- Although Terra Luna Classic was unable to break the range highs, there is potential for a price bounce in the near future.

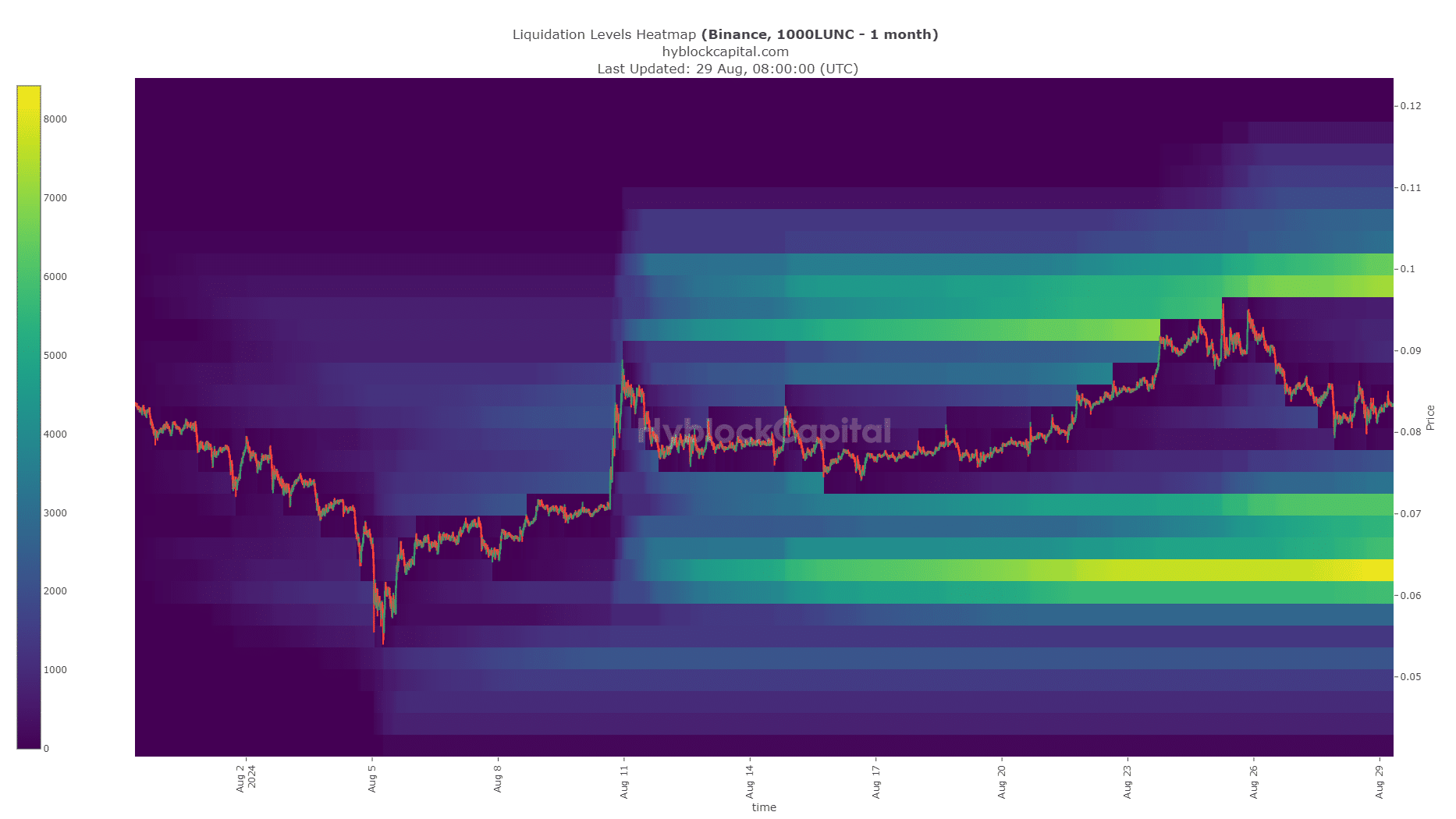

