Ethereum Layer 2 scaling solution Optimism is reevaluating its approach after years of assisting other projects in constructing networks using its technology. Jing Wang, the company’s CEO, acknowledges that this approach came with significant drawbacks.

Optimism was developed to provide more affordable transactions at a time when Ethereum was facing escalating gas fees around 2020-2021. Its OP Stack software has been utilized to introduce chains like Coinbase’s Base and Kraken’s Ink, enabling them to establish their own blockchains while maintaining compatibility with Ethereum.

In a recent post on Nov. 27, Wang admitted that the team had “done too much and focused too little,” highlighting issues such as overstaffing and a lack of strategic direction as market conditions evolved. She mentioned that the company had been overly focused on partner chains, lacking the infrastructure to sustain that momentum in a rapidly changing market.

Despite cost-cutting measures through staff reductions and team consolidation, Wang expressed concerns about the increasing competition from networks like Solana and Stripe-backed Tempo.

Wang hinted at a shift in focus, indicating that instead of solely assisting in launching new chains, Optimism will empower enterprises to have more control over their networks, although specifics were not disclosed.

“Ultimately, enterprises desire control over their own economics. They do not want to be dependent on a third-party blockchain,” wrote the Optimism CEO.

Optimism has yet to respond to The Defiant’s request for comment.

Falling On-Chain Metrics

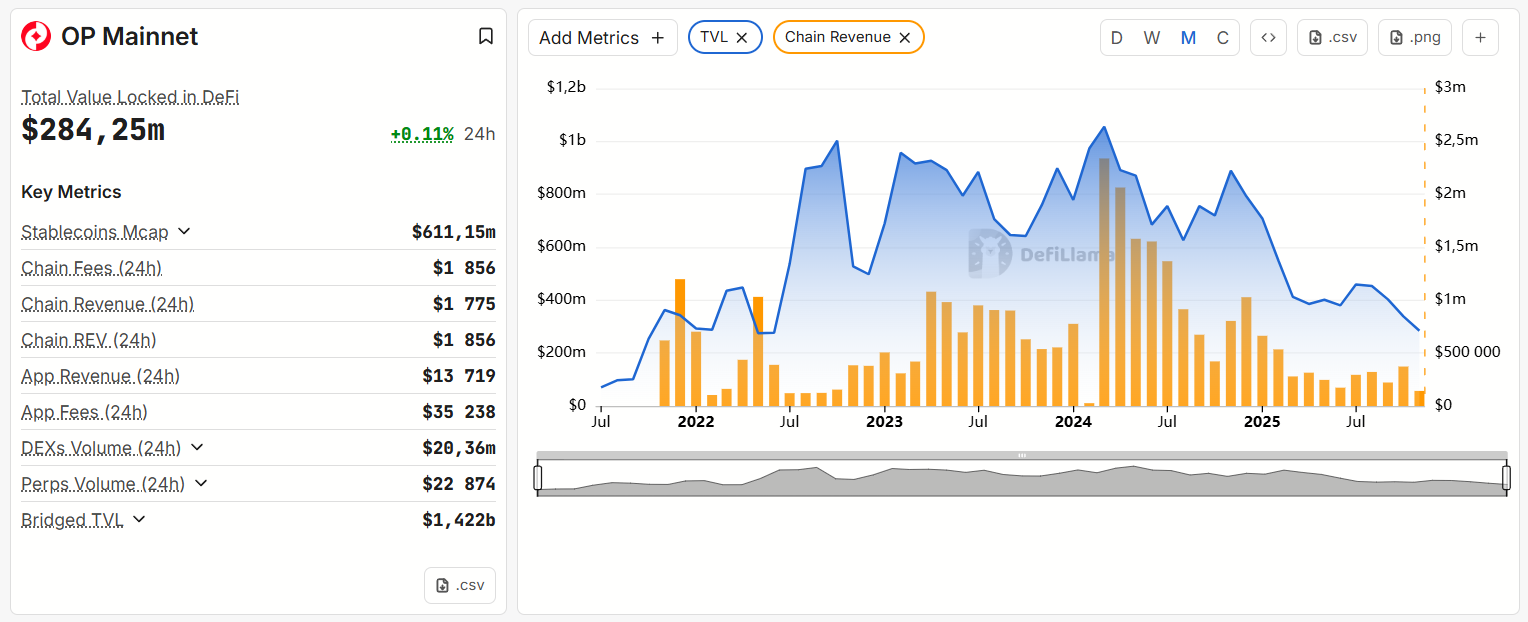

Wang’s statements coincide with a decline in Optimism’s key metrics. Data from DefiLlama shows that the network’s total value locked has regressed to 2022 levels.

OP Mainnet’s monthly revenue vs TVL. Source: DefiLlama

Monthly on-chain revenue dropped from approximately $2.3 million in March 2024 to around $373,000 in October, likely due to a significant decrease in transaction fees following Optimism’s Ecotone upgrade in Q1 2024.

The network’s OP token is also facing challenges, with a decline of over 85% in the past year and more than 90% from its all-time high, based on data from The Defiant’s price page.