- MSTR has shown exceptional performance and has decoupled from BTC.

- Since September, it has surged by 68%, approaching its all-time high.

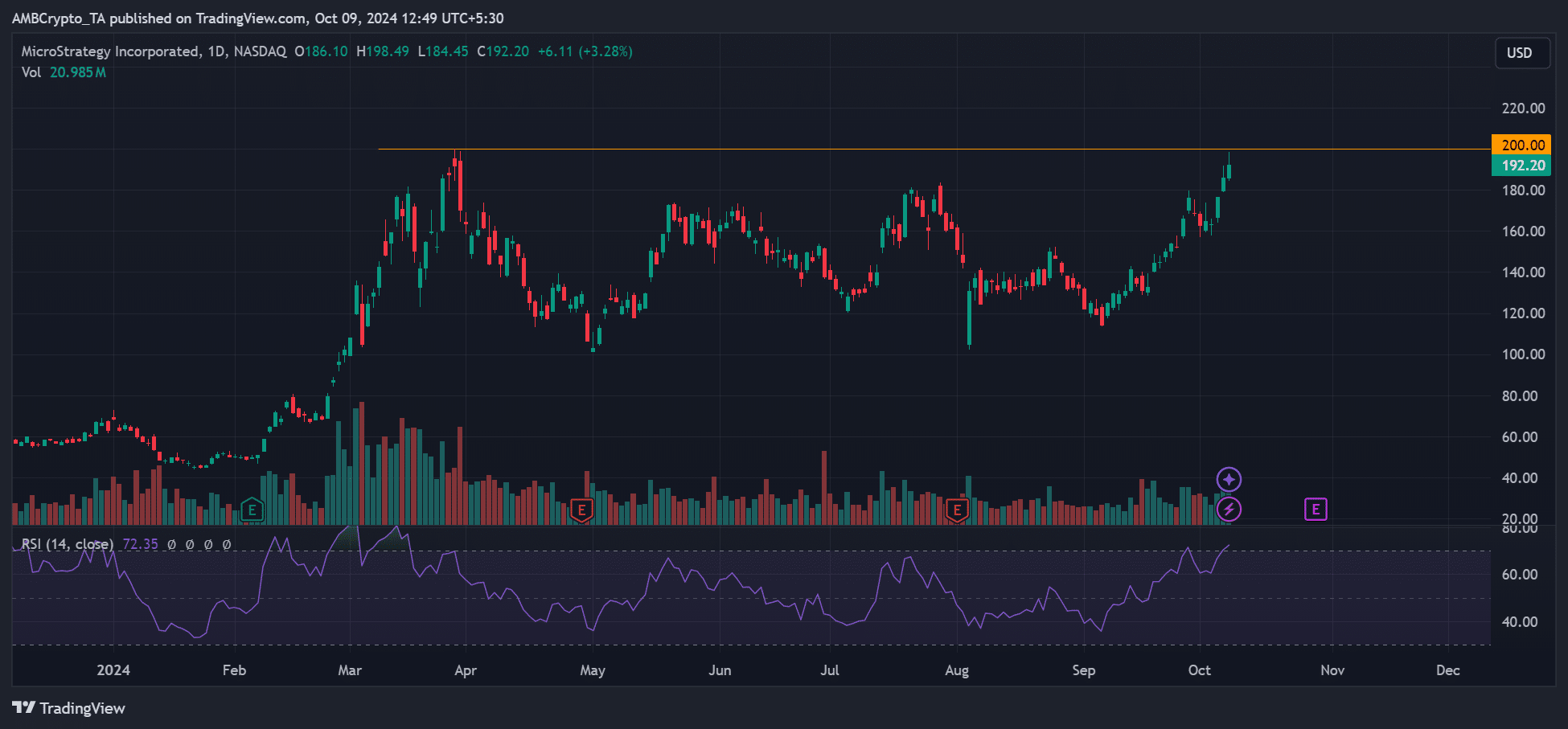

MicroStrategy [MSTR] has hit a six-month peak of $198, just below its ATH of $200. The recent upward trend coincided with the founder, Michael Saylor’s enigmatic message.

In his recent X (formerly Twitter) post, Saylor appeared in a gladiator-inspired outfit, wearing a Bitcoin [BTC] pendant and wielding a sword.

This gesture may symbolize his readiness to publicly defend and advocate for BTC amidst economic instability and fiat-driven inflation.

Saylor is widely known as a staunch BTC bull who holds an extremely optimistic view of the asset. He believes that BTC is the most superior asset and store of value in history due to its fixed supply and resistance to censorship.

His conviction has shaped the BTC treasury strategy, which he pioneered with MicroStrategy.

The Bitcoin-focused software provider now holds nearly $16 billion in BTC (252K coins), with over $1.5 billion acquired in Q3 2024.

$16B BTC holding triggers MSTR rally

MicroStrategy’s MSTR rally has been attributed to the company’s substantial BTC reserve, as highlighted by CryptoQuant.

“Since MicroStrategy started buying $BTC on August 11, 2020, its stock has surged by 1,208%, while Bitcoin itself has risen by 445%.”