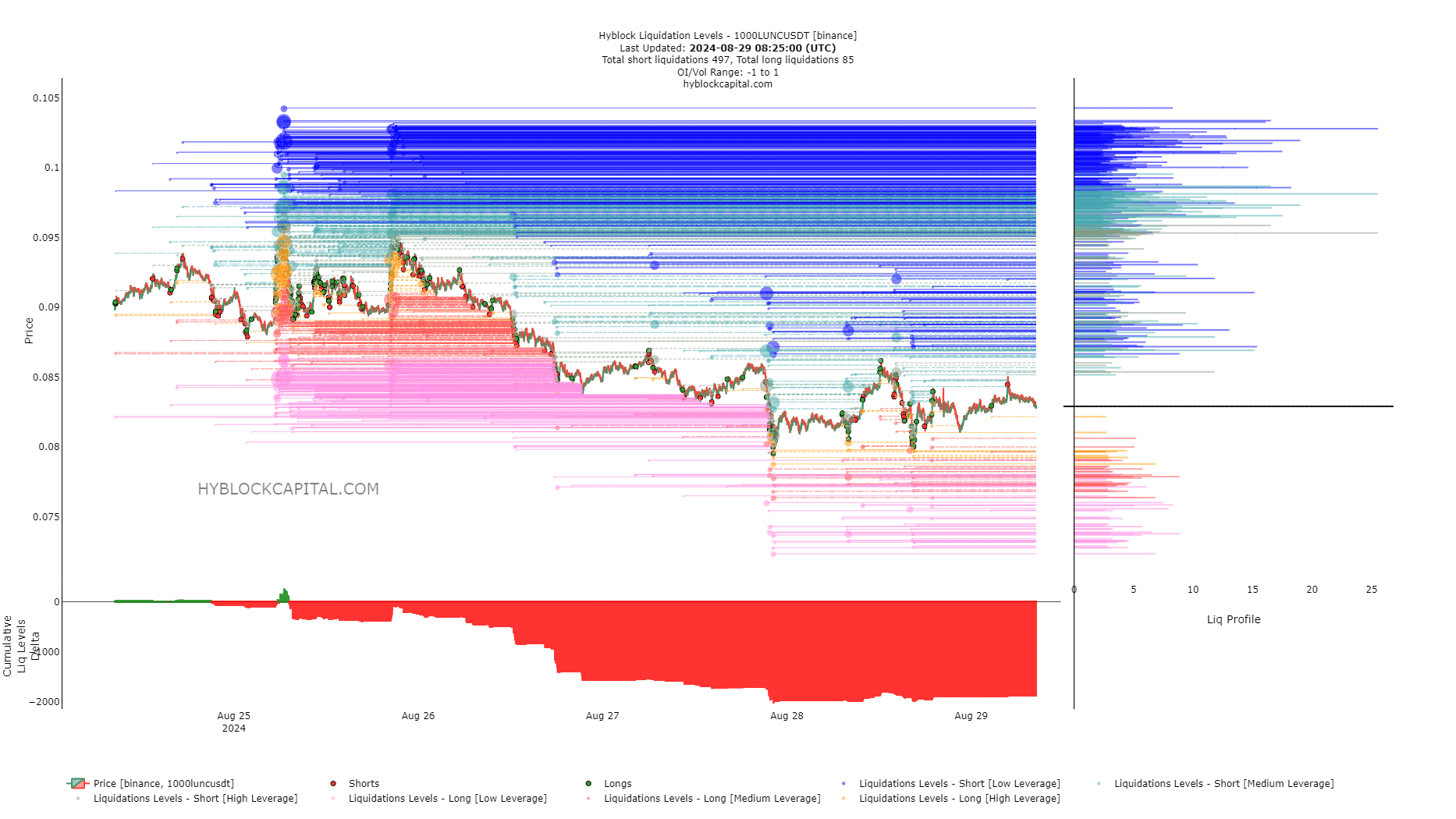

- Analysis of liquidity levels suggests a possible double-digit percentage drop for the token over the next two weeks.

