Authored by Lawrence Wilson via The Epoch Times (emphasis ours),

Medicare is facing a financial challenge that will require attention in the next decade. It’s a problem that may seem distant now, like a looming mortgage payment or a sporadic leaky roof, but it’s one that cannot be ignored for long.

With an annual cost of $1 trillion, Medicare will soon reach a critical point where action is necessary to address the funding shortfall and prevent a crisis by 2036.

According to Medicare’s trustees, the Hospital Insurance (HI) Trust Fund, which covers hospital bills for 68 million Americans, will be depleted by 2036. This will result in an 11 percent shortfall in funding for Medicare Part A.

Although this is a decade away, the HI Trust Fund currently holds a surplus of over $200 billion, and Medicare Part B has reserves exceeding $180 billion.

While Medicare is not insolvent, there is a growing disparity between program revenue and expenses, leading to a significant reliance on cash transfers from the U.S. Treasury to sustain the program.

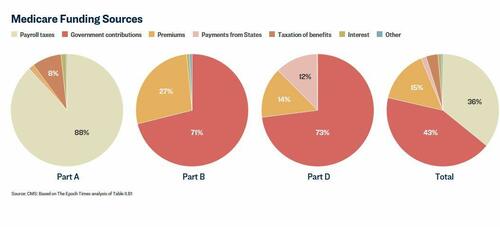

In 2023, Medicare’s income sources like payroll taxes, premiums, and interest covered 57 percent of expenses, leaving a $43 billion gap that had to be filled from the government’s general fund. This gap has been widening and is expected to require the general fund to cover half of program costs by 2053.

Both President Donald Trump and former President Joe Biden have pledged to protect Medicare, but concrete plans for ensuring its financial stability are yet to be detailed.

As Medicare approaches its 60th anniversary, the program is facing challenges that were not as prevalent in the past. Why is Medicare now struggling to keep up with expenses?

Medicare: Not Just a Business

Medicare serves individuals aged 65 and older, as well as those with disabilities or specific medical conditions such as end-stage renal disease or ALS.

While Medicare is labeled as an insurance program, it was not designed to be entirely self-sustaining and has operated more as a federally supported health payment system.

Medicare Part A, responsible for hospitalization costs, relies heavily on a 2.9 percent payroll tax along with funding from a tax on Social Security benefits, interest earnings, and beneficiary premiums.

According to Jon Kingsdale, an expert in health care policy, the HI Trust Fund functions like a checking account, receiving payroll taxes throughout the year to cover expenses for healthcare facilities.

Once the HI Trust Fund is depleted in 2036, it will only cover 79 percent of Part A obligations, signaling a significant financial challenge ahead.

Medicare Part B operates differently, with expenses managed through the Medicare Supplemental Medical Insurance (SMI) Trust Fund, which also covers Medicare Part D for prescription drug coverage.

Enrollees in Medicare can choose Parts B and D by paying premiums, with additional support coming from interest earnings and state contributions towards Part D.

However, the income generated falls short of covering expenses, requiring over 70 percent of SMI Trust Fund funding to come from the general budget, with Congress allocating additional funds annually to bridge the gap.

Premium increases have not matched expense growth, resulting in a greater burden on the general fund.

When the HI Trust Fund runs out, the lack of a mechanism to replenish it poses an immediate issue. However, the larger concern is the inadequacy of primary funding sources to keep pace with rising costs, necessitating a growing share of national wealth to sustain Medicare.

Currently consuming 3.8 percent of the GDP, Medicare’s cost is projected to rise to 5.8 percent by 2048, driven by three main factors:

Demographics, Innovation, and Medicare Advantage

The financial strain on Medicare can be attributed to demographic shifts and healthcare advancements. The influx of baby boomers into Medicare, coupled with a declining birth rate, has skewed the worker-to-beneficiary ratio, increasing the burden on the program.

Rising rates of chronic illnesses like obesity and diabetes are also contributing to higher healthcare costs for all Americans, including Medicare recipients, with healthcare spending per person more than doubling since 2000.

Healthcare innovation has led to the inclusion of advanced diagnostic tools and treatments in Medicare coverage, with prescription drugs now accounting for a significant portion of expenses.

Medicare Part C, or Medicare Advantage, introduced in 1997, allows private insurers to manage benefits for Medicare beneficiaries and has become a popular choice for over half of Medicare enrollees.

While Medicare Advantage offers additional benefits, it comes at a higher cost compared to traditional Medicare, further straining the program’s finances.

Continue reading here…

Loading…