- With strong momentum and buying pressure, PEPE is expected to surpass the July highs in the near future.

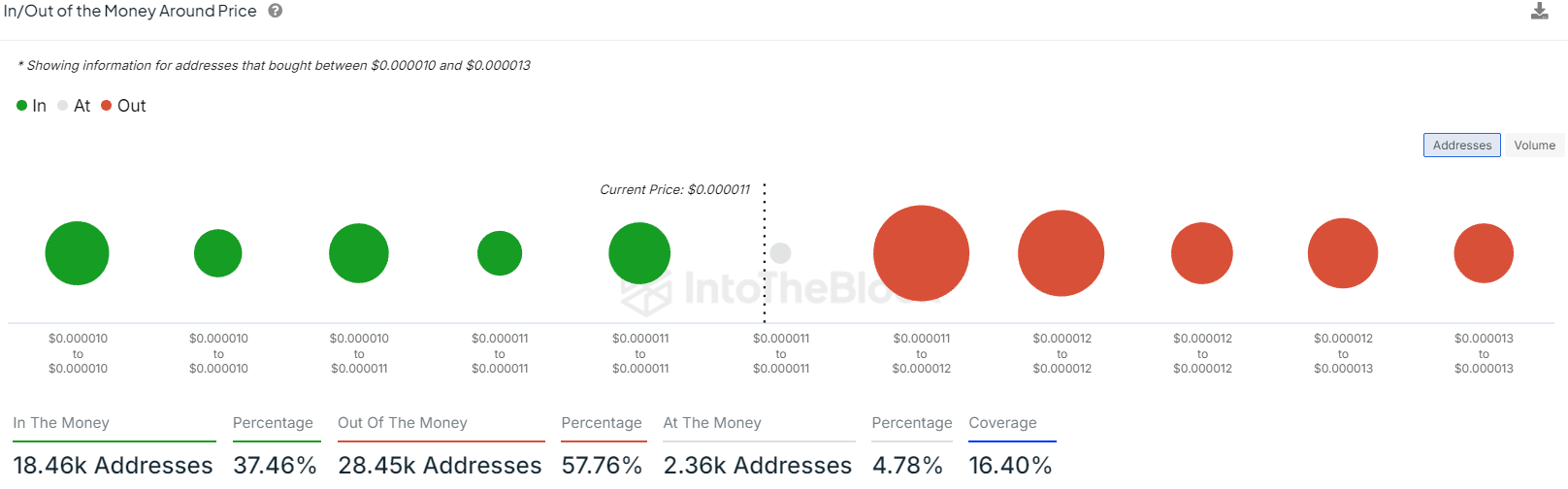

- The resistance zone based on in/out of the money data has proven to be particularly robust.

PEPE emerged from a prolonged consolidation phase and range-bound trading, along with several other popular altcoins. Despite struggling to break the $0.000009 resistance since August, the third-largest meme coin has seen a 58% upward movement in the last two weeks, signaling a potential bullish trend.

Investors holding PEPE are now faced with a decision – whether to take profits and wait for the next move or continue holding in anticipation of a further rally.

