- Various factors contributed to the price drop, such as panic selling and dwindling trader interest.

- NOT was oversold and could potentially see a recovery towards $0.012.

Notcoin [NOT], the native token of a Telegram play-to-earn project, faced a significant downturn on the 4th of July. The price of NOT started at $0.011 in the early hours of that day.

However, an unexpected 18.38% decline within 24 hours led to a drop in price, with Notcoin trading at $0.098 at the time of writing.

This marked the lowest point since its introduction and airdrop phase, where it experienced a sell-off.

Reasons behind Notcoin’s Decline

There are several factors contributing to Notcoin’s price decrease, with one notable influence being Bitcoin [BTC]. Recently, the now-defunct Bitcoin exchange Mt.Gox announced plans to distribute BTC to its creditors, resulting in a market panic and subsequent liquidation of assets, including Notcoin.

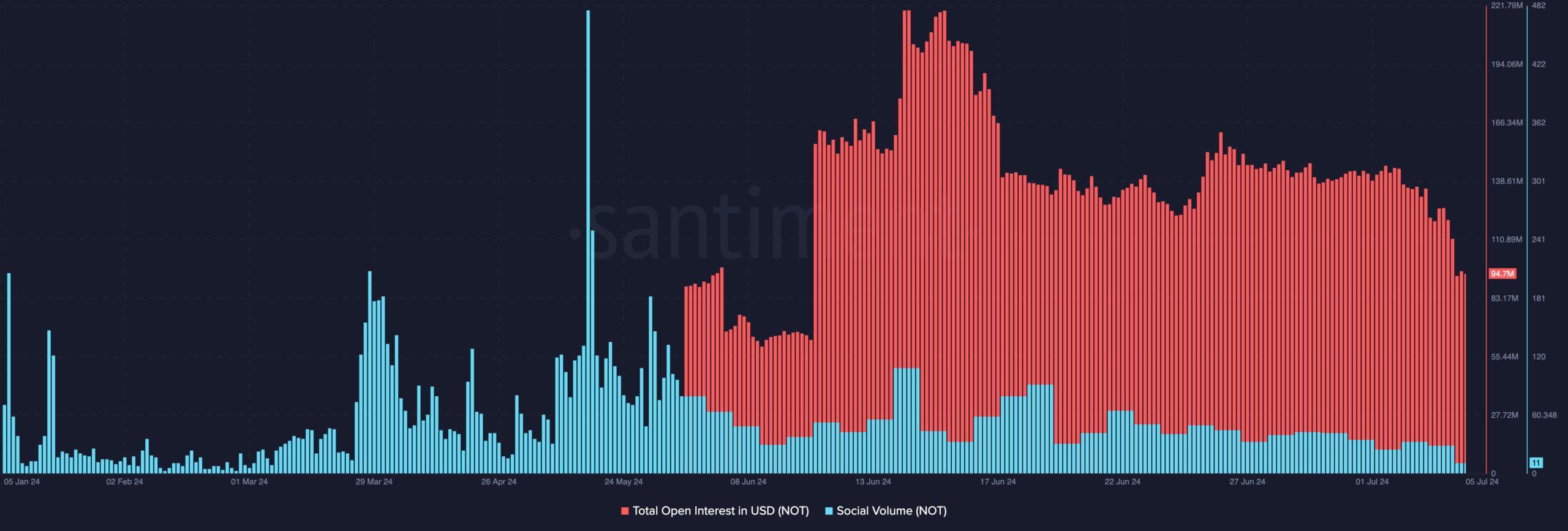

Additionally, a decline in Open Interest (OI) in the derivatives market played a significant role in driving Notcoin’s price down. OI measures the value of open contracts in the market, and Notcoin’s OI has fallen below $100 million.

Source: Santiment

Furthermore, a decrease in Social Volume, which tracks the level of interest in a cryptocurrency, added to the selling pressure on Notcoin, resulting in a price decline.

