After conducting sales channel checks that indicated strong demand for Nvidia’s current data-center processors, investment bank Morgan Stanley raised its price target on Nvidia (NVDA) stock on Monday.

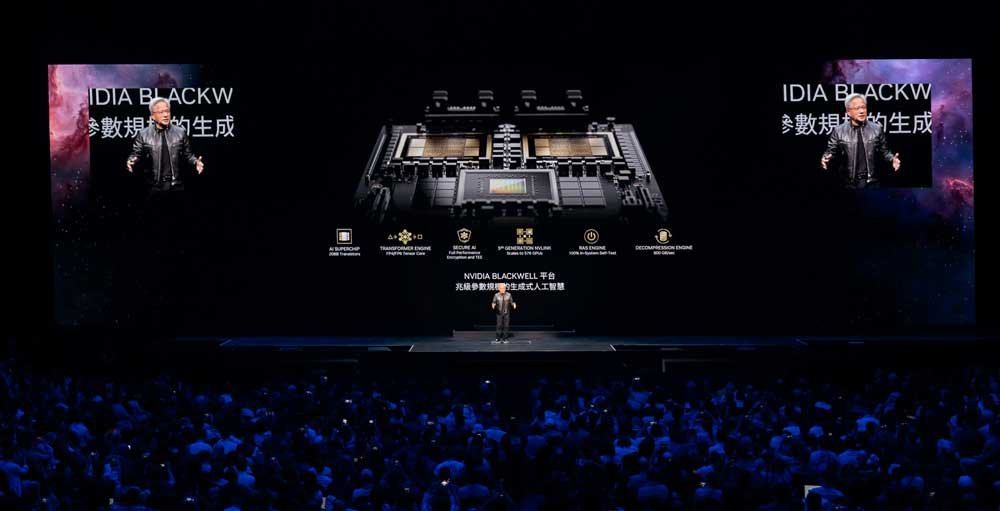

Analyst Joseph Moore adjusted his earnings estimates for Nvidia following positive channel checks in Taiwan and China, which highlighted sustained high demand for Nvidia’s Hopper series products. However, Moore expressed caution regarding the upcoming transition to Nvidia’s next-generation Blackwell series products later in the year.

Despite his concerns, Moore maintained his overweight rating on Nvidia stock and increased the price target to 144 from 116. This new target surpasses Nvidia’s all-time high of 140.76 achieved on June 20.

On the stock market today, Nvidia stock closed at 124.30, marking a 0.6% increase. The stock broke out of a 10-week consolidation pattern on May 23 at a buy point of 97.40, according to IBD MarketSurge charts.

While Moore refrained from being overly bullish given the recent appreciation in Nvidia stock, he highlighted the company’s strong position in the AI semiconductors space. He emphasized the potential for improved visibility and backlog with the transition to the Blackwell series products.

Currently featured on four IBD lists including IBD 50, Leaderboard, Sector Leaders, and Tech Leaders, Nvidia stock continues to attract investor interest.

For more stories on consumer technology, software, and semiconductor stocks, follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz.

YOU MAY ALSO LIKE:

Apple Considering Price Increases for High-End iPhones to Subsidize Lower-Cost Models

Debate Surrounds Nvidia Stock Value Following Recent Decline

AppLovin Poised for Profits with AI Tool Implementation

MarketSurge: Comprehensive Research, Charts, Data, and Coaching in One Place

Explore Stocks on the List of Leaders Approaching a Buy Point