The upcoming NFLX earnings report is highly anticipated, not only because it is the first “tech” company to report, but also because its stock has been underperforming lately after a strong performance year-to-date.

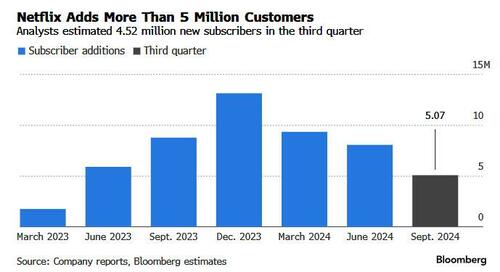

According to Goldman, investors are expecting around 6 million new subscribers in the quarter, an upside to the full-year free cash flow guide of around $6 billion, and a revenue guidance for the fourth quarter that is in line with street estimates. Goldman rates NFLX at 8.5 on a 1-10 positioning scale, indicating high expectations and a risk of potential disappointment. Overall, the market is expecting a strong performance in the upcoming earnings report.

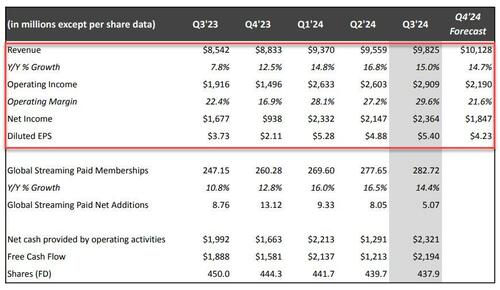

And indeed, Netflix exceeded expectations with the following key financial metrics:

- Revenue of $9.82 billion, up 15% year-over-year, beating estimates

- Earnings per share of $5.40, surpassing estimates, with a $91 million loss related to foreign exchange

- Operating margin of 29.6%, beating estimates, with operating income of $2.91 billion

- Free cash flow of $2.19 billion, exceeding estimates

Despite a constrained new programming slate due to last year’s labor strikes in Hollywood, Netflix outperformed on both revenue and earnings.

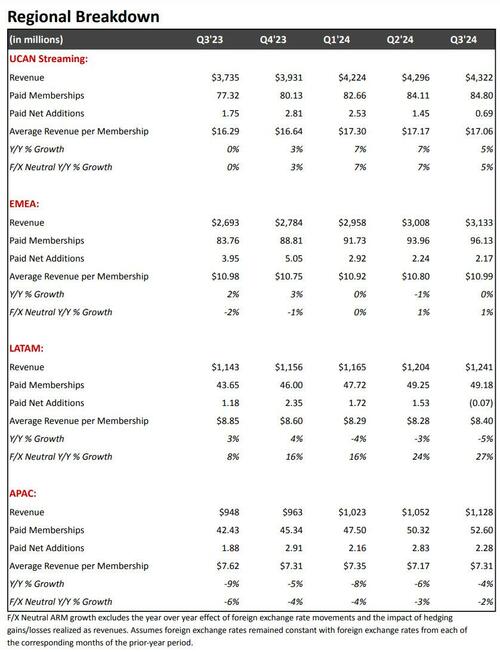

While Netflix added more subscribers than expected, there were some discrepancies at the regional level, with US/Canada and Latin America falling short of estimates. However, EMEA and Asia-Pacific saw strong subscriber growth.

- Streaming paid net change was +5.07 million, with varying results across regions

In terms of revenue growth and subscriber trends by region:

- North America saw a 16% increase in revenue

- EMEA revenue grew by 16%

- Asia-Pacific had the highest revenue growth rate of 19%

- Latin America experienced a revenue increase of 9%

Looking ahead to Q4, Netflix projects strong revenue and operating income, with expectations of higher paid net additions compared to Q3. The company also provided guidance for 2024 and 2025, highlighting plans for revenue growth and margin improvement.

Netflix’s strong financial performance in Q3 and positive outlook for the future have reassured investors, leading to a rebound in the stock price after an initial dip. The company’s focus on revenue growth, margin improvement, and strategic investments in new content and technologies bode well for its long-term success.

While challenges remain, including the need for continued subscriber growth and the evolution of its advertising business, Netflix’s solid performance in Q3 demonstrates its resilience and adaptability in a competitive market.

Loading…