Technical Analysis

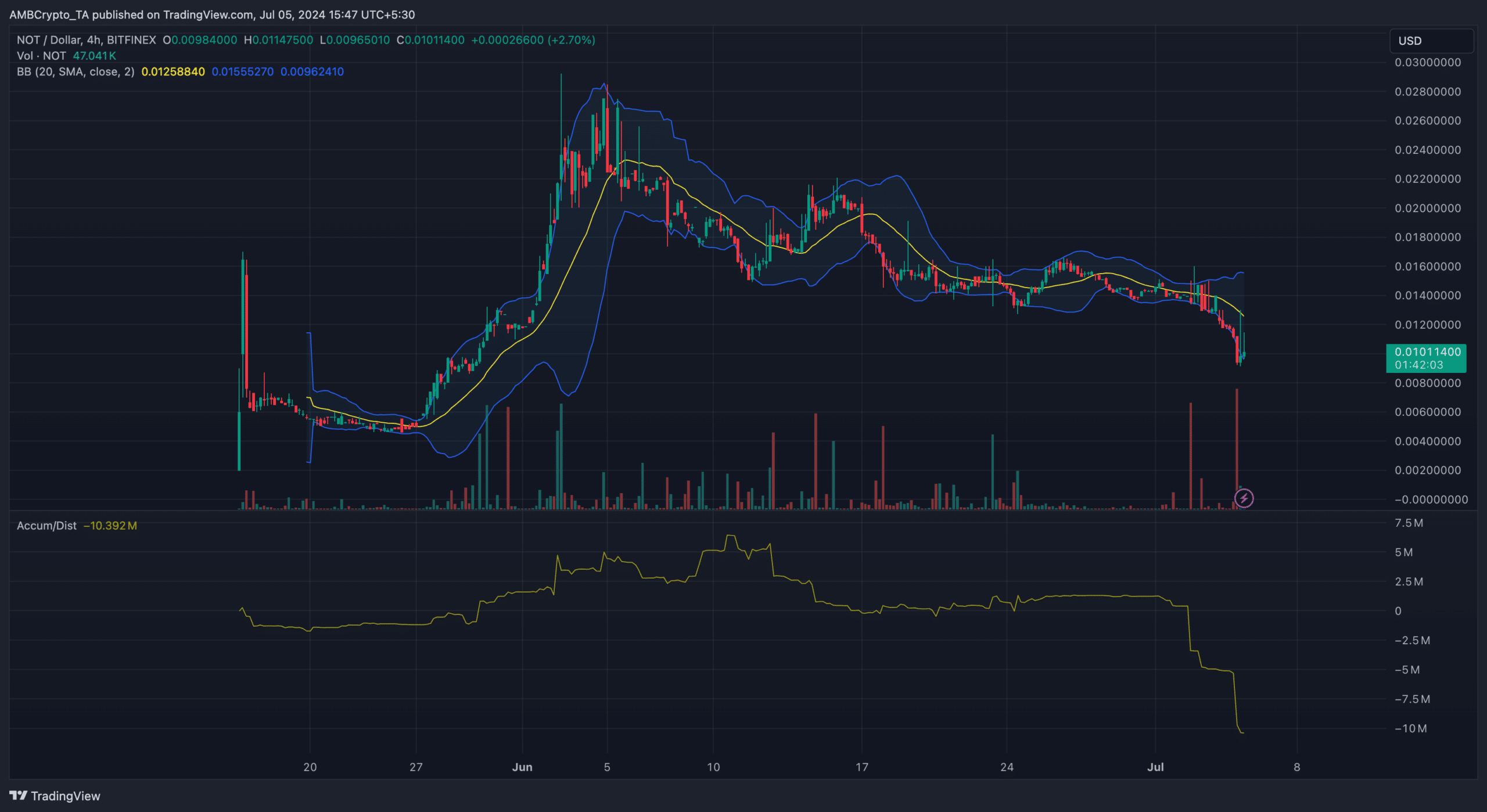

From a technical standpoint, the Accumulation/Distribution (A/D) line for NOT/USD was observed to be at -10.38 million, indicating a selling trend since July 2nd. The Bollinger Bands (BB) also showed increased volatility as the bands expanded.

Source: TradingView

Realistic or not, here’s NOT’s market cap in TON’s terms

The lower BB bands touching Notcoin at $0.093 suggest that the token was oversold. If buying pressure increases at this level, NOT could potentially move towards $0.012. However, if market sentiment remains negative, Notcoin might drop to $0.086.

the following sentence:

I am going to the store to buy some groceries.

My plan is to go to the store and purchase some groceries.