Do you remember those classic internet ads promising one “weird trick” to revolutionize your fitness routine forever? I never clicked on them, but I can’t help but wonder if the trick was simply “exercise often.” Because, well, that actually works.

In a similar vein, people frequently ask me about the best way to utilize credit card reward points — particularly those issued by banks for covering various travel expenses. According to the Consumer Financial Protection Bureau, three-quarters of credit card accounts offered rewards in 2022, many of which come with flexible redemption options. The answer, surprisingly, is quite straightforward: Learn how to transfer those points to travel loyalty programs.

Transferring points may not be the most intuitive option, but the value of points from popular issuer loyalty programs, like Chase Ultimate Rewards®, American Express Membership Rewards, and Capital One miles, can vary significantly based on their usage. This is why BW provides both a “baseline value” and “maximized value” in our point valuations.

The baseline value represents the value of points when used for booking travel directly through the issuer’s rewards portal, such as Chase Travel℠ or Capital One Travel. On the other hand, the maximized value reflects how much these points are worth when transferred to their best partner program. For instance, the baseline value of American Express Membership Rewards is 1 cent, while the maximized value (when transferred to the best partners) is 2 cents.

Don’t Get Discouraged

Many credit card reward programs offer a straightforward way to use your points at their baseline value. They typically display the cost of using points alongside the cash price when searching for travel on their booking platforms.

To clarify, there’s nothing wrong with utilizing your points in this manner. Sometimes, it may actually be the most valuable redemption option. Additionally, you often earn miles on flights booked through this method. However, there is an alternative approach.

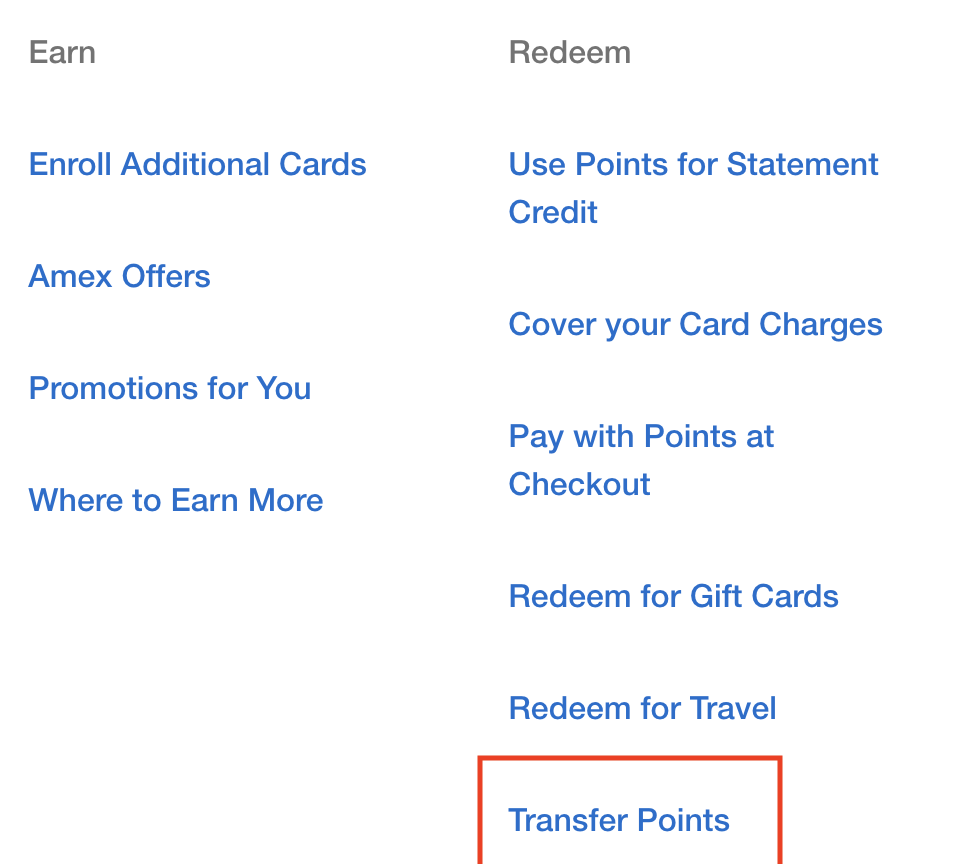

American Express places the “transfer points” option at the bottom of a somewhat hidden menu on its account page. Don’t let this deter you.

Figuring out how to actually transfer your points is one thing. The real challenge comes in deciding which partner program to transfer them to.

This is where most people, myself included, are likely to get discouraged. Each credit card program boasts a lengthy list of transfer partnerships, ranging from familiar U.S. brands like Delta Air Lines to international airlines like EVA Air. So, which transfer partner is considered the “best”?

Define Your Objectives Clearly

Numerous articles on maximizing points tend to focus on redemptions that offer the best dollar-per-point value, typically involving business and first class awards. However, it’s essential to ask yourself: Is that truly what you desire?

If you were already planning to fly in a premium cabin, these articles can be beneficial. Nevertheless, there are various challenges associated with trying to book these awards, such as restricted availability, complex booking processes, substantial fuel surcharges, and other fees.

Opting for economy class may result in a lower dollar-per-point value compared to first class, but you might be able to stretch your points for more trips. Furthermore, transferring points to loyalty programs for economy flights could still offer advantages over booking directly through an issuer. So, don’t rush into becoming a champagne-swilling points maximizer just because an article suggested it.

Another crucial point to remember: Avoid transferring your points until you confirm that the desired redemption is actually available for booking. Otherwise, you might end up with points scattered across random programs, turning this one trick into a major inconvenience.

Stay Committed

Just like exercise, this one weird trick requires consistency and dedication. It’s not a quick fix.

According to a 2022 report from the Consumer Financial Protection Bureau, credit card holders earn $40 billion worth of rewards annually, yet most of these rewards are not maximized. By simply considering transfer partnerships as a viable option for utilizing your credit card points, you’re already ahead of the curve.