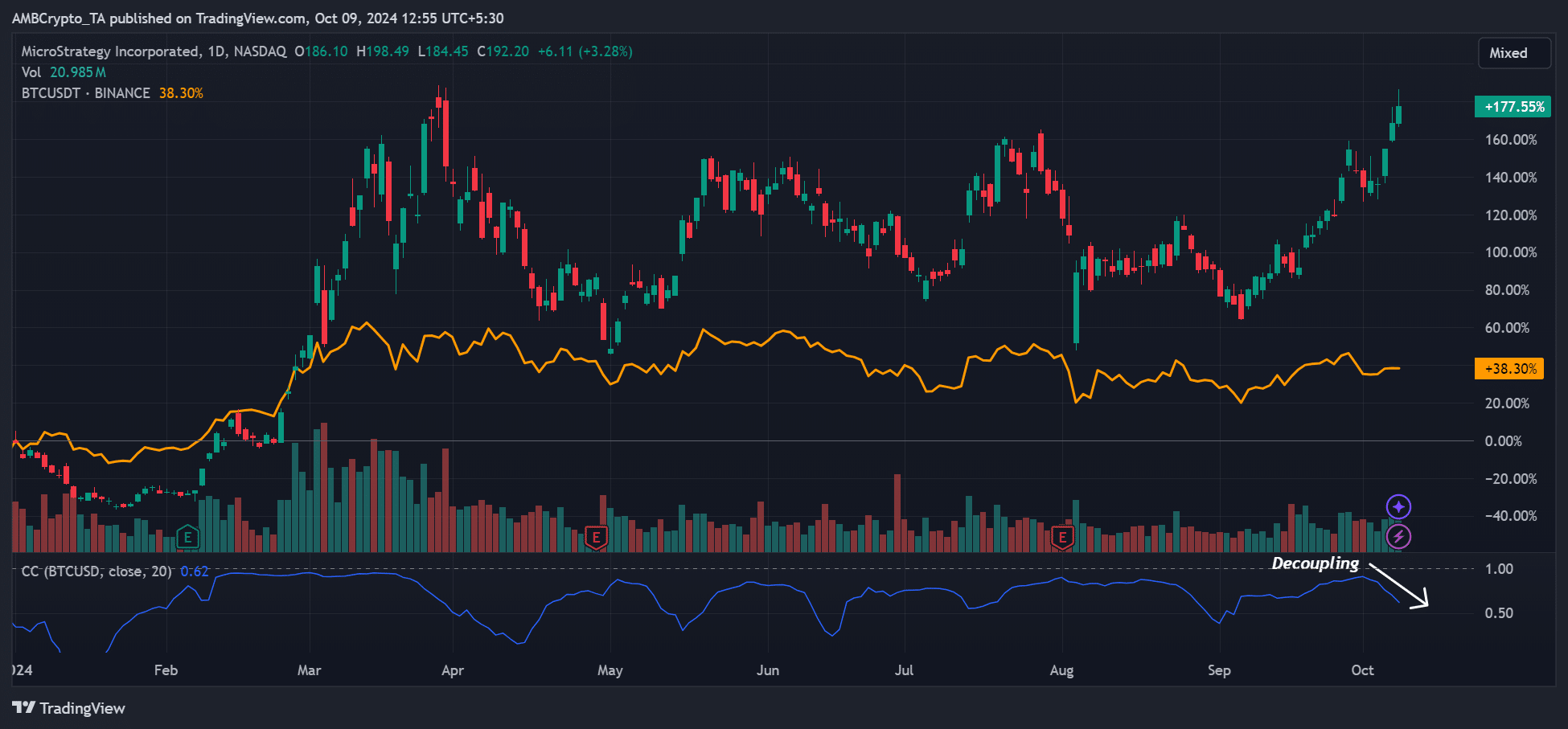

However, despite MSTR’s significant BTC holdings, primarily obtained through convertible notes, the stock recently demonstrated a complete decoupling from BTC.

Source: MSTR vs. BTC, TradingView

Since September, MSTR has soared by 68%, surging from $114 to nearly $200. In contrast, BTC saw an 18% increase during the same period and was struggling with crucial support levels at the time of writing.

The rally even surprised BTC critic Peter Schiff.

“What’s going on with $MSTR? It spiked 18% over the past three days, with #Bitcoin only up 1%.”

On a year-to-date basis, MSTR gained 177%, outpacing BTC’s 38% increase, indicating that MSTR investors reaped more profits than BTC holders.

This also implied that MSTR was trading at a premium compared to BTC.

However, MSTR’s RSI signaled an overbought condition at the time, potentially complicating the short-term outlook, especially with the upcoming earnings season.

Source: MSTR, TradingView

Some market observers have questioned why investors would opt for MSTR to indirectly hold BTC instead of directly purchasing the asset. Yet, Bitwise’s Jeff Park viewed MSTR as a simultaneous long and short global carry trade.

“$MSTR is simultaneously long & short global carry. Taking on debt at low rates to invest in Bitcoin is a long global carry. Bitcoin in and of itself is short global carry.”

For context, carry trade involves borrowing from low-interest currencies to invest in high-yield assets. MicroStrategy’s BTC holdings have been acquired through debt.

However, BTC is also considered a risk-off asset and a hedge against inflation associated with fiat currencies. Therefore, MicroStrategy’s actions could be seen as a bet against global inflation—a short global carry.

sentence to make it more concise:

“Please let me know if you have any questions or need further information.”

“Please inform me of any queries or additional information needed.”