Authored by Egon von Greyerz via vongreyerz.gold,

Trump wouldn’t be shocked if Fort Knox is devoid of gold.

Supposedly, there should be 4,600 tons valued at $430 billion in Fort Knox.

The U.S. is said to hold 8,100 tons of gold in Fort Knox, with the majority of reserves stored at the New York Fed.

TRUMP: “Elon and I are going to Fort Knox to see if there is any gold there. If there are only 27 tons, we would be happy. Would not be surprised if there is nothing here – they stole this too!”

Is Trump hinting that there might be no gold in Fort Knox?

In a recent Tweet, I mentioned:

So, the time has come for the U.S. to reveal their gold hand to the world.

Will Trump suppress the news if it’s unfavorable? Highly likely.

GOLD IN FORT KNOX A SIDESHOW

Whether the gold is present in Fort Knox or not, it could be viewed as a sideshow.

It only represents 2% of all gold ever mined in history.

However, a lack of gold there could severely impact confidence in the U.S. and the dollar.

GOLD PRICE IS ABSURD

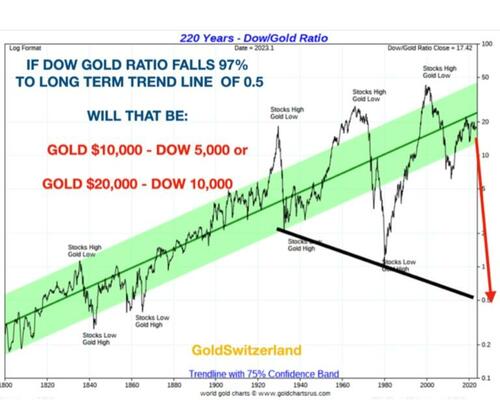

At $2,920, the total gold held by Central Banks is $3 trillion.

Just one US stock – Microsoft – has a market cap of $3 trillion.

How can the value of a SINGLE AMERICAN COMPANY equal the total central bank gold holdings?

It highlights the overvaluation of stocks and the absurdly low gold price.

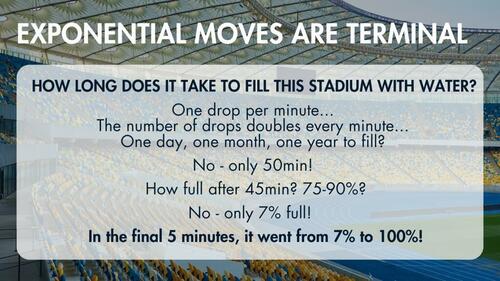

EXPONENTIAL GOLD MOVE IS BEGINNING

Gold is embarking on another significant UPWARD movement. This marks the acceleration or exponential phase, as elaborated below.

This is when gold will once again experience multiple increases, as it historically does when currencies collapse.

Stocks will plummet rapidly, and shortly after, bonds will decline (leading to higher interest rates).

Any significant correction in gold is improbable until it reaches substantially higher prices.

Hence, those relying on conventional overbought indicators may overlook the Gold Wagon.

And don’t forget, the significant silver surge is yet to commence. Silver is currently suppressed by bullion banks’ paper-short positions, keeping its price low.

Once the gold-silver ratio falls below 75 (currently at 91), silver will skyrocket.

Silver will then outpace gold by 2-3 times.

However, bear in mind that silver is highly volatile and not suitable for conservative investors. Therefore, if you prefer peace of mind, maintain no more than 25% in silver and 75% in gold.

And remember, only physical ownership is recommended. The supply of paper gold and silver is unlimited. Eventually, these paper contracts will hold no value.

WHY INVEST IN GOLD?

In reality, very few allocate their assets to gold, as it represents only 0.5% of global financial assets.

Nevertheless, gold has surged by at least 10 times in most currencies in this century.

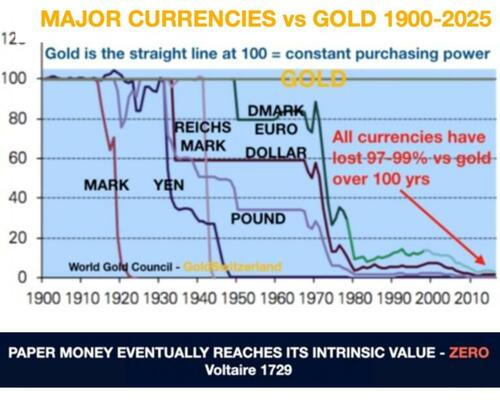

When Nixon abandoned The Gold Standard in 1971, few foresaw the commencement of the largest global debt creation in history, resulting in gold escalating by 84 times. Essentially, paper money depreciating by 99%.

This isn’t meant to be sensational – I’m a cautious Swiss born in Sweden.

For the past 25 years, I’ve advised High-Net-Worth Investors to safeguard their wealth in physical gold and silver stored outside the banking system.

WE’VE BEEN INVESTED SINCE 2002.

Back in 2002, we, along with our HNW clients, allocated the majority of our liquid assets to physical gold at $300. Following successful corporate dealings in 1999, such as selling tech businesses at considerable valuations (sans profits) in 1999, these investors trusted me and significantly invested in gold 23 years ago.

Why has physical gold been the lone money to withstand the test of time?

It’s straightforward – GOLD IS NATURE’S MONEY!

It’s the sole money not crafted by humans.

Thus, it can’t be replicated or artificially produced.

It’s impervious to hacking – North Korea recently pilfered $1.5 billion from the world’s second-largest crypto exchange.

It doesn’t rely on a computer (like crypto or paper money).

It’s improbable to be confiscated (if stored in the right jurisdiction), particularly outside the U.S.

It’s unlikely to be stolen if secured in the safest vaults.

GOLD IS VIRTUALLY INDESTRUCTIBLE.

It’s the only currency that has maintained its purchasing power over millennia.

All other currencies have invariably plummeted to zero.

Given its impeccable track record, why is only 0.5% of global assets invested in gold?

Why are individuals reluctant to invest in gold? They’ve been pampered by a stock market fueled by printed money.

However, this scenario is on the brink of transformation. Once stock markets commence a significant decline and the era of “stocks-always-go-up” concludes, a stock market crash becomes highly probable.

At that juncture, some investors will realize the necessity for protection in the form of physical gold. The predicament is that gold won’t be available at current prices.

Consequently, gold will witness substantial price surges.

Moreover, anticipates major bank failures and exponential money printing.

As highlighted in my previous article – PRINT BABY PRINT.

Please, please hop aboard the Gold (and Silver) Wagon now, before it’s too late.

Loading…

Please provide more context or specify which information you would like me to rewrite.