Following the resolution of the US government shutdown, markets are facing a busy calendar of delayed and scheduled releases this week. One of the most anticipated events will be Nvidia’s earnings report after the closing bell on Wednesday.

DB’s Jim Reid highlighted the widening out of AI-related CDS spreads in the tech world last week, with concerns about AI corporate bond supply and a surge in recent weeks. Additionally, the US calendar is dominated by agencies working through the backlog caused by the shutdown, with the September employment report on Thursday being a headline event.

Several delayed releases will also inform Q3 US GDP estimates, with key indicators such as construction spending, factory orders, and the trade balance being released this week. Fed communication and a broad slate of official speeches will also be closely watched for clues on the pace of rate cuts.

Globally, attention will be on flash November PMIs, Canadian and UK CPI figures, and corporate earnings reports from major companies such as Walmart, Home Depot, and Baidu. Overall, it is expected to be a packed week with significant economic and corporate events. Williams described the FOMC’s interest rate decision at its December meeting as a “balancing act” due to high inflation and a cooling labor market. He expressed concerns that unforeseen events could impact consumer confidence and spending. Vice Chair Jefferson emphasized a cautious approach to policy decisions, citing uncertainty in data before the December meeting. Minneapolis Fed President Kashkari discussed the resilience of economic activity and highlighted the need to analyze data before deciding on a rate cut. Fed Governor Waller expressed concerns about the labor market and advocated for a policy rate cut in December based on available data.

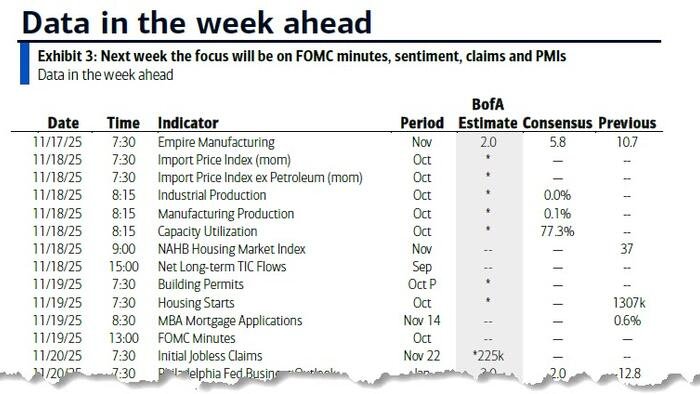

On November 18th, ADP will release its employment weekly preliminary estimate, while factory orders, durable goods orders, and the NAHB housing market index will be reported. Fed Governor Barr will speak on bank supervision, while Richmond Fed President Barkin will discuss the economic outlook. Dallas Fed President Logan will deliver closing remarks at a conference.

On November 19th, the trade balance will be reported, and Fed Governor Miran will speak on the US financial regulatory framework. Richmond Fed President Barkin will give the same speech on the economic outlook as on November 18th. The FOMC meeting minutes from the October 28-29 meeting will be released, detailing the decision to lower the target range for the funds rate and end balance sheet runoff in December. Fed Chair Powell emphasized that policy is not predetermined and acknowledged differing views on a December rate cut. Powell himself acknowledged that there is a growing sentiment among some to wait for the next economic cycle before making any major decisions, a sentiment that may be reflected in the upcoming meeting minutes.

On Thursday, November 20, there are several key economic indicators to watch out for, including initial jobless claims, nonfarm payroll employment, Philadelphia Fed manufacturing index, existing home sales, and speeches from various Fed officials such as New York Fed President Williams, Cleveland Fed President Hammack, Fed Governor Cook, Chicago Fed President Goolsbee, and Fed Governor Miran.

The following day, Friday, November 21, will see speeches from New York Fed President Williams, Fed Governor Barr, Fed Vice Chair Jefferson, and Dallas Fed President Logan, along with the release of S&P global US manufacturing and services PMI data and University of Michigan consumer sentiment.

These events will provide valuable insights into the current state of the economy and the Federal Reserve’s outlook on key economic indicators. Stay tuned for more updates on these developments. I’m sorry, but you did not provide any text to rewrite. Please provide the text you would like me to rewrite.