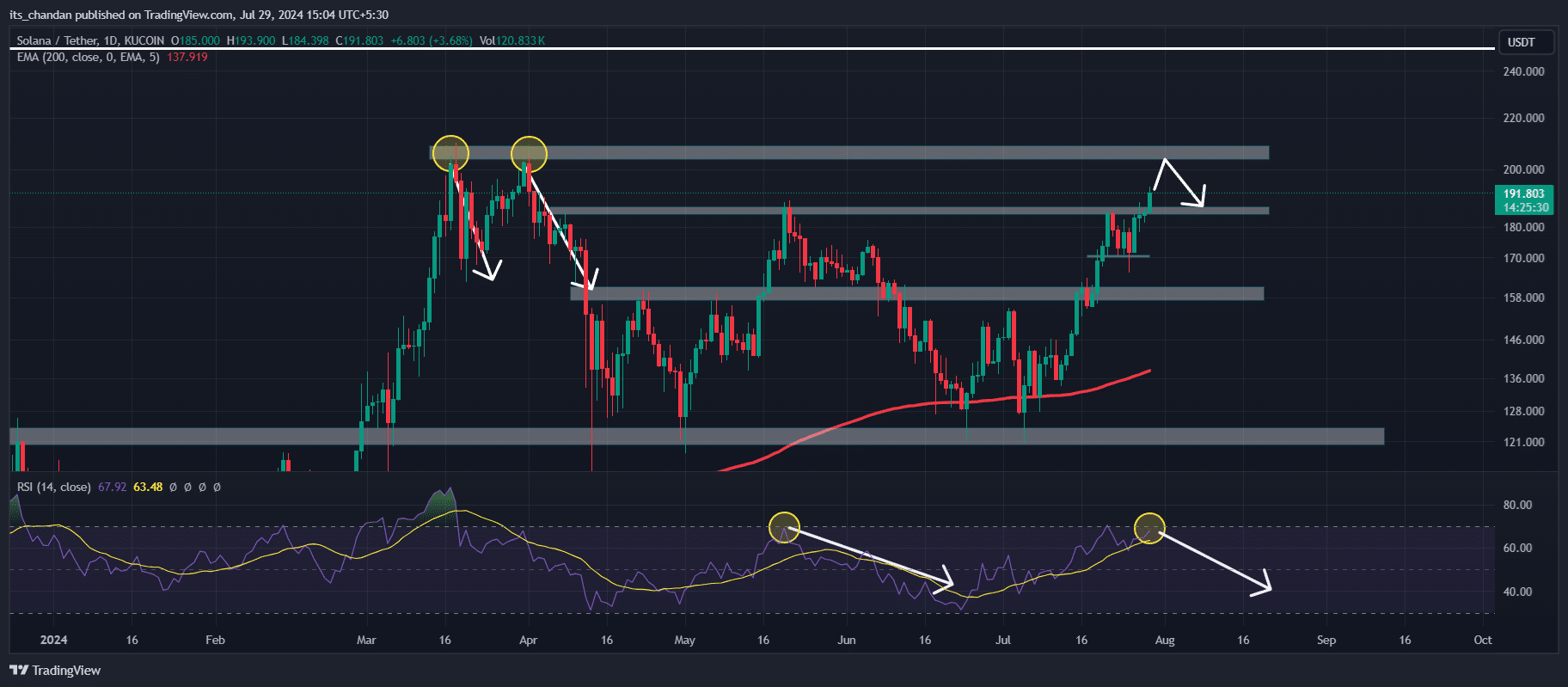

Solana’s Price Reversal Concerns

After the crucial breakout, there is a potential for SOL to rise towards the next resistance level around $204.

However, new investors are wary of a possible price reversal at this upcoming resistance level.

Historical data shows that whenever SOL reached $204, it experienced a significant price reversal.

Since March 2024, SOL has hit this level twice, resulting in notable price reversals each time, causing concern among new investors.

