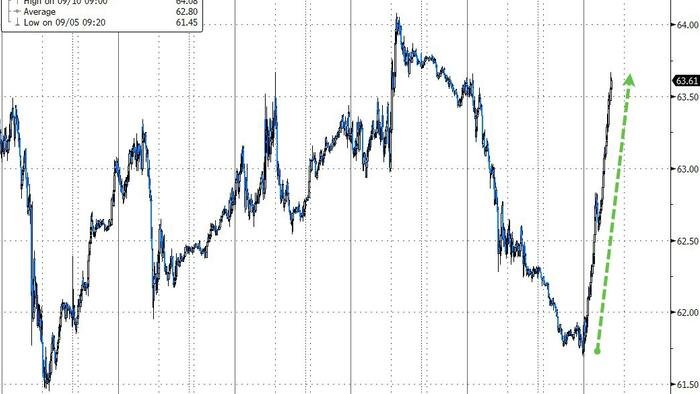

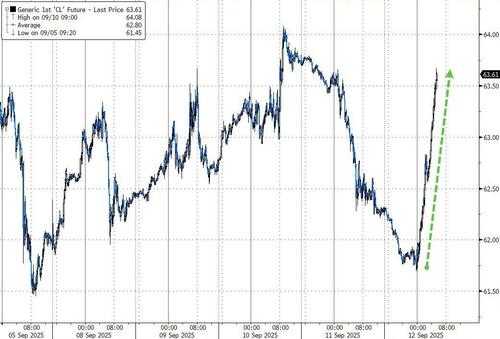

Oil prices are surging this morning as the market is facing a “tug-of-war” between bearish fundamentals and heightened geopolitical risks, according to Citigroup.

“The volatility reflects the market’s ongoing struggle to balance growing surplus risks against persistent geopolitical uncertainty and resilient refined product margins,” said Ole Hvalbye, a commodities analyst at SEB AB.

“Sentiment remains broadly cautious.”

The initial rally in crude prices was driven by mounting fears of Ukrainian drone attacks disrupting flows through Russia’s key crude-exporting hubs on the Baltic coast. Operations at Primorsk, the main oil-loading port in the region, have been suspended, along with three pumping stations pushing crude to the Ust-Luga hub.

Further gains were seen following reports that the Trump administration plans to urge G7 allies to impose tariffs as high as 100% on China and India for their purchases of Russian oil. This move is aimed at pressuring President Vladimir Putin to end the war in Ukraine.

The US proposal includes secondary tariffs on China and India, as well as trade measures to curb the flow of Russian energy and prevent the transfer of dual-use technologies into Russia.

President Trump is willing to impose new tariffs on India and China to push Putin to negotiate with Ukraine, but only if European nations do the same.

After Putin’s failure to engage in peace talks with Ukraine, Moscow has escalated its bombing campaign.

Despite the International Energy Agency’s projection of a record oil supply surplus next year, the heightened risk premium has offset this outlook. OPEC+ has also decided to gradually return idled barrels to the market, albeit at a reduced rate.

Loading recommendations…