PEPE experiences a minor price dip after nearing a three-month resistance level

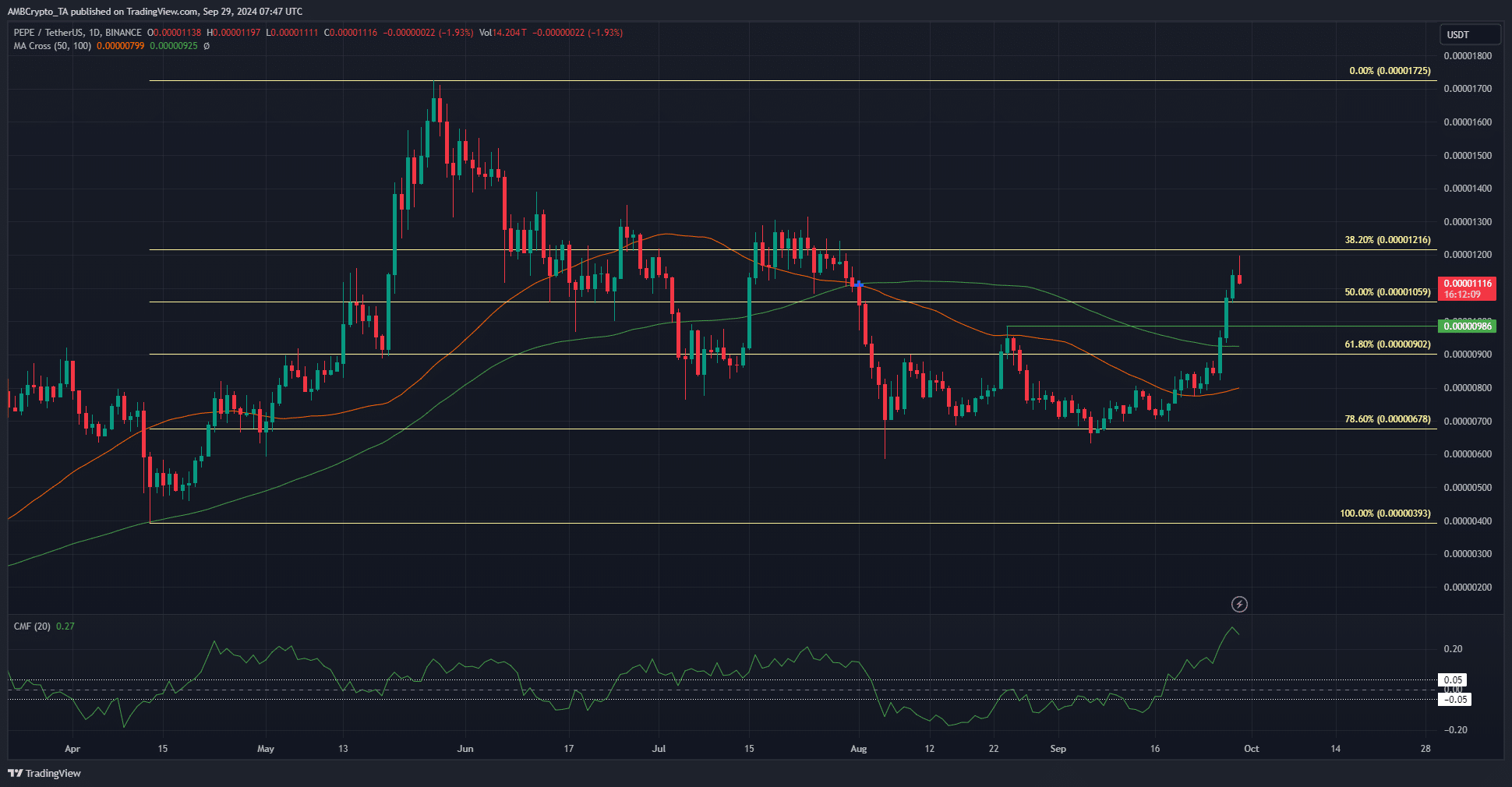

Source: PEPE/USDT on TradingView

Analysis of the weekly chart indicates that if Sunday’s trading session ends above $0.00000986, it would lead to a bullish flip in the weekly structure. The daily structure has also displayed a bullish trend since September 20th.

The successful defense of the 78.6% Fibonacci level and the rally towards the June and July highs have been positive developments. However, there is a possibility of a rejection from the $0.0000123-$0.000013 zone, prompting swing traders to consider taking partial profits.

The CMF at +0.27 reflects the significant buying pressure witnessed in the past two weeks. Additionally, PEPE crossing above the 50DMA indicates a shift towards bullish momentum in the long term.

Psychological resistance level breached by PEPE

The $0.00001 round number holds significant psychological value. Currently, the meme coin is trading above this level, with high buying pressure indicating a potential conversion of this level into a support zone.

Check out Pepe’s [PEPE] Price Prediction for 2024-25

Data from IntoTheBlock reveals a significant resistance zone ranging from $0.000011 to $0.000012. Many addresses acquired the token within this price range, and some investors might consider selling due to the lack of bullish movement since June.

Disclaimer: The information provided is the writer’s opinion and does not constitute financial, investment, trading, or any other form of advice.