Peter Brandt, a seasoned trader, has cast doubt on optimistic predictions following Bitcoin’s recent surge to over $97,000.

His latest technical analysis suggests that the leading cryptocurrency may struggle to surpass the coveted $200,000 mark before 2030.

Bitcoin has shown a mixed performance, with a 0.17% daily gain and a 2.85% decline over the week, leading to Brandt’s forecast.

Related Reading

The Long Road to Six Figures

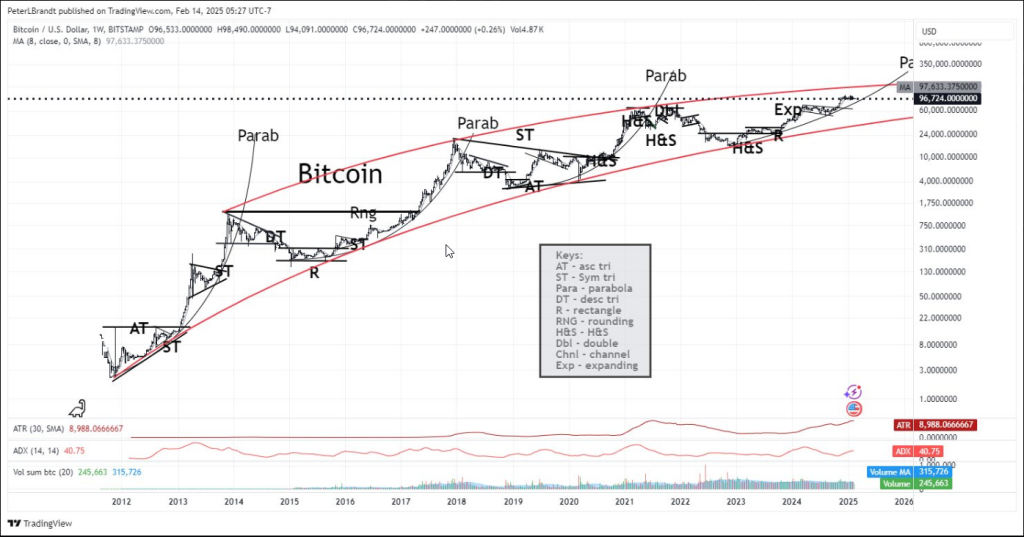

Bitcoin is expected to face significant hurdles in breaking the psychological barrier of $100,000. The 8-week moving average of $97,633, which has consistently acted as a resistance point, poses a challenge for the cryptocurrency.

From the realm of speculative ideas comes this notion – a notion, not a trade

Unless Bitcoin achieves escape velocity through the upper parabolic resistance line, it is unlikely that BTC will reach above $200k by the end of this decade. Only ☑️ can reply. No interest in non-☑️ replies pic.twitter.com/7a5N7Gliw8— Peter Brandt (@PeterLBrandt) February 14, 2025

The Average True Range (ATR) of 8,988 and the Average Directional Index (ADI) of 40.75, which indicate a strong trend, show increased volatility in the current market conditions.

Historical Patterns Hint at a Cautious Approach

Since 2012, Bitcoin has exhibited a distinct pattern that has intrigued technical analysts. Within a red rising channel, the cryptocurrency has been oscillating between two crucial trendlines that act as price barriers.

Of particular interest is Bitcoin’s tendency for sharp corrections and parabolic movements. Seasoned traders are paying close attention due to the similarities between the current rally and previous cycles.

Trading Volume Raises Concerns

The trading volume provides insights into market participation. The low 20-period volume total of 245,600 during the current rally raises doubts about its stability.

Sustaining a long-term uptrend may prove challenging without a significant increase in trading volume. Analysts are closely monitoring this weak volume as a potential red flag for Bitcoin’s next major move.

Related Reading

Support And Resistance: Key Price Levels

The future of Bitcoin hinges on critical price levels that could shape its trajectory. Strong support is found in the $60,000 to $70,000 range, while a substantial resistance zone lies between $100,000 and $120,000.

In a worst-case scenario, Bitcoin could retest the lower boundary of its long-term channel, which is around $40,000 to $50,000.

Brandt’s analysis suggests that Bitcoin’s path to $200,000 by 2030 is uncertain without a significant breakthrough above the upper boundary of its parabolic trajectory.

The experienced trader emphasizes the importance of sustained momentum and overcoming critical resistance levels to reach such high valuations.

Featured image from Pixabay, chart from TradingView