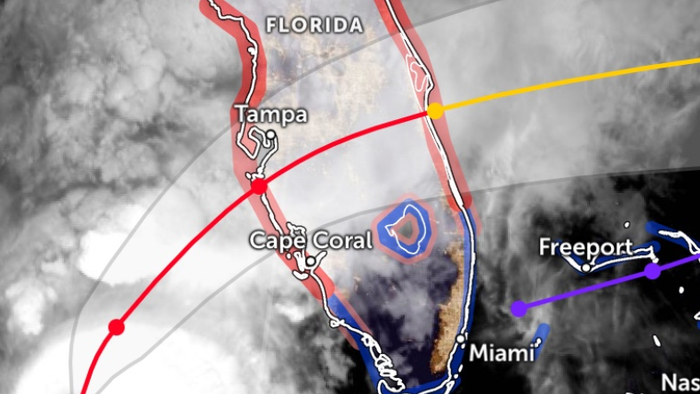

Milton, a dangerous Category 4 hurricane, is expected to make landfall on Florida’s Central Gulf Coast near the Tampa region tonight or early Thursday morning. The storm’s path could result in over $50 billion in damage, with certain estimates reaching as high as $175 billion – equivalent to the funds sent to Ukraine by the Biden-Harris team since the start of the war.

Research firms have warned that this once-in-a-century storm has the potential to bring a catastrophic storm surge of up to 15 feet and winds exceeding 150 mph, making it a costly event for insurers and the government. Analysts from Jefferies mentioned that a major hurricane impacting Florida’s densely populated area could lead to mid-double-digit billion dollar losses, with estimates of $175 billion for landfall in the Tampa region and $70 billion for the Fort Myers region.

Current forecasts from the National Hurricane Center predict a 15-foot surge of water across the Tampa region, with devastating consequences for buildings and critical infrastructure. Morningstar DBRS analysts anticipate insured losses from Milton in the range of $60-$100 billion if the hurricane directly hits the Tampa metro area, potentially putting it on par with Hurricane Katrina in 2005.

Bloomberg Intelligence analysts also estimate losses around $100 billion, emphasizing the significant impact the storm could have on insurers. They predict that Hurricane Milton could generate insurance claims in the tens of billions, with economic losses even higher. The storm is expected to hit Tampa Bay as a Category 3 hurricane, potentially resulting in nearly $100 billion in industry insured losses.

Insurers, particularly those in Florida like Citizens, State Farm, and regional carriers, might face substantial exposure to Hurricane Milton losses. Private insurers are likely to avoid flood claims given the exclusion of flood coverage in most homeowners policies. The National Flood Insurance Program (NFIP) is responsible for underwriting flood insurance in the US, with high costs and inadequate pricing leading to significant challenges for insurers and homeowners.

Despite a rebound in insurance stocks, the potential losses from Hurricane Milton are still a concern for some insurers. Bermuda reinsurers like Arch, Everest, and RenaissanceRe may benefit from higher pricing following the storm. Overall, the impact of Hurricane Milton is expected to be significant, with insurers bracing for substantial losses.

Axis is expected to be the least exposed among global reinsurers in 2022, minimizing potential losses and reinsurance pricing gains for the company.

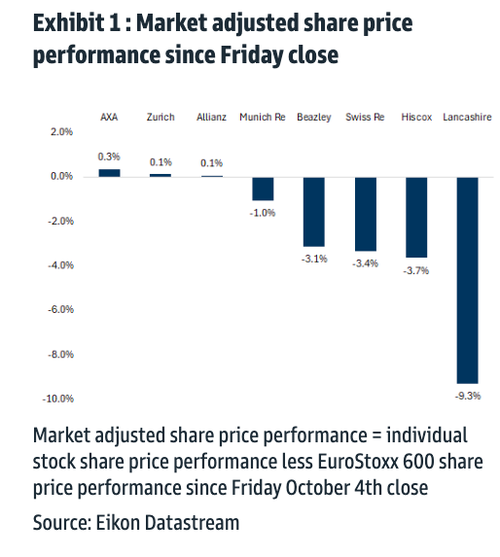

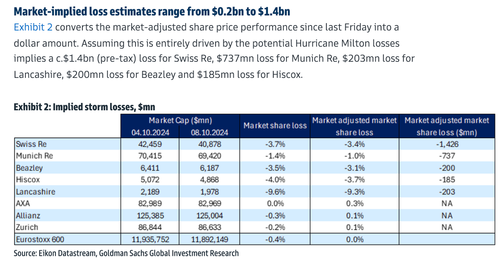

Goldman’s Andrew Baker highlighted the downward pressure on global reinsurers’ stocks since the previous week’s market close.

Baker analyzed the market-adjusted share price performance of each insurer to estimate potential storm losses.

Peel Hunt analysts highlighted Lloyd’s of London’s realistic storm disaster scenario, projecting a $134 billion loss for the insurance sector as a stress test for future catastrophe risks like the impending one in Florida.

Looking at a broader perspective, Oxford Economics’ chief US economist Ryan Sweet mentioned that the storm’s path could affect about 3% of the US economy’s GDP, potentially causing a .14 percentage point drag on fourth-quarter GDP growth.