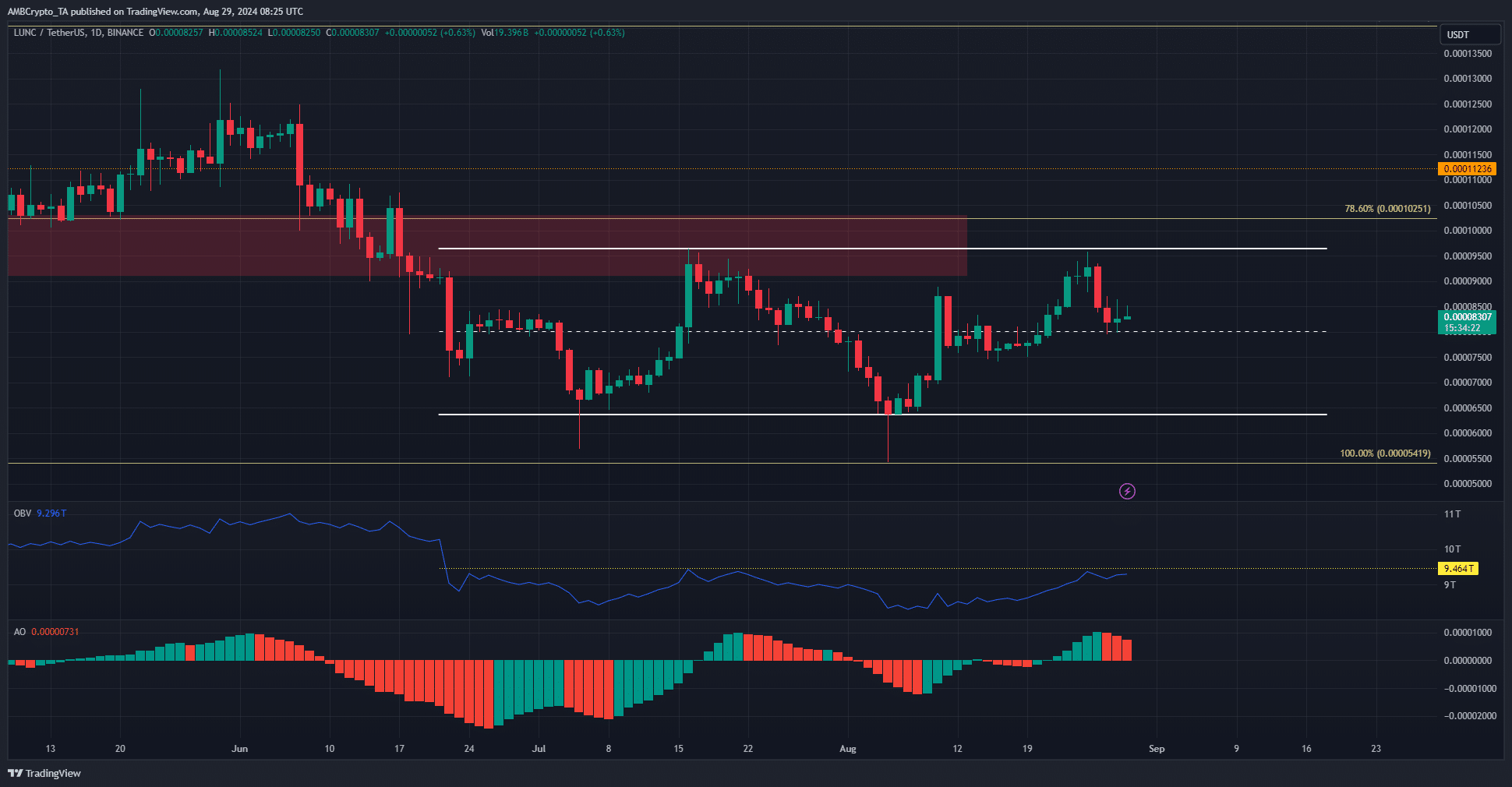

During the recent rally, Terra Luna Classic [LUNC] attempted to surpass the two-month-old range highs but faced resistance. It made progress beyond the mid-range level on August 21st following Bitcoin’s surge above $60k.

The bankruptcy court’s decision in the Terraform Labs case could pave the way for the opening of the Shuttle Bridge, facilitating token transfers between Terra and other blockchains to support the company’s restructuring efforts.

Continued Range-Bound Movement

Source: LUNC/USDT on TradingView

Luna Classic has been trading within the $0.0000637-$0.0000964 range since early July, with its recent attempt to break the range highs falling short. The Awesome Oscillator indicates bullish momentum but with signs of weakening.

The OBV failed to surpass the July highs, suggesting that the buying volume may not be sufficient to support a breakout for LUNC.

While the current market price remains above the mid-range support level, it is uncertain whether prices will hold at this level or undergo a deeper decline. Insights from liquidity charts may provide some clarity.

Potential Move Towards Lower Price Levels

The liquidation heatmap suggests that the $0.0001 and $0.000063-$0.000071 ranges are key levels to watch for price movement.

Given the rejection at the range high, there is a higher probability of a downward trend in the coming weeks, as per AMBCrypto’s analysis.

The recent cumulative liquidation levels delta has been notably negative, indicating a potential short squeeze before a move towards the range lows.

Are your investments performing well? Utilize the Terra Luna Classic Profit Calculator for insights

The $0.000087 and $0.000091 levels are identified as short-term bullish targets. Traders may consider capitalizing on a price bounce to explore selling opportunities for LUNC.

Disclaimer: The views expressed do not constitute financial, investment, or trading advice and solely represent the writer’s perspective

following sentence in a simpler way:

Original: The teacher explained the complex math problem using various examples and diagrams.

Rewritten: The teacher used examples and diagrams to explain the difficult math problem.