Currently, SOL is trading around $192, with a 4.5% increase in the last 24 hours. Despite the positive price movement, trading volume has decreased by 18% during the same period.

This decline in trading volume may suggest that investors and traders are cautious due to the historical price reversal at the resistance level.

Technical Analysis and Future Levels

According to technical analysis, SOL broke through the critical resistance at $187 and is now heading towards the next level at $204.

Following this breakout, there is a high likelihood that SOL could reach $204 in the coming days.

Source: TradingView

However, technical indicators like the Relative Strength Index (RSI) indicate an overbought condition, signaling a potential price reversal.

The stochastic level is also in the overbought territory, with a value above 80 currently.

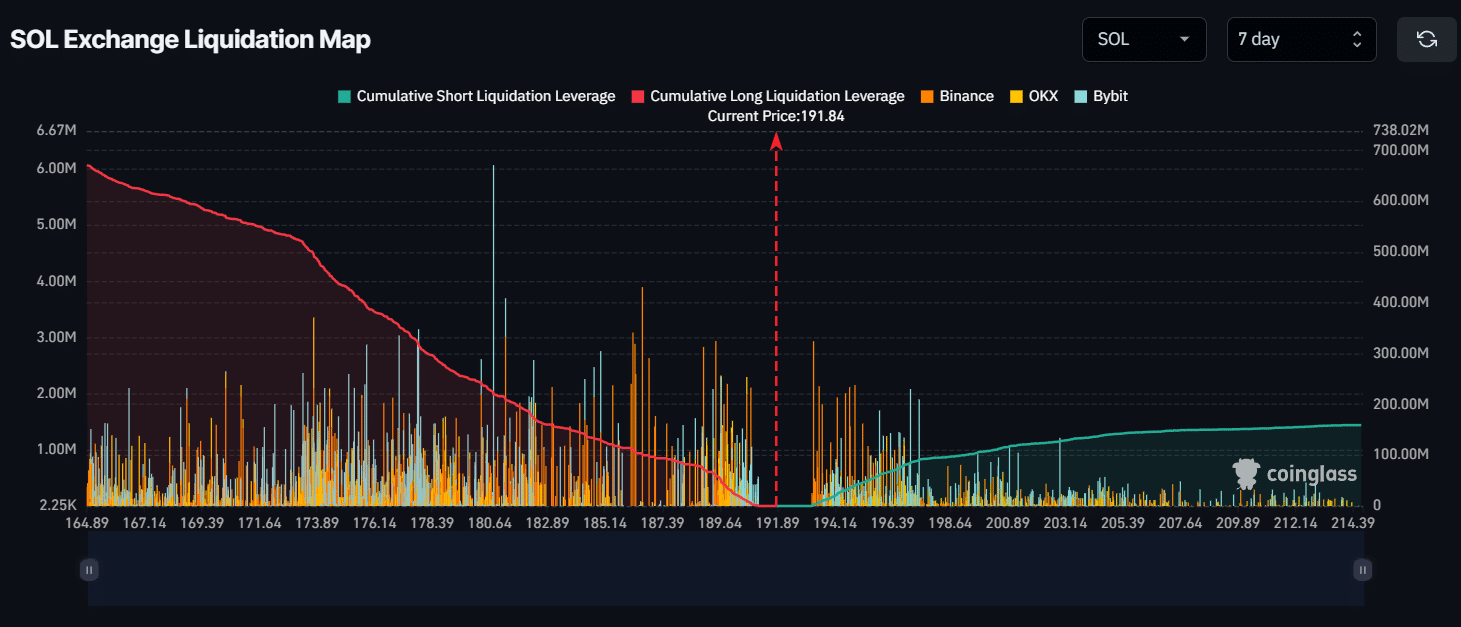

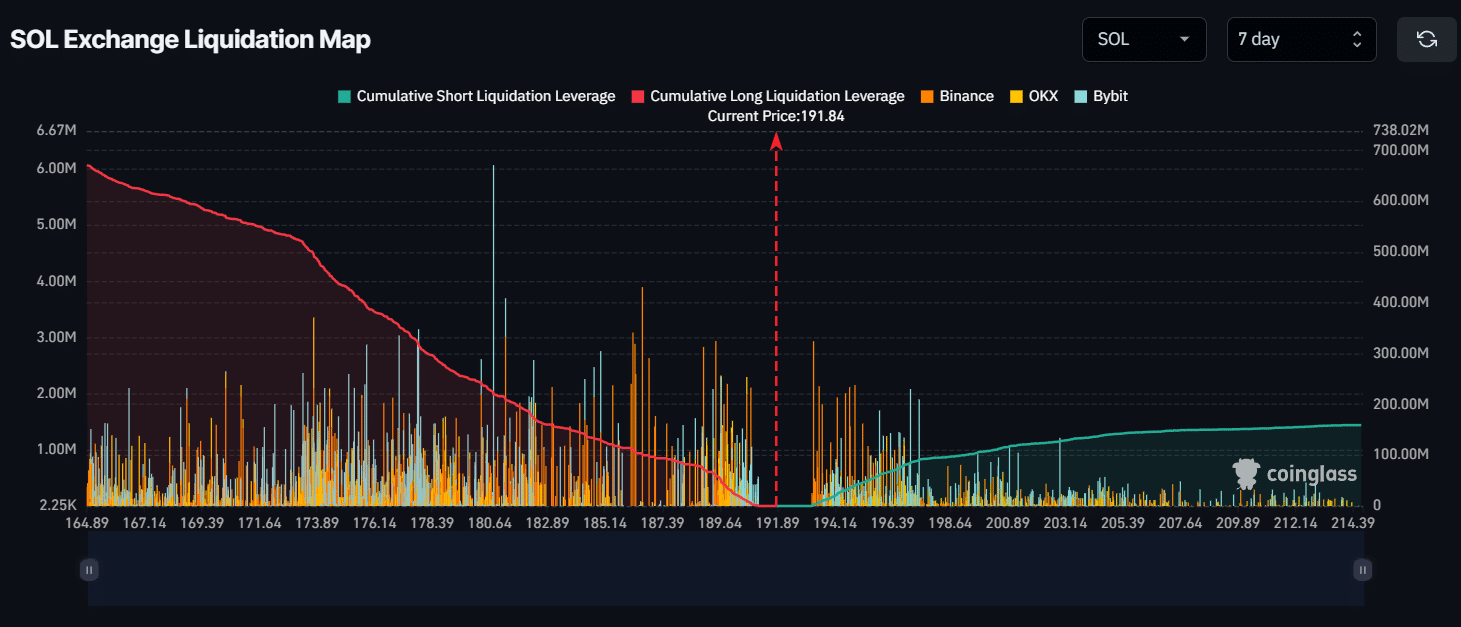

Additionally, significant liquidation levels are present near $180 and $203.

Based on data from CoinGlass, a price reversal leading to a drop to $180 could result in the liquidation of $225 million worth of long positions in SOL.

Conversely, breaching the $203 level could liquidate approximately $132 million worth of short positions.

Source: CoinGlass

Whales’ and Investors’ Activity

Despite concerns about a price reversal, the crypto community remains optimistic as whales and investors show increased interest in SOL.

On July 24th, two whales withdrew around $41.5 million worth of SOL from Binance [BNB] and staked it, indicating long-term confidence in SOL.

In addition to whale activity, Raoul Pal, CEO of Real Vision and a prominent financial analyst, disclosed in a podcast that he has shifted 90% of his liquid assets into SOL.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The combined interest from whales and investors paints a positive picture for SOL’s future.

Furthermore, Solana’s Open Interest (OI) has risen by 10%, as per CoinGlass, indicating growing interest from investors and traders.

sentence using different words:

She decided to go to the store to buy some groceries.

She chose to visit the store in order to purchase groceries.