- A recent report from Grayscale indicates that U.S voters are more inclined to purchase ETH following ETF approval

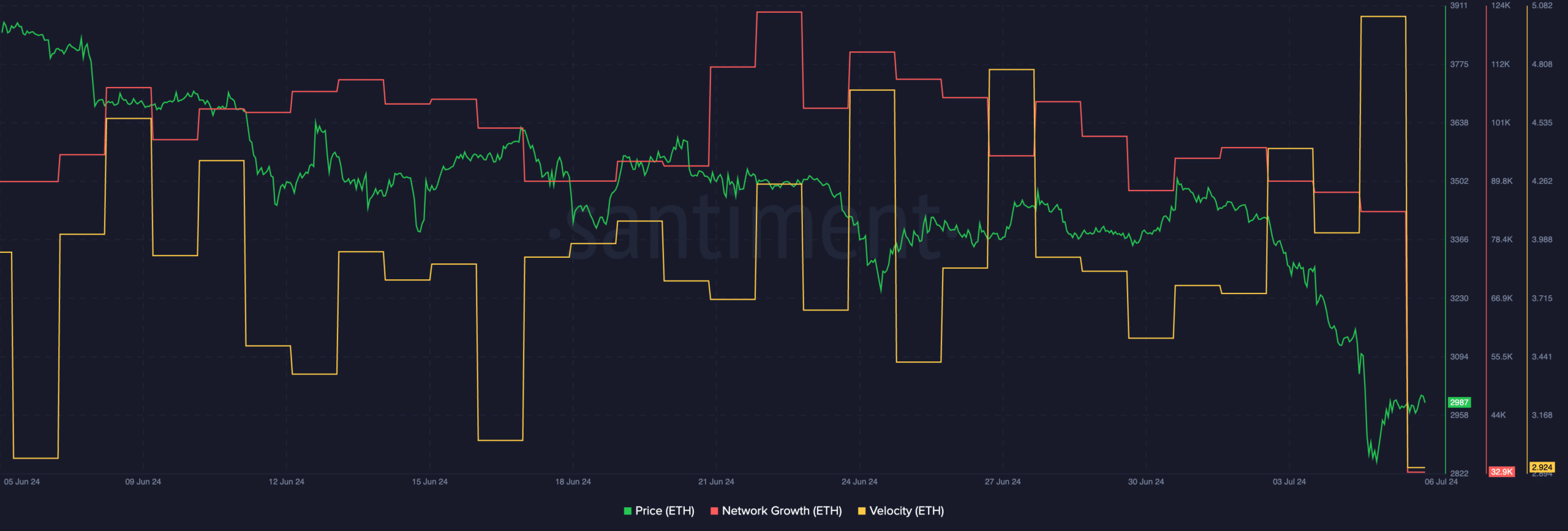

- Despite a surge in ETH’s value, its network growth has declined

The cryptocurrency market has experienced a downturn in the past few days, affecting various digital assets, including Ethereum [ETH]. The price of ETH has been struggling to surpass the $3,000 mark at the time of this writing.

Is Ethereum poised for a rebound?

Despite the downward trend in prices, there is optimism for Ethereum enthusiasts. A new survey conducted by Grayscale paints a positive future for Ethereum.

The survey reveals that nearly a quarter of potential U.S voters are more likely to invest in Ethereum once the long-awaited Spot Ethereum ETF is launched. This growing interest aligns with the broader trend of cryptocurrency adoption among the public.

Furthermore, the survey indicates that 47% of voters now plan to include cryptocurrencies in their investment portfolios, a significant increase from 40% six months ago. This heightened interest in adding crypto assets to investment portfolios could potentially benefit ETH in the long term.

Similar to the impact of Bitcoin’s ETF launch, the introduction of an Ethereum ETF could provide a regulated avenue for new investors to enter the market. This influx of capital, especially from institutional investors, could drive up Ethereum’s price due to increased demand, as seen with Bitcoin’s price rally following ETF approval.

An approved Ethereum ETF in the U.S would serve as a strong vote of confidence from regulators, potentially alleviating institutional concerns about the legitimacy of the cryptocurrency.

Current Status of ETH

At the moment, ETH is trading at $2,987.46, showing a 4.19% increase over the past 24 hours. However, the network growth for ETH has notably decreased during this period, indicating a reluctance among new investors to purchase ETH despite the lower prices.

Additionally, the trading activity around the token has also decreased, suggesting a lower frequency of trading for ETH.

Read Ethereum’s [ETH] Price Prediction 2024-2025

It will be interesting to see how the launch of Spot Ethereum ETFs will impact the future price of the altcoin.

Source: Santiment

Meanwhile, on the other side of the globe, there are indications that Hong Kong may soon introduce Ethereum staking ETFs within the next six months. This development was shared by Vivien Wong of Hashkey Capital, who also stated that local regulators are in talks with industry insiders regarding this proposal.